Monetary policy has responded decisively to the surge in inflation in the United States (US) and the euro area (EA). In less than a year, the Fed has increased policy interest rates 8 times (450 basis points (bp) in total) and the ECB has increased 5 times (300 bp in total) in addition to exiting from unconventional monetary measures. One channel through which monetary policy works is to influence inflation expectations. In this post we describe how the ECB and Fed’s policy announcements between 2021 and 2023 affected markets’ inflation expectations at different horizons.

Monetary policy surprises following ECB and Fed announcements

Central banks announce their policy decisions at regularly scheduled meetings. Market participants have their own expectations about forthcoming policy decisions, based on their interpretation of the state of the economy and their understanding of the central bank’s reaction function. These expectations are reflected in the overnight indexed swaps (OIS) at different horizons, which are contracts where two counterparties exchange fixed and floating interest rate payments.

If the policy decision and communication correspond to what was expected, the resulting change in the OIS yield curve should be minimal. To the extent that the policy announcement differs from expectations, financial markets can be “surprised”. Therefore, we measure the monetary policy surprise through the daily change in the 2-year OIS rates before and after the announcement. We use 2-year rates in order to cover both current and expected future policy changes.

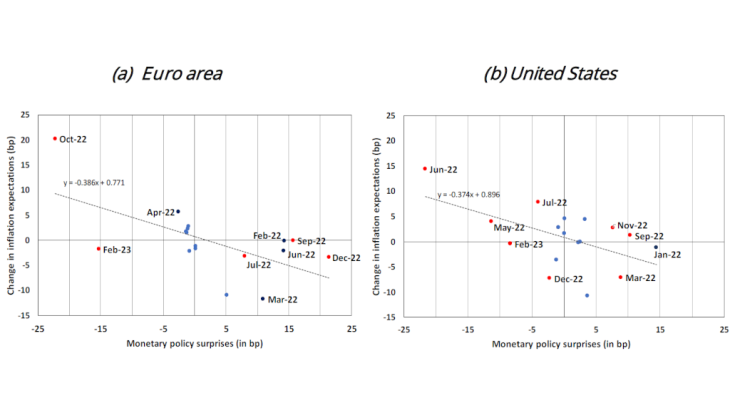

We note that interest rate increases are not always perceived as tightening surprises by financial markets. For instance, the ECB decision to increase rates in October 2022 was actually perceived as a “dovish” surprise. While the 75bp rate increase was already priced in, the press conference was perceived as “dovish” and expectations of future rate increases were revised downwards, thus corresponding to a decrease in the 2-year OIS rate. The same happened after the Fed’s decision to increase its Fed funds rate by a widely expected 75 bp in June 2022. Its communication at the time about the future path of policy rate was more dovish than expected, thus leading to a dovish surprise.

Like other researchers, we use “surprises” to establish causality from monetary policy to inflation expectations (and not the reverse) but it should always be borne in mind that it is actual rate changes (and expectations of future changes) that influence inflation expectations overall (and ultimately output and inflation.)

Monetary policy surprises significantly affect market inflation expectations

We measure implied inflation expectations by the daily change in inflation-linked swaps for the EA (ILS - market-traded derivatives based on future inflation rates). For the US, we rely instead on the “breakeven” rates, which are based on more liquid instruments. Inflation expectations are measured 1 year forward, to account for the transmission lags of monetary policy. Figure 2 plots our 2-year OIS monetary policy surprises against daily changes in market-implied inflation expectations (1y1y ILS for EA and the 1y2y breakeven rate for US). There is a clear negative relationship between the two– a hawkish surprise causes a fall in market-implied inflation expectations at the specified horizons. The regression co-efficient reported in the Figure is around -0.4 for both countries. Although we use surprises to estimate the impact, we can use this elasticity to estimate the effect of announced changes as well. The 350bp increase in 2 year OIS since December 2021 caused a 140bp decrease in 1y1y ILS for the EA, ceteris paribus.

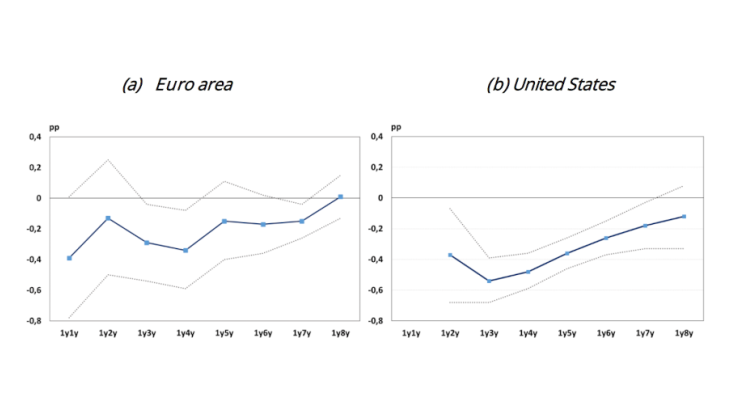

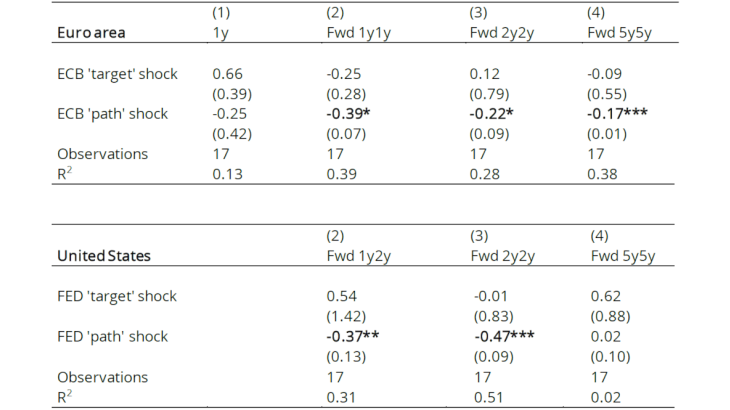

Figure 1 illustrates the response of inflation expectations at different future horizons to the monetary policy surprises defined above based on the same type of linear regression. In both countries, the response of inflation expectations to monetary surprises tends to attenuate as the horizon increases. This gradually diminishing effect is to be expected if long-term future inflation expectations are well anchored at their respective targets. The effect appears somewhat stronger in the US than in the EA and more statistically significant.