China’s rise in global value chains – a long-term trend

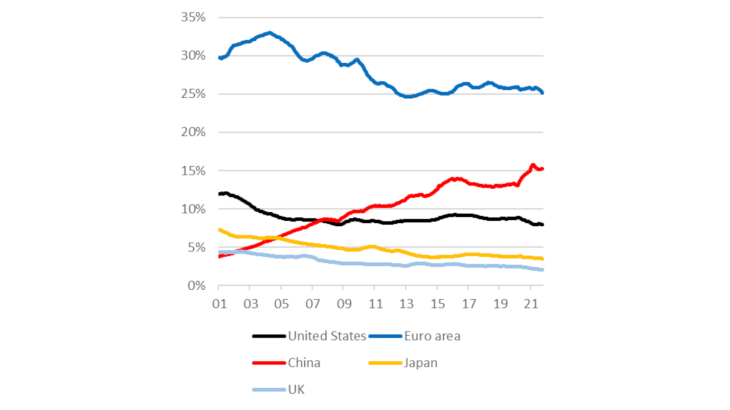

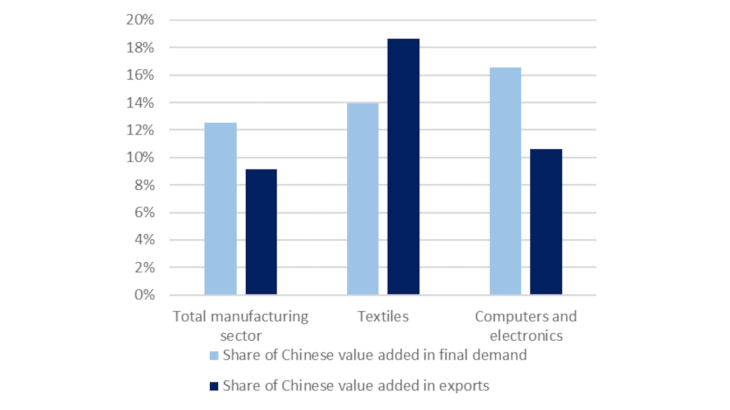

China’s share in global exports more than doubled after it joined the World Trade Organisation (WTO) in 2001, reaching 13% (in value terms) in 2015. However, it subsequently reached a plateau and remained at this level until the start of the Covid crisis. Unit labour costs doubled in China between 2010 and 2017, which affected low value-added and/or labour-intensive activities such as textiles or furniture manufacture. To illustrate, Chinese textile industry exports declined in value between 2014 and 2019, suggesting that these sectors relocated their production to other countries. The phenomenon was amplified by domestic Chinese policies to limit overcapacity.

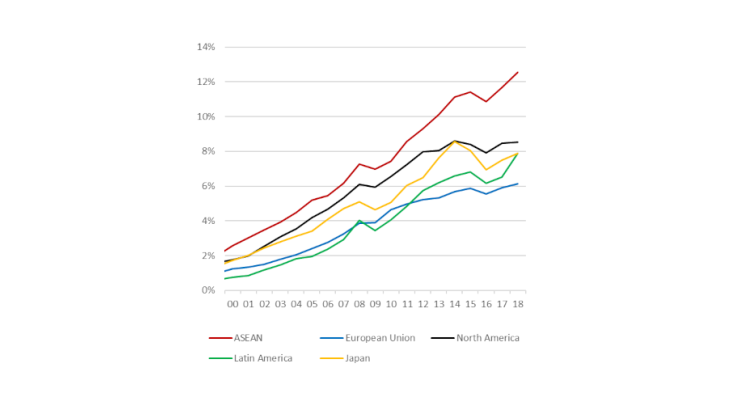

Nonetheless, the stagnation – at the aggregate level – in China’s global trade share in the years leading up to the Covid crisis masks an increase in its number of trading partners, and strong disparities across regions. In Asia, China became the leading source of imports for 70% of countries in the region, and the leading export destination for 50% of countries.

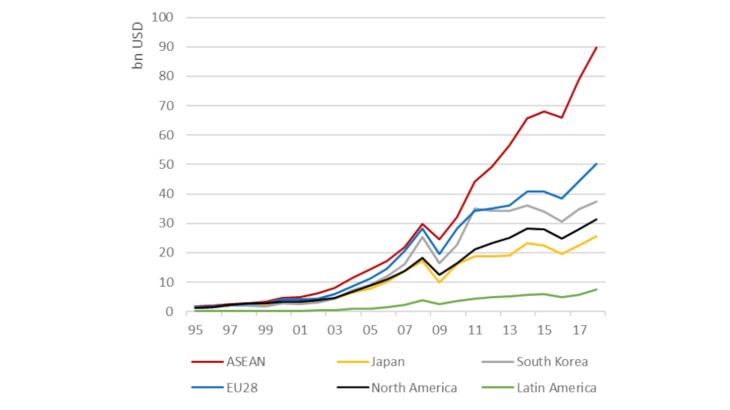

It also became more closely integrated into value chains by exporting the intermediate goods used in other countries’ production processes. According to the UNCTAD-Eora global value chain database, China accounted for a negligible share of the foreign value added embedded in global exports in 1990, but by 2019 this had risen to 20%, placing it just ahead of the European Union.

During the public health crisis, China’s dominant role in the global supply of certain goods, especially electronic equipment, and its ability to maintain production despite the lockdowns, strengthened its role in global trade. Its share of global trade flows increased to 15% in value terms in 2021 (Chart 2).