- Home

- Governor's speeches

- Our two countries facing uncertainty

Our two countries facing uncertainty

François Villeroy de Galhau, Governor of the Banque de France

Published on 21st of November 2024

Paris Europlace Financial Forum – Tokyo, 21 November 2024

Speech by François Villeroy de Galhau, governor of the Banque de France

Ladies and Gentlemen,

今日,皆様とご一緒できて光栄です [I am honoured to be with you today]. It is a great pleasure to attend this Paris Europlace summit in Tokyo with my colleague and friend Governor Ueda. I also wish to thank Jean-Charles Simon for the invitation and the Embassy of France for hosting this gathering. I would like to take this opportunity to give you an update on the economic outlook in France and in Europe, and emphasise the uncertainty that surrounds our horizons. I will then discuss how central banks can foster innovation, which is key to unlocking productivity and growth.

I. Europe and France remain resilient despite uncertainty

Let me start with an update on the economic situation in Europe and in France.

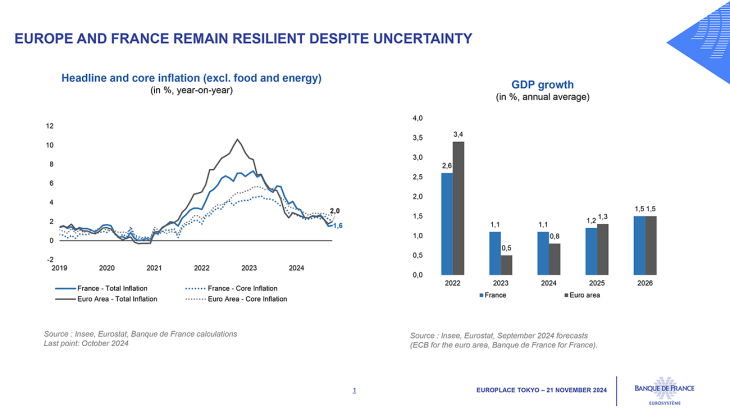

Inflation stood exactly at our target of 2.0% in October in the euro area, and fell below 2% for the second month in a row in France (1.6%), slowing down faster than initially expected. (Villeroy de Galhau (F.),“Rates cuts : inflation slowing faster than expected”, remarks, 18 October 2024) . In the euro area, September ECB projections anticipate inflation to average 2.2% in 2025 and 1.9% in 2026. But markets expect inflation to fall to below 2% already in 2025; and based on the latest actual data, it could already be sustainably at 2% early 2025. When it comes to activity, Europe’s economy remains resilient. Growth was positive in Q3 2024 at 0.4% in the euro area as well as in France. According to our latest forecasts, GDP should grow by 0.8% in the euro area and 1.1% for France in 2024. In my country, two pieces of good economic news are making a positive contribution to this resilience: the long-term effect of disinflation, which boosts real income; and the temporary impact for Q3 2024, of the success of the Olympic Games hosted by Paris.

This “Parisian momentum” extends to financial services. For the fifth year running, France has been Europe’s most attractive country for foreign investment. (EY, Annual Barometer, May 2024). More specifically, the steady rise in exports of financial services since 2020 has resulted in a positive net balance, reflecting partly the growing attractiveness of Paris as a financial centre. A new law adopted in June 2024 and promoted by former MP Alexandre Holroyd, is further boosting our competitiveness. It brings several improvements, to facilitate new public listings and to support trade finance, to name just two. The ACPR, the French banking and insurance regulator, remains strongly committed to pursuing an open dialogue and facilitating the implementation of innovative projects in Paris.

