- Home

- Governor's speeches

- Central Banks’ Exit from the Garden of E...

Central Banks’ Exit from the Garden of Eden

François Villeroy de Galhau, Governor of the Banque de France

Published on 28th of June 2024

Global Interdependence Center Paris – 28 June 2024

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

Welcome to Paris for the latest edition of the GIC conference. For many of the past forty years central banks have lived in a sort of economic Garden of Eden: an apparently peaceful life with easy choices. I will first describe this paradise of stable inflation (I). I will then describe the shocks that have ruptured this tranquility – the Great Volatility - presaging a world of heightened uncertainty: the Exit of the title (II). I will then outline strategies to respond to this more challenging world, emphasizing the importance of our independence and price stability mandate (III).

I. A world of stable inflation and the rise of central bank credibility

The Great Moderation from the mid-1980s to the Global Financial Crisis (GFC) was a period of moderate inflation and steady growth in output, employment and living standards. This macroeconomic stability, after the turmoil of the 1970s, created great confidence on the part of researchers and policymakers in our capacity to smooth the business cycle, although there was a lively debate about whether this long period was due to ‘good luck’ or ‘good policies’. Indeed, economic supply was augmented by the integration of Central and Eastern European economies and the further acceleration of globalization when China started to fully open up in the early 2000s. Moreover, political risks were generally low and technological innovation vibrant.

This period was interrupted by the GFC in 2008 and the European Debt Crisis of 2010-2012. But central banks understood the nature of the shock relatively quickly and responded decisively with new tools targeting the provision of liquidity that prevented crisis-amplifying asset fire sales. What followed was a period of lowflation from 2012 to 2020 associated with very low global real interest rates. Falling r* reflected a global savings glut due to increased pension savings, trade imbalances and a motive for emerging market economies to self-insure.

Certainly, there was an element of “good luck” in a sense that shocks that hit the economies before the pandemic were relatively well understood.i Also, most shocks have been on the demand side, which makes policy less contentious due to a ‘divine coincidence’ between stabilizing output and inflation. However, over the whole period, policymakers reacted with “good stabilization policies” in real time. This good policy was no coincidence but reflected a payoff from investment in institutional credibility. With the disinflationary process that started in the mid-1980s and transitioned over to the Great Moderation, central banks gained the independence necessary to make the tough decisions and act symmetrically. They were given clear price stability mandates (which in practice became inflation targeting frameworks with a gradual convergence towards the 2% target common amongst major central banks). Importantly also, they vastly improved their communication, transparency and accountability to steer expectations about future policy. These three improvements were self-reinforcing because enhanced credibility enabled central banks to stabilise inflation with relatively modest adjustments in policy, which in turn helped anchor expectations and improve credibility.

II. The current period of « Great Volatility »

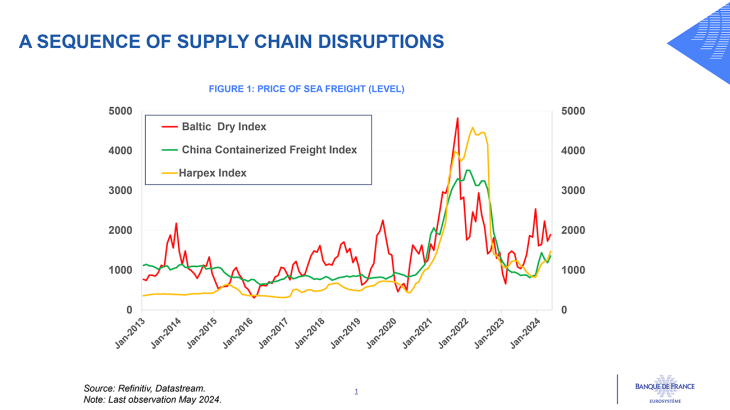

This relatively favorable environment for central bankers came to a sudden end with the Covid pandemic over 2020-22, which from an economic point of view was a sequence of unexpected demand and supply shocks, which considerably reinforced disinflationary dynamics. Yet, while the world was exiting from the pandemic, supply chain disruptions arising from bottlenecks in transportation services or the availability of highly specific intermediate goods operated like cost-push shocks for non-energy industrial goods.

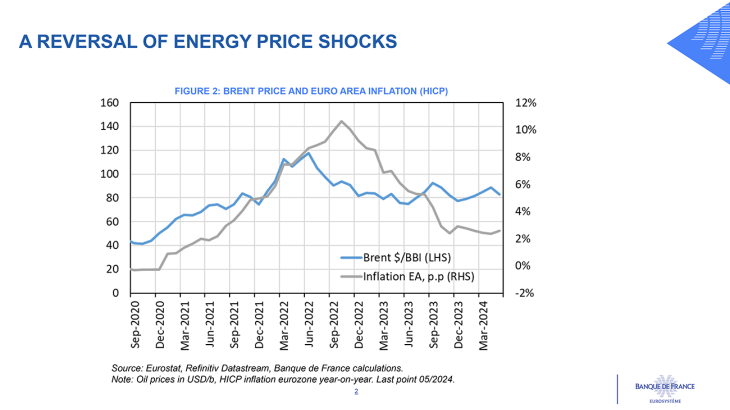

The resulting supply-side constraints occurred during a time when contact-intense services consumption was constrained, encouraging a shift towards durable goods, a sector already under strain. Following the re-opening, the sudden rise in energy prices following Russia’s invasion of Ukraine drastically accelerated inflation, particularly in the euro area, creating the very real danger of a regime with entrenched high inflation.

