- Home

- Governor's speeches

- Monetary Policy in Perspective (II): Thr...

Monetary Policy in Perspective (II): Three landmarks for a future of “Great Volatility”

François Villeroy de Galhau, Governor of the Banque de France

Published on 30th of October 2024

The London School of Economics - London, 30 October 2024

Ladies and Gentlemen,

I am delighted to be in London and I wish to warmly thank Professor Iain Begg for the invitation. The current decade has been remarkable for central banks, characterized by an unprecedented and highly implausible sequence of shocks: a deflationary one with Covid, followed by an inflationary one with the unwarranted Russian invasion of Ukraine. In a speech I gave last week in New York,i I looked back on the critical role and success of credible monetary policies in the recent disinflation episode. Today, I will look forward and discuss how central banks can navigate this new environment of “Great volatility” that sharply contrasts with the stability of the past “Great Moderation”. Expect more supply shocks, while analysing that not all of them are alike (I). Anchor even more our inflation objective, with some adjustments (II). And be ready to support louder and clearer structural reforms (III).

I. Standing ready to face greater volatility and supply shocks

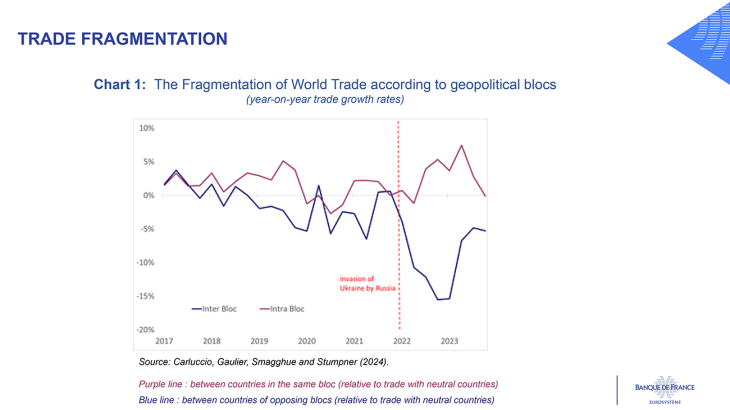

Some argue that the next years will see more inflationary forces, with deglobalisation, decarbonisation and demographics. Maybe… but for sure the near future will be shaped by more uncertainty. Supply shocks are likely to occur more frequently, as stressed by president Lagarde in a widely noted speech in Jackson Hole last yearii. This will contribute to greater volatility and less predictability in inflation. Political fragmentation, beyond extreme events such as wars, is already inducing a decoupling of tradeiii along geopolitical blocs, particularly for energy and selected high-tech products (mobile phones, laptops and computer chips).

With fewer and more specialized suppliers, supply chains turn less flexible, which reduces their capacity to absorb shocksiv. Climate change is already increasing physical risks with their associated supply disruptions: the number of extreme floods, storms and climatological events such as heatwaves or wildfires has more than doubled over the past forty yearsv. The transition to an ecologically sustainable global economy will also be bumpy as the adjustment costs are large and unevenly spread. Yet, these are not the only challenges the world economy is facing going forward. Demographic change is weighting on labour supply and will affect migrations, as well as the composition of peoples’ consumption baskets. Technological shocks are also likely to be more pervasive, starting with AI.

