Starting in the summer of 2021, the Euro Area experienced a significant surge in inflation, with the harmonized index of consumer prices index reaching a year-on-year growth rate of 10.6% in October 2022. This prompted the reaction of the European Central Bank, which dramatically rose its key interest rates, thereby increasing the 3-month Euribor from -0.5% in March 2022 to 3.88% in September 2023. The sudden rise in interest rates, as well as subdued growth prospects and heightened uncertainty, put financial stability concerns at the forefront of policy debates, given the strong empirical link between monetary policy tightening and financial crises. Is this time different? This paper argues that the response largely hinges on the level of banks’ capital requirements.

Indeed, the prudential environment faced by banks is very different compared to past monetary tightening episodes. In particular, following the 2008 Great Financial Crisis, European countries adopted a number of prudential tools to increase banks’ capital requirements, notably in order to enhance their loss absorption capacity. Although some of these tools have initially been considered as countercyclical instruments, competent authorities have reconsidered this approach during the historical monetary tightening of 2021-2023. Despite a significant credit growth slowdown, these capital reserves were not released, while some jurisdictions went as far as tightening their stance. Overall, these buffers have rather been used to strengthen banks’ resilience, rather than to tame the financial cycle.

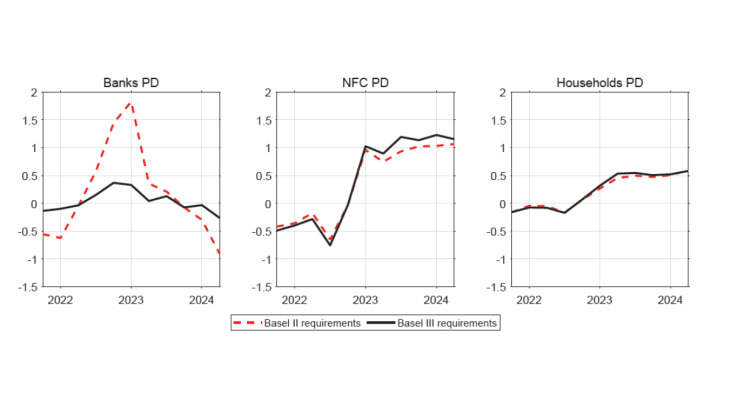

To address the contribution of capital requirements to the transmission of this rise in interest rates, we build a structural macroeconomic model with a rich set of nominal and financial frictions. We then estimate it on Euro Area data up to 2023-Q2, in order to identify the shocks that drove interest rates up. As the model features an explicit banking sector, we can then design counterfactual scenarios regarding the level and design of capital requirements. We first find that the shocks driving the post-Covid inflation growth were related to consumption catch-up, as well as the decrease in the relative price of tangible assets, which fostered investment. Against this backdrop, micro-prudential capital requirements proved to be efficient automatic stabilizers: while they slightly tamed GDP growth during the 2022 expansion, they decreased banks’ probability of default at the beginning of 2023, thereby protecting credit and activity in times of slowdown.

These results rely on the combination of shocks that describes this episode: while the exogenous shock on the relative price of investment contributed negatively to the efficiency of capital requirements, banks’ and firms’ risks shocks contributed positively. We also find that capital requirements had heterogeneous effect between savers and borrowers: while the former increase consumption and reduce housing stocks, the latter have an opposite reaction. Finally, we find that macro-prudential measures, especially a household-specific capital buffer, provided additional layers of protection.

Overall, these findings highlight the usefulness of capital requirements to ensure the resilience of the economy in the face of business and financial cycles, so that monetary policy may be less constrained in its action. Indeed, capital requirements may eliminate the possibility of a hard landing, especially if banks bear interest risks. In addition, capital-based macroprudential policies enable to enter a monetary policy tightening cycle with sufficient capital buffers, and thus significantly contribute to macroeconomic stability, by maintaining bank profitability and credit supply. However, capital buffers per se are not sufficient to guarantee alone macrofinancial stability, as they sustain credit supply provided they are not set too high. Complementary borrower-based measures can then be a useful complement to ensure appropriate leverage, although they are beyond the scope of this paper.

Keywords: Monetary Tightening, Financial Stability, Macroprudential Policy.

JEL classification: E44, E52, G21, G28