The ECB’s monetary policy can affect the euro/dollar (EUR/USD) exchange rate via changes in risk-free rates but also via changes in sovereign spreads. A more accommodative ECB monetary policy is expected to lead to a depreciation of the euro. However, easier financing conditions could also reduce euro area fragmentation risk, reassure investors as to the solidity of the currency union and strengthen the euro. This post investigates whether these two opposite effects are observed in the data for the period 1999 to 2020, with a particular focus on changes in sovereign spreads.

The co-movement of sovereign spreads and the EUR/USD exchange rate has varied over time

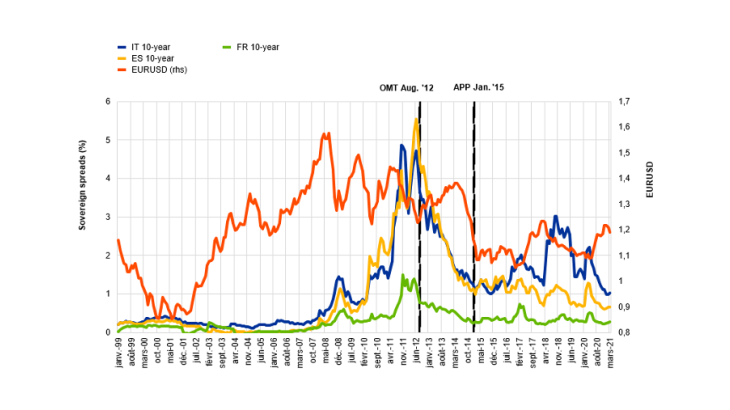

Before 2009, the yield spreads on French, Spanish and Italian 10-year sovereign bonds relative to the 10-year German Bund were very low and tended to move in tandem (Chart 1). With the outbreak of the European sovereign debt crisis, however, yields diverged significantly. The ECB’s non-standard measures have played a strong role in containing these sovereign spreads.

Looking at the joint evolution of the nominal EUR/USD exchange rate and 10-year sovereign spreads, we observe that the co-movement between the two has changed over time (Chart 1). For the overall period, correlations are low (either computed using monthly levels or using changes in these variables). Since 2015, correlations have become stronger and negative, as periods of low spreads have coincided with a stronger euro. In the case of Spain, correlations have reached -0.1 and -0.5 respectively for changes and levels.

Monetary policy affects the euro through risk-free rates and sovereign spreads

In this section, we investigate whether ECB monetary policy affects the EUR/USD exchange rate via changes in risk-free rates alone, or also via changes in sovereign spreads. To do this, we measure the impact of monetary policy news or surprises on the EUR/USD exchange rate in a tight window of some 90 minutes surrounding ECB monetary policy announcements. We report the results for the six-weekly ECB press conference, which starts at 14:30 CET and lasts for about 60 minutes. During this event, the ECB President reads out the Monetary Policy Statement summarising the Governing Council’s assessment of the economic situation and the policy change. After this, the ECB President and Vice President answer questions from journalists.

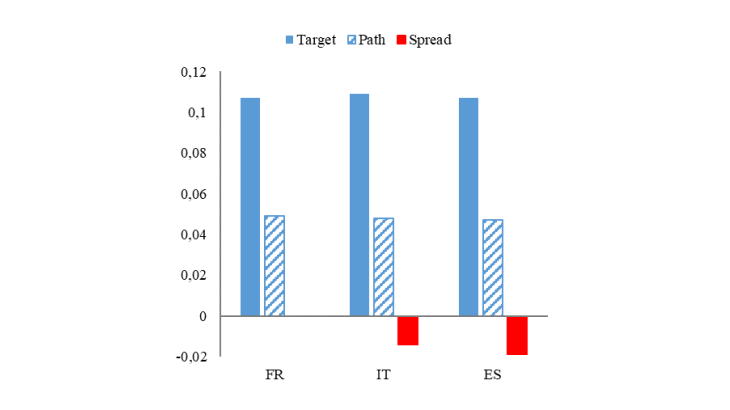

The news content of monetary policy announcements is identified via: (i) changes in the 1-month OIS interest rate, which we refer to as the “target” surprise; (ii) changes in the orthogonalised 2-year OIS yield against the 3-month OIS rate, which we refer to as the “path” surprise; and (iii) changes in French, Italian and Spanish 10-year sovereign spreads versus the German bund, which we refer to as the “spread” surprise. This set of surprises captures policy news on both standard and non-standard monetary policy. We then regress the changes in the EUR/USD exchange rate in response to target, path and spread surprises, in order to isolate the effect of ECB monetary policy on exchange rates via each of these components.

As expected, a positive (negative) monetary policy target surprise leads to an appreciation (depreciation) of the EUR/USD exchange rate. For instance, for the period 1999 to 2020, on average, the EUR/USD exchange rate depreciates by up to 1% in response to an accommodative policy surprise of 10 basis points during the ECB press conference (PC) window (see target surprise in Chart 2). The reaction to path surprises is similar in sign, albeit smaller in magnitude. In addition, we observe that higher (lower) spreads lead to a depreciation (appreciation) of the currency. These effects are significant when considering Italian and Spanish sovereign spreads. For instance, the EUR/USD exchange rate appreciates by up to 0.2% in response to a 10-basis point decrease in Spanish spreads during the PC window.

Evidence of a “fragmentation risk” channel via which monetary policy affects the euro

The negative relationship between the exchange rate and riskier sovereign spreads reported above is predominant in times of high financial stress in the euro area, as quantified by the redenomination risk indicator (RDR) of De Santis, 2019. By looking at the price spread between CDS contracts denominated in euro and US dollars, the RDR measures the risk that a sovereign bond might be redenominated into a (devalued) legacy currency. When RDR is high for some euro area countries, the demand for their assets diminishes and their refinancing costs increase, leading to disparities in refinancing conditions between member countries. Accommodative monetary policy counters such a fragmentation risk, thus strengthening the solidity of the euro.

Overall, this result could be interpreted as monetary policy working through a “fragmentation risk” channel, and therefore having a “save the euro” effect, in line with the findings of Kane, Rogers and Sun (2020). Nonetheless, this effect is substantially smaller than the depreciation induced by the standard channel of monetary policy through target and path surprises.