1. Not all supply shocks are alike

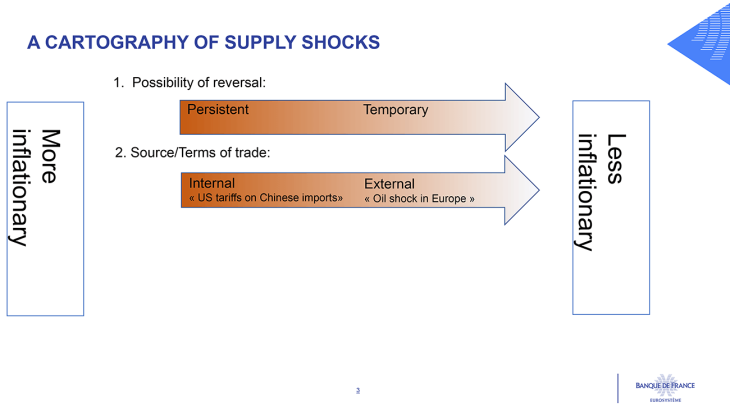

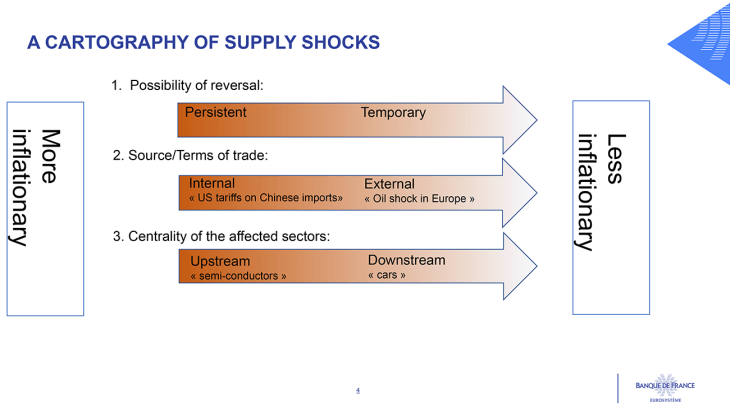

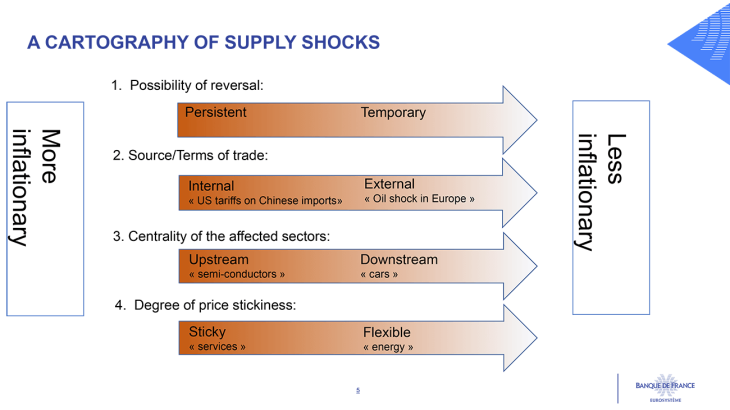

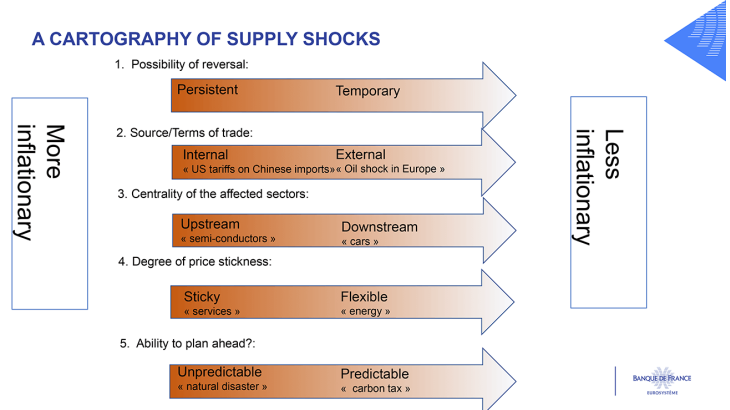

These multiple supply-side shocks will have different implications for inflation. Adverse supply shocks, while usually contractionary, need not be inflationary at all horizons. As a consequence, there is no ‘one-size-fits all’ policy response. The starting point is a thorough analysis of the anatomy of supply shocks, with a corresponding cartographyvi. Five key characteristics of the shock matter for monetary policy.

The first one is the degree of shock reversibility. This is why central banks may want to “look through” supply shocks, since the inflationary effect of a transitory shock might dissipate before monetary policy reaches its full effect (after 18 to 24 months). Symmetrically, as central banks can be uncertain about the transitory nature of supply shocks, they may want to react early to avoid spillovers to core inflation.

The second characteristic is between the domestic or external origin of the disruption. When the shock is imported from the rest of the world (e.g. an oil-price shock for an importing country), the impact on domestic inflation may be later mitigated by the negative impact of the terms-of-trade shock on aggregate demand. The same shock can be an external supply shock and an internal demand shock. Such mitigation of inflation is absent if the shock is domestic (e.g. a drought leading to an increase in local food prices).

