Post n°323. In response to European sanctions, Russia has redirected some of its crude oil exports to other countries, notably China. China has thus benefited from a discount on the price of its Russian oil imports, showing that the impact of sanctions has gone beyond flows between Russia and Europe alone.

Source: China General Administration of Customs, CEIC and Banque de France. Note: 3-month moving average price.

Since the Russian invasion of Ukraine, China has restructured its crude oil imports

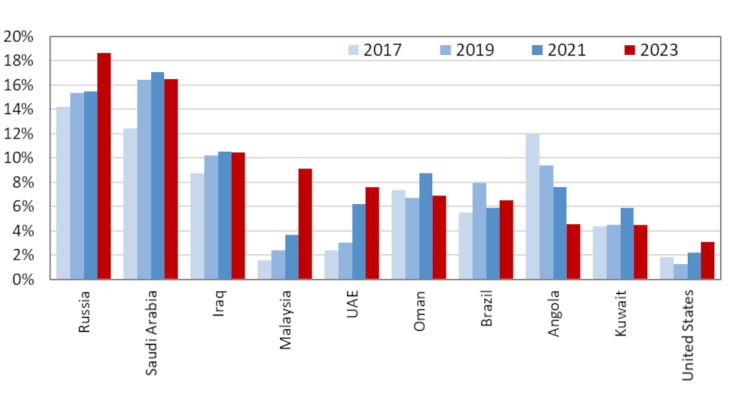

With the deterioration in the economic environment, China's crude oil imports did not grow in 2022, and even fell very slightly in volume terms (-1%). But this stability masks a shift in the origin of imports: in 2022, Chinese customs data show an 8.2% increase in the volume of crude oil imports from Russia and a near doubling of imports from Malaysia (90.6%). Building on a number of recent publications (Babina et al., 2023, Hilgenstock et al., 2023) that analyse trends in Russian oil exports, this post aims to assess the extent to which China has benefited from the situation brought about by the war in Ukraine.

The above trend continued in the first half of 2023. The share of Russian oil in Chinese imports in volume terms, which had stood at around 15.5% since 2018, rose by 1.4 percentage points (pp) in 2022 and then 1.7pp by mid-2023 (i.e. 3.1pp in 18 months) to reach 18.6% of the total in the first half of 2023. The increase in the share of Russian oil in Chinese imports in volume terms since 2008 thus accelerated as from 2022, making Russia China's main oil supplier, ahead of Saudi Arabia (16.5%) and Iraq (10.5%). With an increase of 3.4pp in 2022 and 2.1pp in the first half of 2023 (i.e. 5.5pp in 18 months) in its share of Chinese imports, this rise is particularly remarkable in the case of Malaysia, which exported more oil to China in 2022 than it had produced annually in previous years. This suggests that Malaysia appears to have re-exported oil from other countries, and possibly from Russia. In the first half of 2023, Malaysia became China's 4th-largest oil supplier, up from 9th place in 2021.

Source: China General Administration of Customs, CEIC and Banque de France. Note: 2023 stands for H1 2023.

China has benefited from a discount on the price of oil imported from Russia and Malaysia

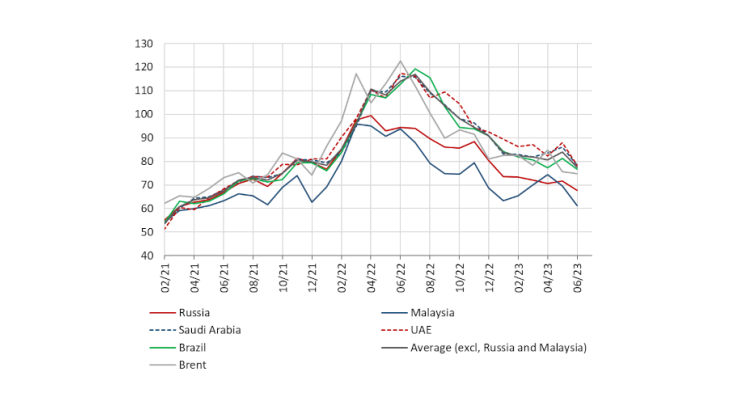

While the war led to a significant rise in all energy prices as from the end of February 2022, the price of Russian oil fell almost immediately in relation to international benchmark prices such as Brent. The reluctance of market players to buy Russian oil, combined with the sanctions announced and gradually implemented by the EU and G7 countries, led to a significant drop in the price of Russian crude. The resulting differential appears to have benefited China via its oil imports from Russia, and probably in turn from Malaysia too. These sanctions include the price cap policy, which prohibits any Western company from transporting - and insuring the transport of - Russian oil if it has been priced above a certain threshold (set at USD 60 per barrel for crude), and an embargo banning virtually all EU imports of oil from Russia.

