Supervisory bank stress tests are used to assess the resilience of banks to a significant deterioration in economic and financial conditions or a crisis scenario. They aim to identify vulnerabilities in individual credit institutions and in the banking system as a whole, leading to the implementation of preventive actions if necessary. The tests employ models developed by supervisors and banks to project institutions’ risks, losses, revenues and expenses under a hypothetical stress scenario.

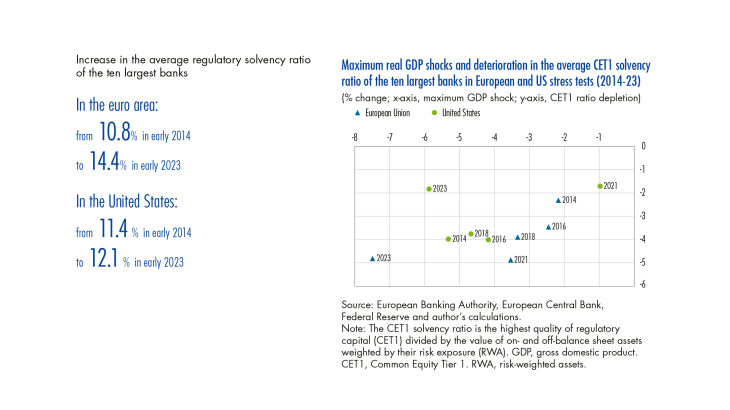

This article exploits publicly available data to examine the methodologies used for the two main comprehensive European and US stress tests – known as the EU wide stress test and the Dodd Frank Act Stress Test (DFAST). The study highlights some discrepancies in application methods that can affect outcomes. The severity of the adverse economic scenarios and their negative impacts on bank solvency have increased over time in Europe and are now stronger than in the United States. In the United States, the economic shocks tested are shorter in duration and notably weaker in intensity during crisis years. For comparability, we analyse the ten largest European and American banks that have participated in all stress tests since 2014. The two groups have very similar total assets, amounting to around EUR 15 trillion in 2023. Since the implementation of the European Single Supervisory Mechanism (SSM) in 2014, the solvency indicators of the largest banks subject to stress testing have increased more in Europe than in the United States. As a result, even in the tested adverse scenarios, banks in both jurisdictions would generally continue to meet their core regulatory capital requirements, and would still be able to provide financing to the economy. The disclosure of the test results – which are published in greater detail in Europe than in the United States – has also created a positive incentive for banks. This is especially true for those European banks identified as fragile (undercapitalised) in the adverse scenario of the 2014 EU wide exercise.

1 European and US stress tests have identical Basel regulatory frameworks but very different methods of application

Bank stress testing is part of the Basel international regulatory framework, which constrains banks’ activities and financing structures by requiring them to hold a minimum level of capital. …