I also have to mention that domestic or external disruptions can be policy-induced.

Think about tariffs. Who bears the cost of higher tariffs depends on which firms can pass the increase in costs to its buyers. The imposition of US tariffs on Chinese imports is a case in point of a policy-induced shock: its impact is almost fully passed through to importer prices in the USvii, and in that case a persistent price level shock.

The third characteristic is the centrality of the affected sectors.

It determines how far shocks can ripple through the supply chain. The semiconductors shortage in 2021 is an example of an upstream shock leading to significant production losses in the downstream production of automobile around the globe.

The fourth factor to consider is the degree of price stickiness in the affected industries.

Differences here interact with the sector centrality I just mentioned. Recent energy price shocks originated in a sector with fairly flexible prices. But energy is an upstream sector and shocks here are cost-push shocks for downstream sectors with overall stickier prices, including services. While inflation initially rises only in a limited way in sectors with sticky prices, it persists for longer. viii

Finally, the fifth characteristic of supply shocks is their predictability.

Disruptions do not need to be sudden and unexpected, they can be anticipated well-ahead. The more predictable a supply shock, the more manageable it will be. For instance, a preannounced steadily rising carbon tax will have more manageable effects than an unexpected one-off jump.

Bottom line: there is no longer one textbook answer to supply shocks. Central banks will have to analyse more granular data, and exert their judgment. Most shocks to come could be expected to be external for the euro area and on more flexible prices like commodities or critical raw materials, and hence have less persistent inflationary effects if inflation expectations are kept well anchored. But their centrality in the economy, and their intricacy with more sticky services prices should keep central banks in alert.

While climate-related and natural disasters are often unpredictable, risk scenarios help us to identify the worst possible outcomes and mitigate them (by reacting ahead of time).ix These could be useful input to a risk-management approach to policy setting.

That said, expect all of us to live with increased uncertainty. Frank Knight (1921) famously coined the difference between risks, which are measurable and hence hedgeable, and uncertainty, with unknown probabilities and outcomex. Today’s world is more and more “Knightean”. And uncertainty negatively impacts investment decisions as shown by Bloom et al.xi, as well as household consumption: see the recent increase in the savings rate in Europe, at least partially explained by a lowering confidence. Central banks themselves won’t fully escape this increased uncertainty; but they must do their best, as “uncertainty absorbers”, to reduce it for economic agents: this brings me to our inflation objective.

II. Anchoring while adjusting our inflation objective

Responding to supply shocks poses a greater challenge for central banks compared to the demand shocks faced in the 2010s. Unlike demand shocks, supply shocks create a trade-off, as higher inflation is accompanied by a negative hit on output. Moreover, monetary policy primarily influences demand, has no direct effect on supply. A further clarification is important: monetary policy does not target specific sectors and relative prices, as price signals play a key role in the market economy to enable an efficient allocation of resources. Nevertheless, we must remain vigilant as households and firms are very sensitive to specific prices in forming perceptions of inflation.

Do we then need to modify our price stability framework? Increased volatility, even well managed, means that we could likely deviate from our inflation target more frequently. Maintaining inflation precisely on target 2,0 at all times is neither realistic, nor necessary. Instead, our focus must remain forward-looking, as monetary policy affects the economy with considerable lags.

