- Home

- Deputy governors' speeches

- Central bank accounts: an expected lull

Central bank accounts: an expected lull

Agnès Bénassy-Quéré, Second Deputy Governor of the Banque de France

Published on 28th of March 2024

Tribune By Agnès Bénassy-Quéré, Second deputy-governor of Banque de France.

March 2024

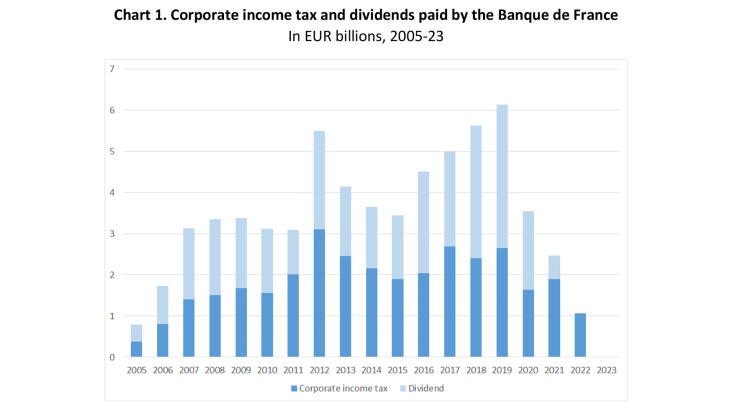

Remember 2020 and its series of lockdowns. In France, inflation was zero, growth stood at -7.5% and the fiscal deficit was -9.2% of GDP. That year, however, the Banque de France paid a corporate income tax of EUR 1.6 billion and a dividend of EUR 1.9 billion to the state (see the 2020 Annual Report).

That same year, some observers were excitedly touting the radical idea of "cancelling" the public debt held by the central bank as a means of freeing up budgetary resources to finance the ecological transition. The advocates of this idea recognised that any such cancellation would result in a loss for the central bank without wiping out its liabilities (i.e. banknotes, commercial bank reserves). But in their view, this loss would not matter, as a central bank could function perfectly well even with negative equity.

This overlooked the fact that in France, as in most other European countries, the state is the sole shareholder of the central bank. Impoverishing the central bank would not enrich its shareholder. In concrete terms, a loss-making Banque de France would not have paid EUR 3.5 billion to its shareholder-tax collector in 2020. The state would have had to find these resources elsewhere, by raising taxes, cutting spending or borrowing on the markets. Using the central bank to finance expenditure is forbidden and, even if it were allowed, unfortunately it would not escape the harsh realities of public finance arithmetic. But it would do lasting damage to a central bank's ability to fight inflation (see Bénassy-Quéré, 2020).

Between 2015 and 2022, the Banque de France paid a cumulative total of almost EUR 32 billion to the state in corporation tax and dividends (2022 Annual Report). The annual breakdown shows that a peak was reached in 2019, when more than EUR 6 billion was paid (Chart 1). The profits generated that year were a direct result of the quantitative easing policy pursued by the Eurosystem since 2015 to tackle the threat of deflation: between end-2014 and end-2019, the Banque de France's balance sheet doubled, from EUR 578 billion at the end of 2014, to EUR 1,142 billion at the end of 2019. However, in 2019, assets comprised loans and securities with positive interest rates, while liabilities essentially consisted of commercial bank reserves paying negative rates! The Banque de France's profit therefore resulted essentially from a negative cost of funds, whereas the yield on loans to banks and securities acquired within the framework of monetary policy was positive – in the context of a balance sheet that had doubled compared with 2015.

The Banque de France's profit began to fall as from 2019 because securities held in assets were paying increasingly less interest (as lower monetary policy rates were gradually passed on to the Bank’s entire stock of assets), while the rate of return on bank reserves stopped falling. From the end of 2022, this rate then turned positive again, while the average rate of return on portfolio assets continued to decline. The Banque de France did not distribute a dividend in 2022, and it paid no corporation tax in 2023 as it posted a net profit of zero (after releasing part of its Fund for General Risks).

