- Home

- Publications and statistics

- Publications

- Debt structure and rising interest rates...

Debt structure and rising interest rates: focus on European companies

Post n° 350. The rise in interest rates in the euro area is increasing the cost of the stock of corporate debt, but at different rates across countries. This blog post examines corporate debt structures in euro area countries between 2021 and 2023, and confirms that average costs rise less quickly in euro area countries where debt is contracted at a fixed rate and a long maturity, as is the case in France.

The cost of debt servicing: a component of corporate interest rate risk

Rising interest rates mean higher financing costs for economic agents. This post looks at changes in the financing costs of European non-financial corporations (hereafter "companies"), i.e. the interest they pay on the loans they have taken out and the debt securities they have issued. Using detailed databases for these debt instruments, we can carry out a comprehensive analysis of changes in interest expenses. However, the latter only reflect the negative impact of a rise in interest rates on companies: high interest rates also have a positive impact, as they increase the interest income they receive, particularly on their available cash.

The interest expenses incurred by companies are calculated by multiplying the total amount of debt in euro by the average interest rate. This article looks at changes in the average interest rate, which should be fairly uniform within a currency area.

Unlike the interest rate on new loans, which reacts directly to changes in the interest rate environment, the average rate on the stock of debt changes in a complex way, combining two effects: a direct effect for variable-rate loans and a gradual effect for fixed-rate loans. The interest on a variable-rate loan is periodically adjusted in line with the benchmark current interest rate, so it immediately reflects any rate rises. Conversely, loans taken out at a fixed rate before the increase remain cheaper until they mature, but as these loans are repaid and new loans are taken out at higher rates, the average rate paid on the total debt gradually increases. The effects of this substitution mechanism depend on the rate at which fixed-rate loans are repaid.

Thus, the proportion of variable rate debt and the repayment schedule for fixed-rate loans shape the changes in the total cost of debt when interest rates fluctuate. To understand the impact on companies' costs of the rise in interest rates that began in the euro area in 2022, we therefore need to look at their debt structure when this rise started.

Detailed databases only cover part of corporate debt

The Eurosystem has detailed databases which provide precise monthly information on each bank loan taken out and each debt security issued by companies, and in particular their rate type (fixed or variable), maturity and repayment schedule.

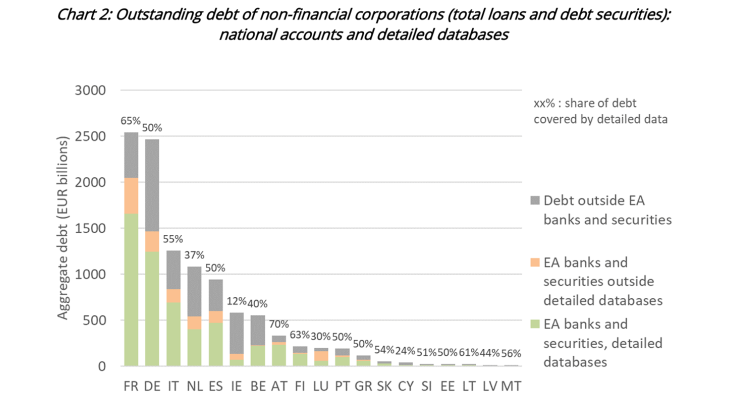

These databases cover only part of companies' interest-bearing liabilities, which can be monitored using the sectoral data in the national accounts. These accounts provide details of liabilities in the broad sense: debt securities, loans - including inter-company loans - and trade debts. For the study of corporate interest rate risk, we can limit the scope to consolidated securities and loans, i.e. excluding loans between non-financial corporations of the same country; however, even with this limited scope, the coverage of the detailed bases is only partial, see Chart 2. The reasons for these differences are discussed in a box in the Banque de France Bulletin (December 2022) on the debt structure of companies. In particular, the detailed databases only collect data on loans granted by banks in the euro area. So, while 50% of the amounts recognised in the national accounts are recorded in the detailed data for the euro area, this share varies from 71% in the case of Austria to just 11% in the case of Ireland. The share that is not covered is excluded from the scope of this article, due to a lack of data regarding the applicable rates.

Note: Amounts at 30 June 2023. The national accounts aggregates used here are F3 (debt securities) and F4 consolidated (all loans, whether granted by banks or other entities, excluding loans granted between non-financial corporations in the same country). The coverage rate of these outstandings by the detailed databases is 50% for the euro area as a whole.

The debt structures of European companies are heterogeneous

The characteristics of the debt in terms of maturity and type of rate vary greatly across companies, but it is possible to identify average characteristics by aggregating the financial data provided by the detailed databases into large groups: here we have chosen to aggregate data by country of economic activity within the 19 countries that adopted the euro before 2022.