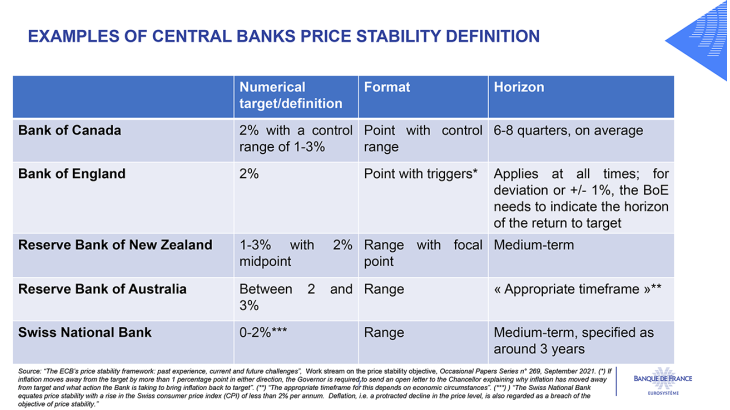

1. Keeping the 2% target

Central banks have converged on a 2% target and there are good reasons for it. It is low enough to make inflation barely noticeable when it is at target. But it also provides a buffer to avoid deflation and a margin on nominal interest rates to reduce the risk of hitting the effective lower bound. The 2% target has proven effective in anchoring expectations, as historical evidence demonstrates. It has now become a global standard in advanced economies. Revisiting it is not on the table for our Strategy Review next year, as the ECB President already made it clear. That said, facing greater volatility, should central banks have more flexibility around this inflation target?

2. Flexibility in space: ‘control’ bands?

Without changing the point target, some argue that we may want to make it more flexible thanks to inflation bands. Facing greater volatility, inflation bands could reduce the risk of fine tuning and overreacting to small changes in inflation. Several advanced economies’ central banks today follow a target with an explicit tolerance band. However, the explicit numerically defined band can play different roles. Most of those central banks pursue a point target, with a tolerance band that serves as a communication device: being off the target does not immediately call for activism on the side of the central bank. The central banks of the UK and Canada fall into this category. New Zealand, also, added a focal point to the inflation target band in 2012.

In contrast, some central banks like the Swiss National Bank target an inflation band, for which they express to be indifferent, as long as inflation materializes within that band or zone. There are however some drawbacks of such target zones in my opinion. One consequence of the implied nonlinearity of central bank policies in the presence of inflation target zones could be higher output volatility, as central banks need to take more forceful actions outside of a band.xii In practice, there is a risk that explicit inflation tolerance bands, even if augmented with a focal point and intended as a communication device only, can be misunderstood as non-intervention zones, thereby undermining the expectation channel of monetary policy.

3. Flexibility in time: medium-term orientation

An alternative and possibly preferable approach in my view is to maintain our medium-term orientation around the symmetry of our objective. As with tolerance bands, under a medium-term orientation a central bank does not have to react to short-term point deviations, but rather respond to inflation dynamics that risk pushing it off target. What matters is not so much the level of deviation from target at one point in time, but the trend and persistence of expected deviations, in other words, whether this deviation is more likely to increase or to decrease. In concrete terms, if inflation is above target, but converging at a sufficient pace, this may not call for action. Nevertheless, a too vague medium-term objective without a clear roadmap is a blurred signal that can ultimately undermine credibility. Hence, the counterpart of such flexibility is that it implies a clear communication about the horizon and the journey back to target.

Finally, the medium-term orientation provides some flexibility to deal with supply shock trade-offs. In such situations, headline inflation may not accurately foreshadow medium-term outcomes. Central banks can then decide to put less weight on headline inflation data, and give more weight to measures of underlying inflation. This has been the case since 2022 in the euro area, when underlying inflation became one of three criteria of our reaction function. This issue is also covered in the chapter 2 of the latest WEO of the IMF, which shows in particular that, in the recent period, policy rules targeting inflation in sectors with stickiest prices would have delivered relatively faster disinflationxiii.

However, we should not abandon our reference to headline inflation in the definition of our objective. This measure is well understood by the general public and fits their inflation perception, and this is the inflation that matters for expectations and second round effects.

III. As structural policies play a larger role facing supply shocks, how can central banks help?

In an environment where supply matters more, structural policies also matter more for price stability. To the extent that they raise the path of potential growth, structural policies reduce the inflation rate for a given growth rate of effective GDP. Furthermore, a more flexible economy will reduce the reaction of prices to a given shock, because reallocations and substitutions across sectors, technologies and geographies will be faster. More than ever, monetary policies should not be “the only game in town”; but they could even not be the “central game”. As regularly repeated – but not much noted? – in our Monetary Policy Statement, “fiscal and structural policies should be aimed at making the economy more productive, competitive and resilient”xiv.

