Credit mediation: a tool put in place in the 2008-09 crisis

The Credit Mediation Scheme for Businesses was set up in November 2008 at the height of the financial crisis. It is designed to facilitate access to financing for firms that have been refused a new loan by their bank or had an existing loan foreclosed.

Credit mediation aims to correct information asymmetries between firms and banks and hence reduce imperfections in the functioning of the market and in the supply of loans. Mediation thus facilitates dialogue by providing information that is relevant to the analysis of firms’ applications.

In general, two in three credit mediation processes result in a loan being granted or maintained, leading to a twofold decrease in the one-year default rate for the firms concerned. Between 2008 and 2018, this helped to save more than 400,000 jobs (see the assessment of the first ten years of the credit mediation scheme in the Banque de France bulletin published in September 2019).

In France’s départements, credit mediation is governed by a national agreement signed with the banks, under which the latter commit to attending meetings organised by the mediator, and to maintaining all financing for businesses for the duration of the mediation.

A surge in mediation requests triggered by the outbreak of the health crisis

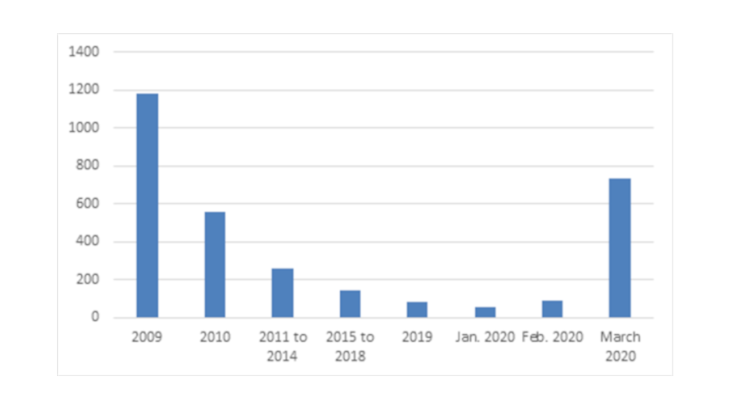

When the credit mediation scheme was first created, it attracted a significant flow of applications, with the numbers reaching around 1,200 per month in 2009 (see Chart 1; for the data in this section, see the various press releases on the Banque de France website). As the economy gradually exited the 2008 crisis, applications declined markedly, to around 200-300 per month in the period 2011-14 and then 100-200 in the period 2015-18.

The improvement in the economic environment and in firms’ finances, better dialogue between lenders and borrowers and a highly accommodative monetary policy have fuelled a steady rise in access to credit in recent years. As a result, the number of requests for mediation fell to a particularly low level of around a hundred per month in January and February 2020.

This trend was reversed in March, however, with the implementation of the Covid-19 lockdown. As certain economic activities came to a complete or virtual halt, the first requests for mediation linked to the pandemic began to come in.

The banks initially made a public commitment to defer firms’ loan instalment payments by up to six months (see press release from the Fédération Bancaire Française, published on 15 March 2020). However, certain companies were denied this deferral, prompting them to seek recourse in mediation. In the second phase, the government set up the State-Guaranteed Loan scheme (SGL), and the first refusals again began to be observed. A portion of these firms also turned to mediation. Since April, the majority of requests for mediation have been from firms that have been refused an SGL.

The trend in monthly applications illustrates the impact of the crisis. The numbers have gone from around 100 a month in January-February 2020 to more than 700 in March, just under 4,000 in April, just over 3,000 in May and close to 2,000 in June. The total comes to nearly 10,000 cases, which nonetheless needs to be viewed alongside the number of firms that have actually received SGLs (more than 535,000 as at 3 July 2020), and the rate of SGL refusals (2.7%). The use of mediation during this crisis has thus been significant, but needs to be put into perspective against the number of firms actually benefiting from the SGL scheme. The recent decline in mediation applications is linked to the trend in SGL requests, which have been declining recently after the high numbers seen in the initial phase of the crisis.

In April and May alone, the total amount of loans requested by firms in mediation, and which had therefore been refused financing, came to EUR 1.2 billion (compared with EUR 109 billion of SGLs granted by banks as at 3 July 2020). In three out of five cases, mediation proves successful and the banks agree to grant the SGL.

The typology of firms in mediation remains unchanged vs. the pre-crisis period

The vast majority of requests for mediation (85%) are from very small enterprises (VSEs). The retail and services sectors account for the highest shares, especially accommodation and food service activities which have been particularly hard-hit by the lockdown. From a geographical perspective, the rise in applications in spring 2020 can be observed across all French territory (metropolitan France and overseas territories). However, the Île de France region accounts for the largest share, with Auvergne-Rhône-Alpes, Provence-Alpes-Côte d’Azur, New Aquitaine and Occitanie also seeing high numbers of applicants.

Overall, the typology of firms seeking mediation remains fairly similar to that observed before the crisis.

Credit mediation will remain in strong demand

The decline in new requests for mediation is good news, but the numbers are still high and are likely to remain so over the coming months, even ruling out a “second wave” of the pandemic.

- The SGL scheme will remain in place until the end of 2020, so there will continue to be applications for SGLs over the coming months (either first-time applications or requests for additional loans), and hence refusals of loans.

- The determining factor will be whether firms that have received SGLs will be able to repay them under the stipulated terms as of spring 2021. The crisis is expected to trigger a sharp increase in corporate debt.

- The crisis will also impact corporate earnings for 2020, as well as equity capital. Debt ratios are therefore expected to rise, which will in turn prevent firms from accessing additional financing. By way of illustration, 88% of SGLs, or more than 40% in terms of amount, have been granted to VSEs (representing an additional EUR 43 billion of debt for VSEs). Moreover the situation of VSEs in terms of equity capital is relatively deteriorated, and more than 20% are now in negative equity.

As a result, public authorities have begun looking for ways to adapt the existing support measures in the near future, with the aim of increasing firms’ equity levels.