I would now like to discuss one takeaway from this economic outlook and emphasise one important caveat. First, and this is excellent news, the victory against inflation in Europe is in sight. Let me stress that the latest rise in negotiated wages in Q3 (+5.4%) is a somewhat backward looking indicator, mainly driven by the lagged effects of past negotiations in Germany. And it was already taken into account in our September projections. The balance of risks on growth and inflation is indeed shifting to the downside, and possible US tariffs are not expected to alter significantly the inflation outlook in Europe. Based on this assessment, our Governing Council decided on October 17 to lower the deposit facility rate by 25 basis points to 3.25%. This was the third cut in interest rates, and it will not be the last. Looking forward, the path is clear in my view – we should continue to reduce the degree of monetary policy restriction. But the pace must be determined by an agile pragmatism: we maintain full optionality for our upcoming meetings. By the way, this monetary easing creates favourable conditions for the fiscal consolidation which is needed in many countries including France.

And now for my caveat: like the fishermen tossed around by the “Great Wave off Kanagawa” by the famous Japanese artist Hokusai, our two economies are navigating increasingly uncertain waters. Frank Knight (Knight (F.), Risk, Uncertainty and Profit , Boston et New York, Houghton Mifflin Company, 1921) (1921) famously coined the difference between risks, which are measurable and hence hedgeable, and uncertainty, with unknown probabilities and outcome. Today’s world is more and more “Knightian” (Villeroy de Galhau (F.),“Monetary Policy in Perspective (II): Three landmarks for a future of “Great Volatility”, 30 October 2024), while uncertainty negatively affects investment decisions ( Bloom (N.), Bond (S.), Van Reenen (J.), « Uncertainty and Investment Dynamics », The Review of Economic Studies, Vol. 74, Issue 2, April 2007) as well as household consumption.

In the wake of the US presidential election, the world economy may be further confronted with an adverse fragmentation. At the international level, this calls for greater cooperation between like-minded jurisdictions to deliver on existential global public goods such as financial stability in the face of increased global debt or ecological transition to address climate change, to name just two of them. Europe and Japan believe in an open multilateralism based on internationally agreed standards. In particular, we must reaffirm our strong commitment to ensure a level playing field between different jurisdictions and, consequently, a fair application of Basel III standards that are essential safeguards for the stability of the international monetary and financial system.

II. Innovation and central banks

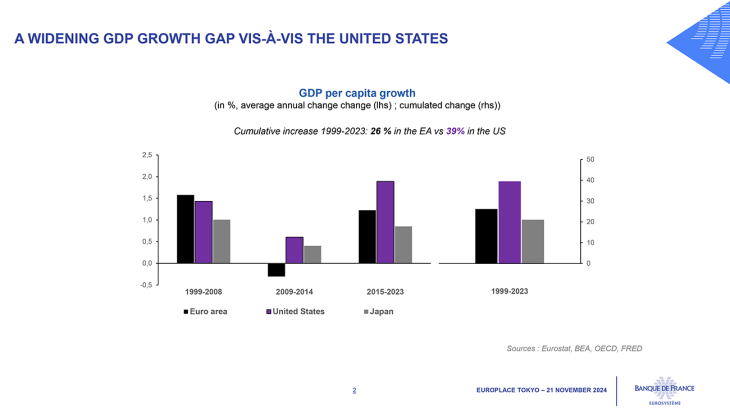

Innovation is the primary explanation for the widening gap in GDP growth between Europe and the United States, with the cumulated increase of GDP per capita reaching 26% between 1999 and 2023, compared with 39% in the United States.

The Draghi report recently gave its thorough diagnosis: too slow innovation, insufficient investment in ICT and too low productivity.

First, central banks can contribute to an innovation-conducive environment. This starts with our mandate to maintain price stability. Our commitment to bring inflation back durably to 2% in Europe underpins household and business confidence, and helps ensure a low cost of financing, which is a necessary condition for innovation to thrive.