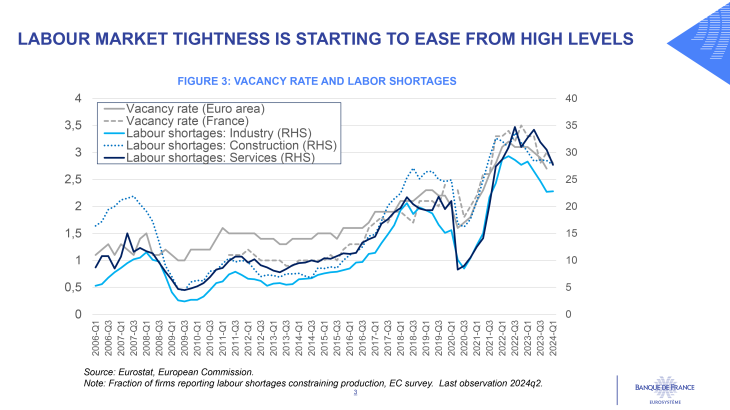

Tight labour markets amplified inflationary pressure, a problem exacerbated by very loose fiscal policy (particularly in the US).

The real question at this point is whether this presages a new regime with a permanent increase in economic volatility or will it eventually revert back to a more moderate environment? Like most “two-handed” economists my answer is “both are partly right”.

The fall in inflation and the success(es) of monetary policy

The good news and what supports the argument that the “Great Volatility” may be temporary is that inflation has come down relatively quickly in the euro area, as well as in the US, partly due to a reversal of energy and food prices and partly due to our determined monetary policy response. After the peak of headline inflation in October 2022 at 10.6%, inflation rates halved to 5.3% by September 2023, when the ECB policy rates reached their peak, and has halved again to 2.6% in May. In retrospect, the underlying shocks were transitory but monetary policy played its role by preventing a lasting propagation to core inflation.

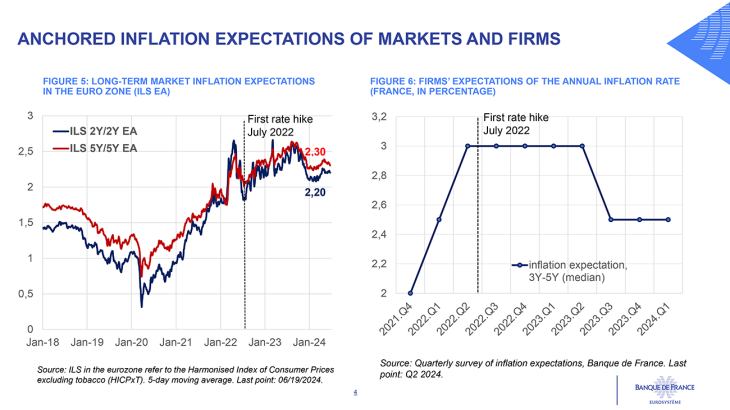

This successful disinflation reflected two key channels: the ”traditional” channel whereby higher real interest rates dampen credit and demand (estimated to have contributed up to 2pp less inflation in 2024); and the newer expectations channel, whereby inflation shocks die out because of anchored inflation expectations.

The power of this second channel can be traced directly to the virtuous cycle of credibility I mentioned above.

Is the “Great Volatility” here to stay?

Unfortunately, there are also reasons to fear that the period of high inflation volatility may endure. Some macro trends could make inflation more erratic and less predictable. Let me elaborate:

Supply-side factors are turning less favorable. Here I list just a few: Fertility rates in most European countries are trending down, reducing the potential labor force; policies favoring carbon-free sources of energy, while warranted, could weigh on the supply-side during the transition period; and global trade fragmentation is becoming more likely and supply chains more fragile, in the context of weaker multilateral institutions. Commentators locate peak-globalization at the end of the first decade of this millennium. ii Much faith is placed on AI to improve productivity but the impact on inflation is unclear.

At the same time, exogenous shocks may become more frequent and larger in magnitude: Climate change is creating more frequent extreme-weather events, as witnessed by the devastating flooding in southern Germany and northern Italy earlier this month. Geopolitical rivalry and political uncertainties are likely to intensify.

III. Policy strategies to tackle periods of high volatility

What adjustments are needed for a new inflation regime with higher volatility?