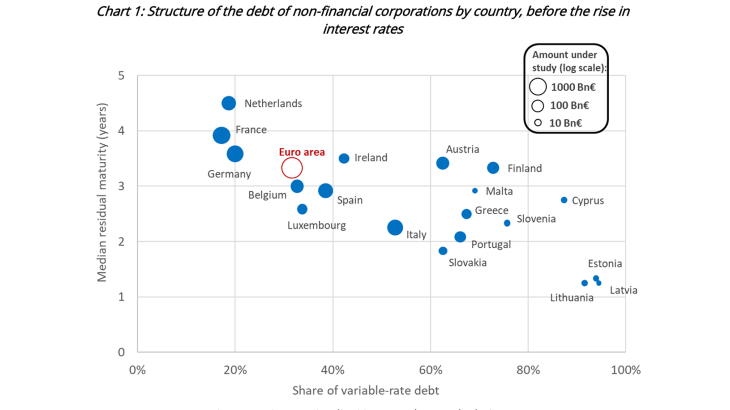

Chart 1 shows the debt structure of companies in each country at 31 December 2021, a few months before interest rates began to rise: the x-axis shows the share of amounts borrowed at variable rates; the y-axis shows the median residual maturity, i.e. the period after which half of the amounts borrowed will have to be repaid based on repayment schedules. The chart shows a sharp contrast between the countries in the euro area. On the left-hand side of the chart, French, German and Dutch companies have a stock of debt with a fairly long median maturity - almost 4 years - 80% at a fixed rate: such a structure subjects interest expenses to a high degree of inertia and they only gradually react to changes in the interest rate environment. On the right-hand side, more than 90% of the debt taken on by companies in the three Baltic countries is variable-rate debt, with a median maturity of less than 18 months: this profile means that interest expenses react almost immediately to any rise or fall in interest rates. The other countries studied fall into the intermediate category. Aggregate corporate debt for the euro area as a whole tends to be long-term, with a low share of variable-rate debt, driven by French and German companies, which account for 55% of total outstanding debt.

Cost rises are consistent with debt structures

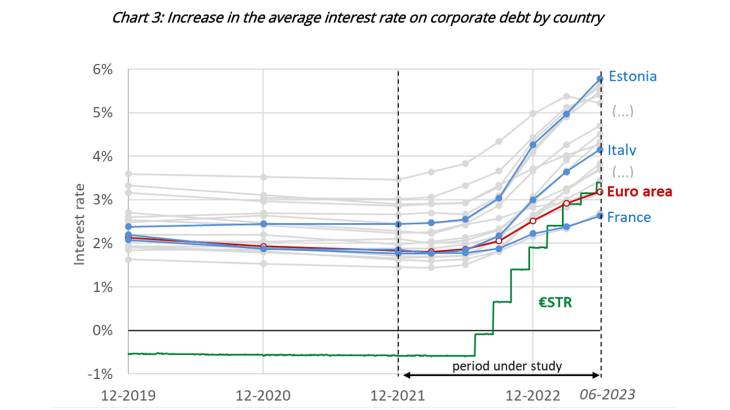

The rise in interest rates in 2022-23 after several years of low and stable rates enables us to confirm the expected relationship between changes in the cost of corporate debt and its structure. Between December 2021 and June 2023, the €STR – the overnight rate used as a benchmark in the euro area – rose by 4 percentage points (pp). At the same time, average interest rates on corporate debt rose in all euro area countries by between 0.8 pp for France and 3.3 pp for Estonia.

Note: The average interest rate at each date is calculated by weighting the rates applicable to each debt instrument by the amounts outstanding.

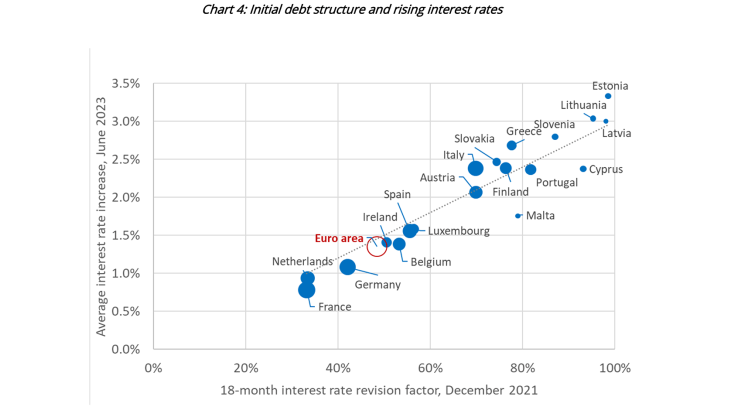

Chart 4 compares the increase in the average interest rate on corporate debt in each country between December 2021 and June 2023 with their debt structure, summarised by a 'revision factor': this represents the share of outstanding debt for which interest rate conditions will vary over a given time horizon, either because it is at a variable rate or because it must be repaid. The 18-month interest rate revision factor is shown on the x-axis of the chart: it shows the share of debt in December 2021 for which the interest rate would no longer apply in June 2023. Euro area countries have factors of between 33% and 99%, consistent with the distribution of median maturities and shares of fixed-rate debt.

Note: The increase in the average rate is the difference between the average interest rate calculated for the aggregate of companies in each country at 30 June 2023 and that calculated at 31 December 2021.

A comparison with the rise in interest rates over the period reveals a strong correlation: the initial structure of corporate debt largely determines the speed of adjustment of companies’ costs when interest rates change, even though other differentiating factors, such as risk premia, may also come into play.

Changes in the cost of corporate debt by country are expected to continue to depend on their structure, which changed little between December 2021 and June 2023. Thus, if rates remain stable at their 2023 level, the average interest rate on debt in countries with a low revision factor should continue to rise, as inexpensive fixed-rate loans taken out before 2022 are repaid. Conversely, countries with a high revision factor have already largely absorbed the increase and their rates should remain constant: we can therefore expect a gradual convergence of the average rates in the different countries. In the event of an interest rate cut, companies in countries with a high revision factor should benefit most from the new rates.

Download the PDF version of the publication

Updated on the 25th of July 2024