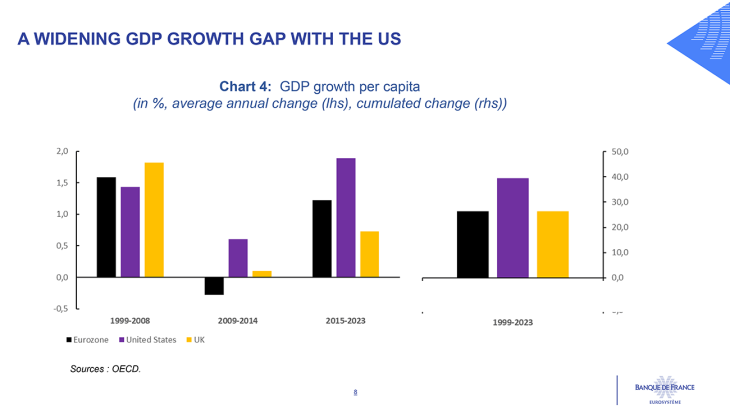

Let me first emphasise the urgent need for action. Europe has a growth and productivity problem. We had rather good news in the short term on Q3 growth this morning, in the euro area (+0.4%), as well as in France (+0.4%). But with a broader view, there is a widening gap in GDP growth compared to the United States, with cumulated increase of GDP per capita reaching 26% since 1999, compared with 39% in the US.

Given the tight fiscal space – at the end of the first quarter of 2024, debt-to-GDP reached for example 111% in France –, fiscal policy should be focused in many countries towards consolidation rather than stimulus. We must escape the high debt / low growth trap.

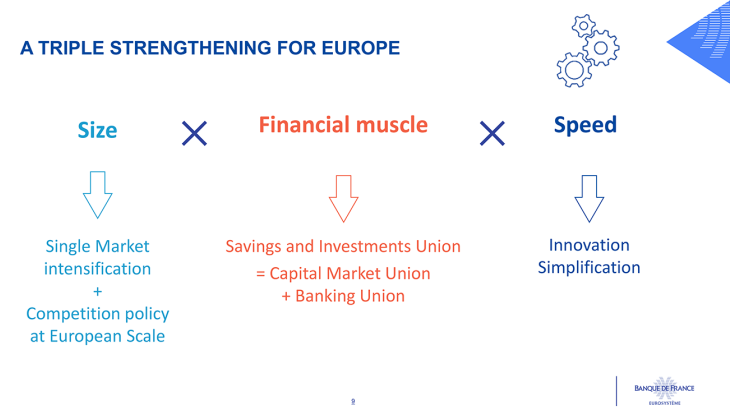

Reassuringly, we have nevertheless two roadmaps with concrete proposals to tackle these growth challenges, the Draghi report for enhancing European competitiveness and the Letta report for empowering the Single Marketxv. They provide the structural reforms agenda essential to foster innovation and productivity, while leveraging the green and digital transitions. If we put aside the Eurobond part of the Draghi report which could be disjoined, let me sum up this agenda with a triple strengthening of the European economy: size, multiplied by muscle, multiplied by speed.

1. The supportive role of central banks

Central banks can help fiscal consolidation and structural reforms by preserving stability in this volatile environment. Central banks can be the anchors in the storm. By keeping long-term inflation expectations anchored, they reduce long-term inflation risk premia, the cost of long-term funding and ultimately improve macroeconomic stability.

2. Using our credibility, and inspiring good governance practices?

Central bankers are naturally reluctant to address the structural economic challenges and reforms, as these are often somewhat of political nature; but the Bank of Spain by law or the Bank of Italy in practice for instance often have to stress such topics. More generally, central banks in Europe are more vocal there than say, the US Federal Reserve. There are good economic reasons, as said, why central banks have some legitimacy for providing help to governments in this field while preserving their independence. Unfortunately, many of these governments are at present politically weakened and face a difficult task, under pressure of short-termism, conflicting objectives and national biases. One key element of central banks’ successes comparatively has been credibility. This credibility on monetary policy was built through decades of tenacious action and communication.

