This paper proposes an analytical framework to quantify the impacts of climate policy and transition narratives on economic and financial variables necessary for financial risk assessment. Focusing on transition risks, the scenarios considered include unexpected increases in carbon prices and productivity shocks to reflect disorderly transition processes.

The modelling framework relies on a suite of models, calibrated on the high-level reference scenarios of the Network for Greening the Financial System (NGFS). The baseline scenario is aligned with the NGFS narrative and data of an orderly transition toward a low-carbon economy. The severely adverse scenarios feature two different cases of a disorderly transition. The first relates to a delayed transition, which would be implemented only from 2030 onwards and requires an abrupt revision of climate policies. The second scenario covers for the case of a sudden transition. It would start earlier, in 2025, but assume lower technological progresses and crowding-out effects on investments leading to lower productivity levels compared to baseline.

To quantify these scenarios at the appropriate level of sectoral and geographical granularity, we identify three main modelling bricks. First, the NiGEM model is used to assess the impacts of these scenarios, including the baseline case, on key macroeconomic and financial variables. It results from the simulation that the tightening of climate policies, with a sharp increase in the carbon price, generates negative supply shocks with effects on growth and inflation. At the macroeconomic level, each scenario ends up including 12 variables, such as GDP, inflation or unemployment and covers four blocks of countries (France, the Rest of the EU, the USA and the Rest of the World).

The second brick consists of a static multi-country, multi-sector model developed specifically for this exercise. It assesses the impacts of carbon price and productivity shocks across 55 sectors. Results provide an indication of the magnitude of the sectoral impacts of a disorderly transition, suggesting significative possible disruptions at the sectoral level.

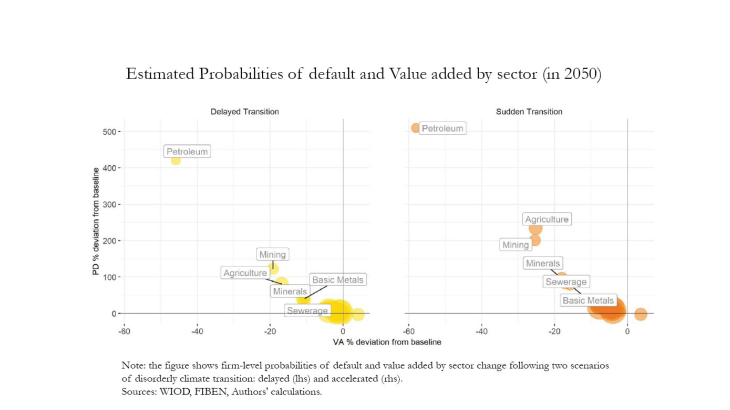

Finally, a financial block is added to the modelling to estimate a number of financial variables. First, the Banque de France’s rating model, providing financial information on firms, is used to generate probabilities of default (PD) at the infra-sectoral level. A number of macro-financial variables are further linked up to the modelling architecture. A dividend discount model is calibrated on the macroeconomic and sectoral results for each scenario to estimate the associated market stock price shocks at sector level. Simulations of the EIOPA risk-free interest rates and credit spreads complete the set of information.

The results show the materiality of the negative economic impacts of disorderly transitions toward a low-carbon economy. Although the effects at macroeconomic and financial market levels remain somewhat limited, the impacts on the sectors exposed to the transition policies simulated are substantial. This sectoral heterogeneity is also found at an infra-sectoral level, with companies within sectors affected differently by the transition. The magnitude of these sectoral and infra-sectoral impacts gives rise to financial stability risks that are potentially much more pronounced than macroeconomic and financial market overall levels would have suggested.

The modular approach adopted in this paper provides a flexible and efficient architecture, compartmenting the numerous modelling challenges. Based on this approach, the ACPR will develop and submit a number of climate-related scenarios to a representative group of banks and insurance companies in a bottom-up approach.