Sources : RICA (French Farm Accountancy Data Network), Caisse Centrale de Réassurance between 2002 and 2021; authors’ production.

Crop insurance is heavily subsidised but take-up in France is low

Farming is a risky activity and the climate, a determinant of annual yield variations, is becoming increasingly extreme. In that context, multi-risk crop insurance, which insures farmers against climate shocks, is a highly strategic tool across the world. This explains why it is widely subsidised in many developed countries. Yet, policymakers face major challenges when setting crop insurance subsidies. In the United States for example, the GAO 2023 reports show that while crop insurance uptake is high, subsidies are poorly targeted and mostly benefit larger farms.

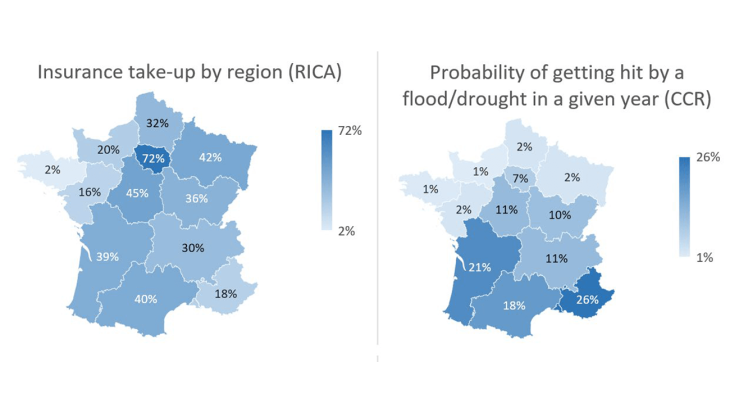

In France, which constitutes the case study for our recent paper, the penetration rate of crop insurance is low (Chart 1). Only 13.3% of farms were insured in 2020, and the numbers are stable, perhaps up slightly from 12% in 2016. Subsidies, on the other hand, are high. Before the 2022 reform, a first level of crop insurance contract was subsidized at 65%, a second level with additional products and guarantees at 45%, and a third level allowing full coverage was not subsidized. In practice, a farmer could choose to insure the first level only, the first two levels or to be fully insured. This begs the question: why is adoption so surprisingly limited? Not only the need for protection insurance is clear, but insurance premiums are highly subsidised and insurance has a net positive impact on earnings, according to the literature. Our work aims to provide insight into this paradox.

A methodological approach applied for the first time to crop insurance

As far as averages are concerned, it is generally in the interest of farmers to be insured (Di Falco et al., 2014 ; Annan and Schlenker, 2015 ; Wang, Rejesus and Aglasan, 2021). We provide here a unique heterogeneity analysis of crop insurance. To obtain our results and concrete recommendations, we combine a variety of econometric methods, including the Marginal Treatment Effect (MTE) framework à la Heckman & Vytlacil, which has, to the best of our knowledge, never been used in the context of crop insurance. Basically, this methodology allows us to compare the willingness of farmers sharing similar characteristics to take up crop insurance with the benefits that they would actually draw from their contracts. This enables us to perform counterfactual analyses to explore the efficiency of different types of policies in both increasing the take-up rate and yielding high benefits for farmers. This way, we provide key insights regarding the right policies to maximise insurance take-up and social welfare.

This large-scale analysis across mainland France over a 20-year period is performed on a unique and highly granular dataset gathered from individual data on farmers between 2002 and 2021. This dataset combines several sources; it includes agronomic and financial variables from the French “Réseau d’Information Comptable Agricole” (part of the European Farm Accountancy Data Network), weather data at a 0.1°×0.1° resolution (from Copernicus) and administrative data for climate disasters (from the French public reinsurer, Caisse Centrale de Réassurance).

Insurance benefits farmers but highly heterogeneously

First, we show that, in France, not everyone benefits from insurance. Notably, larger farms and diversified ones draw much smaller, if not negative, benefits from their take-up. Second, we find a "contrarian" selection outcome where, in most cases, farmers who would benefit the most from insurance tend to insure the least. We identify these as mainly small, diversified farms, and as well as farms less likely to purchase insurance for idiosyncratic (and non-observable) reasons, meaning that there are unobservable barriers to take-up (beliefs, non-financial barriers, etc.).

How to increase insurance take-up?

We show that the level of insurance subsidies is not the issue causing the low insurance take-up, as increasing insurance subsidies would not lead to a larger increase in take-up, and those newly insured farmers would actually derive little benefit from their policies. Instead, overcoming the non-financial barriers to insurance (i.e. information, paperwork) by directly targeting the propensity score (probability of insuring) appears to be the optimal way of tackling this issue. Pursuing a goal of 100% of insured farmers might not be a feasible nor a desirable outcome, and smaller, more specialised farms should be targeted instead.

A time of reform

This study comes at a time of reform for the French crop insurance market implemented in 2023. It was clear from observers and concerned parties that barriers to a general extension of coverage where high, though this is no consensus on the remedies. It seems that the take-up rate was boosted in 2023, the first year of implementation, but less so afterwards.

We have identified mechanisms that are weak and costly (subsidies) and other that are promising yet still fuzzy (information, assistance with paperwork, nudges). Subsidies should target farmers who would benefit most from being insured. Focusing on cognitive and behavioural frictions is likely to have a much larger effect on insurance take-up compared to straight increases of subsidy rates. In that sense, the 2022 reform, which greatly increased subsidies but strongly simplified the subsidy system, is a welcome addition to the crop insurance landscape. Increasing our understanding of how farmers actually perceive crop insurance, finding ways to improve how they update their beliefs, and designing insurance policies that can reduce those frictions will be the next challenge facing the sector.