Benchmark-driven investment in emerging markets has been under scrutiny recently

Benchmark-driven investment is a strategy tied to a specific market index, or any other benchmark. Funds endorsing these strategies can be outright passive (asset allocation fully replicates an existing benchmark) or “nearly” passive if they allow some limited flexibility in the tracking of the benchmark. Exchange-traded funds in particular have gained importance over the past decade, mostly due to their tradability and modest fee structures that made them attractive (ECB (2018)). However, even an active fund where asset allocation is discretionary might in reality mostly be mirroring a benchmark. Estimates indicate that as much as 70% of all mutual funds’ investment can be benchmark-driven in some way (Raddatz et al (2017)) and MSCI claims a total of USD 1.8 trillion in assets under management to be tracking its emerging markets equity indices.

From an emerging markets perspective, inclusion in widely tracked indices implies a widening of the investor base, but it also makes those countries more sensitive to external factors, which can cause capital outflows if many investors move in sync (IMF (2015)). Emerging economies are particularly vulnerable to such sudden stop of capital flows given their reliance on foreign investors to fund their external deficits and their foreign currency needs. On top of that, changes in the weight attributed to an individual country can generate abrupt movements of capital flows.

Given the substantial impact it generates, index producers rebalance the composition of indices gradually and upon extensive consultations with investors worldwide. The inclusion of new countries is typically linked to the quality of market access for foreign investors, which contributes to the predictability of the changes in index composition.

Since 2018, major indices have started to increase the weighting of Chinese securities

Chinese capital markets are still mostly of a dual nature, where restrictions strongly limit foreign investment in onshore capital markets, as opposed to offshore markets, mainly set in Hong Kong. While onshore China represents the second largest stock market capitalization worldwide, foreign investors only account for less than 4% of total holdings. Since 2014, Chinese authorities have been undertaking significant measures to increase market access for foreign investors, bringing the country closer to major indices inclusion criteria. The Stock and Bond Connect programmes, for instance, enable transactions between the onshore and offshore market.

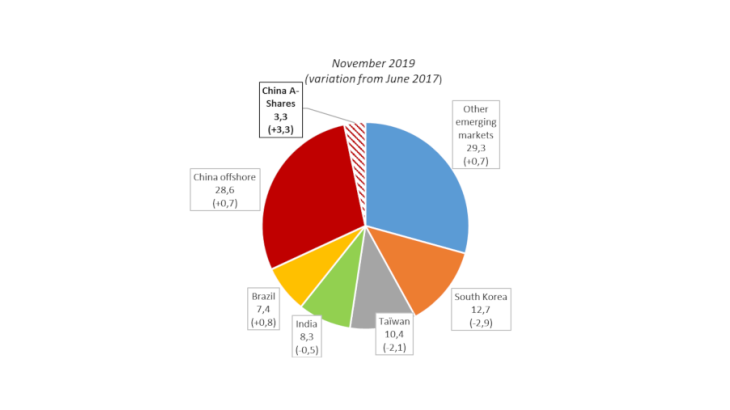

In response to this improvement in market access, MSCI announced in June 2017 the progressive inclusion of Chinese onshore renminbi-denominated equities (A-shares) in its popular Emerging Market Index (MSCI EM). China’s total weight will have increased from 28% to 32% between June 2017 and November 2019. While A-shares account for around 70% of the capitalization of all Chinese listed stocks, only offshore securities were included in the index previously (chart 1). FTSE Russell likewise started the gradual inclusion of Chinese A-Shares in some of its indices in June 2019. Similar developments can be observed with major global bond benchmarks. The Bloomberg Barclays Global Aggregate Bond index will for example increase China’s weight by 6 % by November 2020. Consequently, the rebalancing of China will also apply to the numerous global, regional and country sub-indices.

How will this rebalancing affect capital movements across emerging markets?

The rebalancing of indices will mechanically induce additional portfolio inflows to China. Considering the MSCI EM and the Bloomberg Barclays Global Aggregate Bond indices, we estimate that China’s fully increased weight will cumulatively have generated USD 220 billion of additional portfolio inflows between June 2017 and November 2020 (20% of the end-2018 total stock of portfolio investment). This projection is based on the estimated amount of assets tracking theses indices and China’s increased weight. Taking into account the rebalancing announced in other majors indices, the IMF (GFSR (2019)) estimates the total to reach close to USD 450 billion (more than 3% of the country’s GDP).

Given the decrease of China’s current account balance over the past few years, benchmark-related inflows are expected to meet part of the country’s external financing requirements. Conversely, some other countries may suffer adverse consequences from this rebalancing as their weights decrease. We estimate that the MSCI EM index rebalancing alone will result in a USD 75 billion shortfall, most of which absorbed by major constituents like South Korea, Taiwan, India and South Africa.

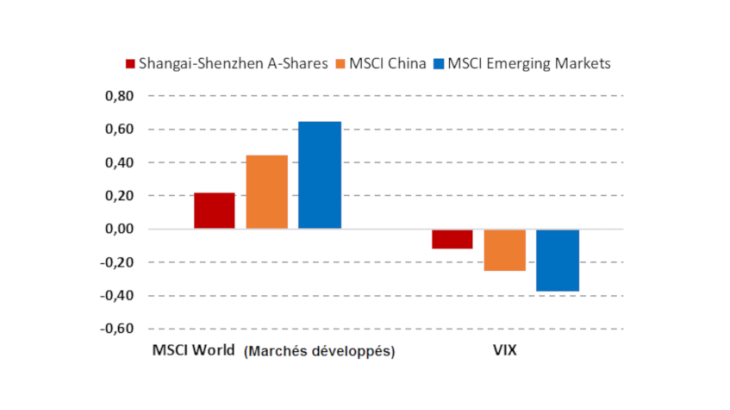

This crowding-out effect may nevertheless be mitigated. Firstly, the total amount of funds invested under benchmark-driven strategies is constantly increasing, notably with the growing popularity of exchange-traded funds. Access to Chinese onshore markets may make index-tracking funds even more attractive to investors, not least because of the lower correlation of A-shares with global assets (chart 2). This increases the diversification features of these indices in the short term. Secondly, abrupt flows may be softened by different strategies employed by fund managers who often have a discretionary margin even if benchmark-bound, enabling them to anticipate and smooth over time the changes in their portfolio allocation.