While preserving their independence and making clear that they are not the decision-makers in this field, central banks in Europe can also have a supportive role.(Villeroy de Galhau (F.),“Monetary Policy in Perspective (II): Three landmarks for a future of “Great Volatility”, 30 October 2024) . They can provide their insights and expertise to governments regarding structural economic challenges, which includes innovation policies that are vital to foster future growth and productivity. In today’s Europe and today’s world, non-monetary action is both more necessary and more difficult than ever, due to the weakening of governments in many countries. We, as central bankers, will for example continue with President Lagarde to advocate the Draghi and Letta reports.

Second, central banks are supporting innovation through their own projects. Let me focus today on our progress regarding central bank digital currencies (CBDCs) through two distinct spaces.

Starting with the retail space, like the Bank of Japan with the yen, the Eurosystem is preparing for a digital euro. This new form of public money would be comparable to a “digital banknote”: it would be accepted everywhere in the euro area, with a high level of privacy and free of charge for individuals. It would be distributed by banks and other private intermediaries, therefore preserving financial intermediation. Private pan-European projects, such as the European Payments Initiative (EPI), could take advantage of its open and harmonised standards. In this sense, the digital euro would help overcome the fragmentation of payment solutions in Europe.

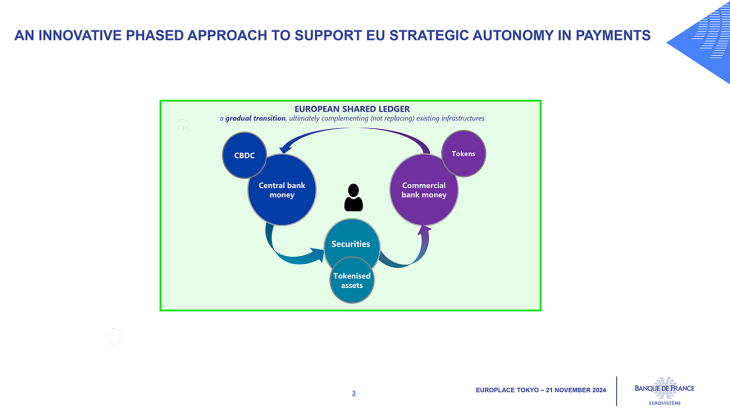

In the wholesale space, the Banque de France has been a pioneer in exploring the use of CBDC in various settlement processes, launching an ambitious experimental programme (Banque de France, Wholesale central bank digital currency experiments with the Banque de France, New insights and key takeaways, July 2023) as early as 2020. In 2024, thanks to our initiative, this work broadened with an extensive exploratory programme within the Eurosystem. Since its launch in May, the Eurosystem has been testing three interoperable solutions (Full DLT interoperability solution provided by the Banque de France, TIPS Hash-Link provided by the Banca d’Italia, and Trigger Solution provided by the Bundesbank) for large tokenised payments transactions and for settling tokenised financial assets using central bank money. Such work is crucial in a quickly evolving landscape, where traditional infrastructures are likely to coexist with new DLT systems. The euro area could later build a shared ledger, understood as a shared utility platform where tokenised financial instruments, tokenised settlement assets (CBDC and tokenised commercial bank money, or tokenised deposits), and potentially a digital euro, could coexist.

At a global level, Project Agorá is bringing together private financial firms and central banks (including the Bank of Japan and the Banque de France as the Eurosystem’s representative), for making this vision a reality.

Let me conclude this speech on a musical note by telling you how delighted we are to welcome back in a few days the renowned Japanese pianist Junko Okazaki to the Bank of France. Ms Okazaki is regularly invited to play at the Bank – she notably gave a concert in our Galerie Dorée for the 150th anniversary of the French-Japanese relations in 2008. She is a living testimony of the fruitful interaction between our two countries, be it at the cultural or financial level. In today’s Knightian world, rest assured that we, central bankers, will do our part, in close cooperation, as “anchors” of confidence, to reduce uncertainty and promote innovation. Rather than paralysing us, uncertainty should prompt us to accelerate our structural transformations.ご清聴ありがとうございました [Thank you for your attention]

Download the full publication

Updated on the 22nd of November 2024