The starting point: mapping potential supply shocks

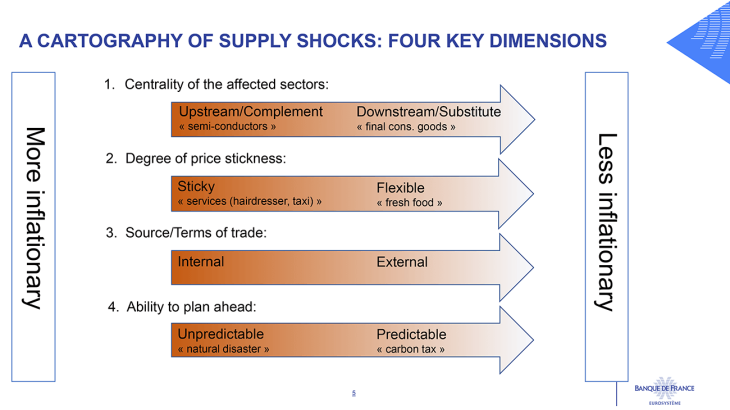

In order to define a proper starting point for the policy process, we need to foster our analytical capabilities to take these new risks on board in a comprehensive and evidence-based policy process. One lesson learned from the recent inflation surge is that not all supply shocks are alike. Indeed one of the challenges is how to map the multitude of potential shocks into an analytically manageable cartography. Let me propose 4 dimensions along which we should parse any potential shocks:

a) Which part of the production network is directly affected? Shocks affecting upstream sectors of complementary goods or services (or difficult to substitute) have greater effects than downstream and highly substitutable goods or services

b) The degree of price stickiness of the affected sector. Persistent shocks to sectors that change prices infrequently will have more durable costs than temporary shocks to sectors with highly flexible prices in both directions.

c) Internal versus external shocks. Shocks to imported goods with no domestic substitute have a stronger immediate impact, while afterwards a terms of trade effect can partly mitigate the overall inflationary pressures. Changes to internal relative prices (such as a carbon tax) redistribute purchasing power between domestic consumers.

d) The predictability of the effects (a preannounced steadily rising carbon tax will have more manageable effects than an unexpected one-off jump).

Central banks will need to invest in more granular models to analyse these shocks. In particular, the integration of climate-related (physical) risks, despite in its infancy, should feed into our risk assessment for the inflation outlook. Since all supply shocks are not alike, one approach is to use scenarios to explore complex interactions or low-probability/high impact events. These could be useful input to a risk-management approach to policy setting. In times of high uncertainty, we will not always be able to identify all shocks in real time so a risk-management approach leans against the most costly outcomes.

Two messages about the endpoint

About our endpoint, let me emphasise two key messages.

- First, whilst supply shocks can create complicated short term trade-offs between output and inflation, they do not prevent us from achieving our inflation target, which creates the most favorable conditions for sustainable growth in the long run.

- Second, commitment on our inflation target is an efficient strategy in boosting the expectation channel of monetary policy. iii In this regard, the symmetric target of 2% over the medium-term we defined in 2021 has served us well over recent years. We should thus refrain from changing this 2% level, but its adequate flexibility will be part of our strategy review next year. A 2% symmetric medium-term target does not mean strictly 2.0% at all times; some margin of adjustment in time is probably preferable to one in space. Our medium-term horizon gives us sufficient flexibility to smooth the adjustment to shocks, whereas a band could weaken the anchoring of inflation expectations and may potentially be misunderstood as policy inaction zone. iv

Let me switch from these longer term challenges to say one remark on our current policy.

Our pragmatic gradualism is consistent with a gradually higher weight given to the projected outlook – and giving gradually lower weight to the inflow of data. This reflects time-varying uncertainty and risks. Data are inherently noisy and there is a risk of overreacting to volatile news, especially until the end of this year: so “data-driven” in the current inflation environment does not mean “flash-driven”. That said, French inflation in June published this morning at 2.5% after 2.6% in May, is encouraging news: disinflation is on track. As data surprises are now smaller and revisions to the current assessment more minor compared to two years ago, we are gaining more confidence in the forecast and more scope to disregard smaller bumps in the disinflation process.

Let me conclude with a metaphor. The car racing at Le Mans this year was particularly challenging in treacherous weather conditions and 10 cars abandoned because of mechanical failures. This underscores that the more uncertain the journey, the more reliable the vehicle you need. This equally applies to monetary policy and central banks: in uncertain times, we need a reliable vehicle. We have solidity from our two pillars of independence and our price stability mandates. Be assured that, through the present uncertainties, the credibility of the Banque de France and the ECB, and the trust they inspire, will be firmly anchored on these two pillars.

iGarnier, O. (2023) « De la grande modération à la grande volatilité de l’inflation ».

iiNussbaum (2010) Peak globalization.

iiiVilleroy de Galhau, Anatomy of a fall in inflation: from a successful first phase to the conditions for a controlled landing, speech at Paris-Dauphine University, 28 March 2024.

ivLe Bihan, Marx, Matheron (2021) Inflation tolerance ranges in the New Keynesian model, and Grosse-Steffen (2021) Anchoring of inflation expectations: Do inflation target formulations matter?

Updated on the 4th of September 2024