For Chinese oil imports from Russia, discounts started in April 2022 and peaked in July (-19% compared with other suppliers). Prices occasionally converged with Brent prices (around USD 80 per barrel) in December 2022, the month in which the embargo and price cap were first applied, but then diverged again in 2023. From USD 73 per barrel in January to USD 67 per barrel in June, Chinese imports of Russian oil remained above the price cap (USD 60 per barrel) but below the price of Brent (-10% on average over the half-year). The gap with the average price applied by other suppliers widened in 2023 (-12.7% in the first half of 2023 compared with -10.4% in 2022). For Malaysian oil imports, the discount that existed before the war in Ukraine (-7% in 2021) has increased since April, averaging -18.9% in 2022 and -17.6% in 2023.

These discounts observed from 2022 onwards, compared with the average import price, excluding those from other suppliers, are estimated to have reduced China's energy bill by USD 6.6 billion in 2022 and USD 4 billion in the first half of 2023 for oil imported from Russia, and by USD 4.9 billion in 2022 and USD 2.7 billion in 2023 for oil imported from Malaysia. Thus China is estimated to have saved EUR 18 billion over 18 months, or around 3.5% of the total value of crude oil imports.

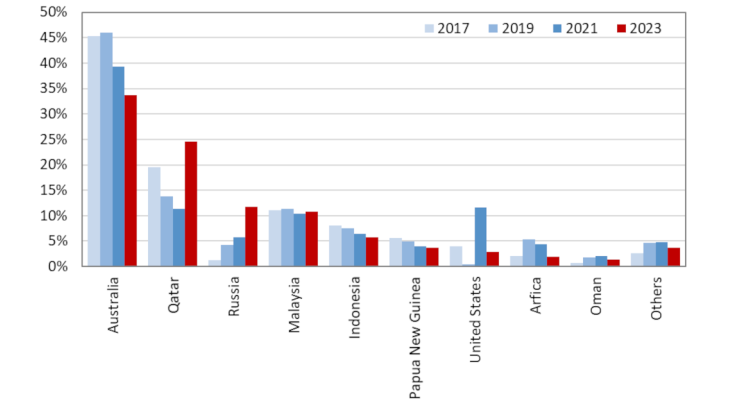

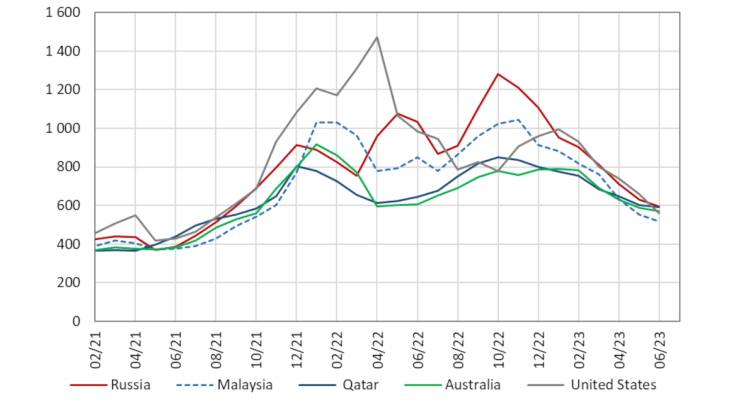

Liquefied natural gas imports reorganised, but without offering similar opportunities

For liquefied natural gas (LNG), the stakes are less high, as Chinese LNG imports in 2022 represented the equivalent of 12% of China's oil import bill in value terms. On this market, the significant increase in European demand, prompted by the need to replace Russian gas, put pressure on prices. As there were no sanctions against Russian LNG exports, China was unable to benefit from discounts similar to those seen on Russia’s crude oil exports. Admittedly, China increased its LNG imports from Russia (42% in volume over the year), mainly to the detriment of Australia, but Russia remains a minor supplier for China (Chart 3). Australia's share has fallen by 5.7pp in two years, to stand at 33.8% of China's import volume in June 2023, and the US share, which had risen significantly between 2017 and 2021 to reach 11.4% in 2021, has finally fallen back to less than 3% in 2023. Conversely, Qatar's and Russia's share of total imports in volume terms rose by 13.3pp and 5.9pp respectively over 18 months.

Source: China General Administration of Customs, CEIC and Banque de France.

Customs data do not show a discount for LNG from Russia or Qatar. In fact, while the price of LNG imported from Qatar was comparable to the price applied by Australia in 2022, the price of Russian LNG was much higher (42% above the Australian price). However, this price differential seems to have been gradually absorbed in the first half of 2023.

From Russia's point of view, the redirecting of its exports towards non-aligned countries such as China has enabled it to partially offset the losses incurred due to the fall in imports from Western countries, which could partly explain the country's economic resilience in 2022. This persistent discount on Russian oil imported by China nevertheless shows that the impact of the sanctions has extended beyond flows between Russia and Europe alone.

Updated on the 25th of July 2024