Using this credibility to speak, beyond monetary policy, about structural reforms and fiscal consolidation, is not without risks. We as Central Banks should make clear that we are not the deciders there; that we mention structural policies as far as these are relevant for price stability; that our role is to bring independent data, expertise and explanation in the public debate; that we accept our views to be discussed and even contested. But in today’s Europe and today’s world, where non-monetary action is both more necessary and more difficult than ever, this risk may be worth taking for central banks. If we do not advocate the Draghi and Letta reports, who will? Or if we do not defend open trade, with fair rules, who will?

However, credibility did not come by chance: the architecture of the ECB, as a central bank, was designed to counteract short-termism, and to achieve the common goal of price stability. While our governance may not be directly transferable to other institutions, I see three key ingredients that can serve as an interesting example – and are by the way also gathered for European successful competition policy: (i) clear and precise objectives, the “mandate”, conferred by democracy; (ii) institutional independence with majority voting after an open and confident discussion; (iii) full accountability on decisions and results. I will sum up this way: if we were not efficient, we would not be fully legitimate in being independent.

While this governance is obviously not universally applicable, and the decision here belongs to political authorities, these could possibly consider replicating it in some specific domains in Europe. As an example, achieving the capital markets union, now adequately rebranded as a broader “Savings and Investments Union”, is vital for fostering growth: as part of it, a unified and independent supervision of markets is key. Regarding climate change, some have put forward innovative reflections around a “central bank of carbon”xvi, which could steer the climate agenda, with a clear mandate to reduce carbon emissions and reach net neutrality in 2050.

Let me conclude with Bertrand Russell, the famous British philosopher and mathematician who was awarded the Nobel Prize in Literature in 1950. He was also one of the founders of the London School of Economics. In his History of Western philosophy, published in 1946, he wrote: “To teach how to live without certainty, and yet without being paralysed by hesitation, is perhaps the chief thing that philosophy, in our age, can still do for those who study it.” We, central bankers of the 21st century, have started to learn how to manage uncertainty in an unprecedented succession of shocks. We stand ready to adapt to this new environment of Great Volatility and to act where needed, in order to remain an anchor of stability. For our economies to show resilience, structural policies have to follow suit: rest assured that we will do everything in our remit to help keep these fundamental issues front-stage. Thank you for your attention.

iVilleroy de Galhau (F.), A monetary policy perspective (I): three lessons from the recent inflation surge, speech at New York University, 22 October 2024

iiLagarde (C.), Policymaking in an age of shifts and breaks, speech at Jackson Hole, 25 August 2023

iiiMancini (M.) et al., Positioning in global value chains: A new dataset available for global value chain analyses, VOXEU Column, 18 April 2024

ivMancini (M.) et al., ibid

vDrudi (F.) et al., Climate change and monetary policy in the euro area, ECB Occasional Paper Series No 271, September 2021

viVilleroy de Galhau (F.), Central Banks’ Exit from the Garden of Eden, speech, 28 June 2024

viiCavallo (A.) et al., Tariff Pass-Through at the Border and at the Store: Evidence from US Trade Policy, American Economic Review, Vol. 3, No. 1, March 2021

viiiAfrouzi (H.) and Bhattarai (S.), Inflation and GDP dynamics in production networks: A sufficient statistics approach, NBER Working Paper, February 2022 (updated in July 2024)

ixDées (S.) et al., An analytical framework for assessing climate transition risks: an application to France, Review of World Economics, 1-57, 17 July 2024

xKnight (F.), Risk, uncertainty and profit, published in 1921

xiBloom (N.), Bond (S.), Van Reenen (J.), “Uncertainty and Investment Dynamics”, The Review of Economic Studies, Vol. 74, Issue 2, April 2007

xiiLe Bihan (H.), Marx (M.) and Matheron (J.), Inflation tolerance ranges in the New Keynesian Model, European Economic Review, Vol. 153, April 2023

xiiiInternational Monetary Fund, World Economic Outlook, Chapter 2, October 2024

xivEuropean Central Bank, Combined monetary policy decisions and statement, 17 October 2024

xvLetta (E.), Much More than a Market – Speed, Security, Solidarity, report, 10 April 2024

xviDelpa (J.) and Gollier (C.), Pour une banque centrale du carbone (For a central bank of carbon) (French only), October 2019

Download the full publication

Updated on the 30th of October 2024