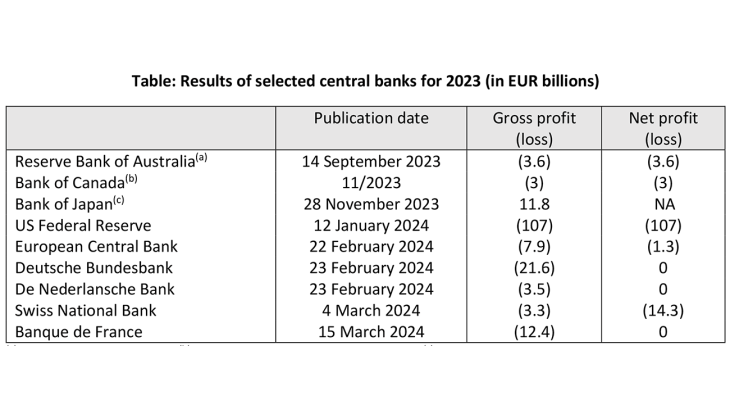

This development is in no way unique to the Banque de France. Gross losses (before transfers from reserves) reported by the Bundesbank for 2023 are almost twice those of the Banque de France, and both the ECB and De Nederlandsche Bank (DNB) posted losses. Admittedly, only 20% of profits and losses on portfolios of securities acquired under the various quantitative easing programmes are shared within the Eurosystem. However, monetary policy is identical throughout the euro area and market yields are very similar. Consequently, the results of national central banks tend to follow the same general trend, with differing impacts on equity depending on the precautionary reserves previously set aside.

Outside the euro area, the US Federal Reserve announced a loss of around USD 116 billion (EUR 107 billion), while the Swiss National Bank reported a loss of CHF 3.2 billion (EUR 3.3 billion), not including an additional CHF 10.5 billion (EUR 14.2 billion) in the provision for monetary reserves. Last September, the Reserve Bank of Australia reported a loss of AUD 5 billion (EUR 3.6 billion) for the period from June 2022 to June 2023, together with negative equity of USD 17.7 billion (EUR 107 billion) at 30 June 2023. In November, the Bank of Canada announced a loss of CAD 4.4 billion for the first nine months of 2023 (around EUR 3 billion). Of the main advanced economies, only the Bank of Japan fared better as its key interest rates remained negative at -0.1% in 2023.

Source: central banks. Gross profit equals financial profit before reversals of provisions and use of reserves.

The Banque de France is starting this period in a relatively favourable position, which it had built up over the past few years. It was able to draw on its Fund for General Risks (EUR 16.4 billion at end-2022) to cover a gross loss of EUR 12.4 billion for 2023. It can also rely on revaluation reserves of at least EUR 18 billion that it could use in the coming years.

The disappearance of profits is neither a surprise nor a tragedy. Bear in mind that the goal of a central bank is to combat both inflation and deflation, not to make a profit. To achieve this objective, the Eurosystem eased monetary conditions considerably during the 2010s before tightening them rapidly as from 2022. As a result of this proactive policy, its profits rose sharply and then disappeared and this situation could last for several years.

Central bank accounts versus national accounts

The fact remains that the Banque de France will pay neither corporation tax nor dividends for 2023. The disappearance of payments to the state budget is a timely reminder that there is no such thing as magic money: when a central bank makes a loss, it doesn’t risk bankruptcy (because it does not depend on external financing), but it does cease to pay corporation tax and dividends. In some countries (notably Sweden), the central bank has even had to be recapitalised. Not only is the Riksbank not paying anything into the state budget for 2023, but around SEK 40 billion (around EUR 3.5 billion) has to be found in the budget to recapitalise the central bank as a result of losses in 2022, which caused equity to fall below the regulatory level (Riksbank, 2023, Riksbank 2024).

Even without sufficient reserves, euro area central banks would not need to be recapitalised: they would simply have to carry their losses forward until the return on their assets rose above that on their liabilities, allowing them to generate profits and increase their equity themselves. Indeed, this is how the Central Bank of Australia, which has negative equity, operates.

At the height of the health crisis, the Eurosystem increased its duration risk ("maturity mismatch" between assets and liabilities) by acquiring securities of all residual maturities, while its liabilities consisted of banknotes and short-term reserves. This policy has helped to bring down medium and long-term interest rates, and thus to support aggregate demand for goods and services and, ultimately, inflation, which, as we know, was at zero in 2020 (+0% year-on-year in December 2020 for the harmonised index, see Insee, 2021). It also benefited the state, which was able to borrow at a lower cost. In a way, the quantitative easing policy implemented as of 2015 transferred a duration risk from the state to the central bank, without any impact on the consolidated accounts of the central bank and its public shareholder.

The success or failure of a central bank cannot be measured by its accounting results, even if they are inter-temporal. We need to ask in particular how the euro area economy would have behaved if central banks, and in particular the ECB, had remained passive during the long period of very low inflation (2010s), during the pandemic (2020-21) and during the energy crisis (2022-23). Naturally, the answers to this counterfactual exercise are incomplete, but it is highly likely that the economy would have experienced deflation, followed by a degradation of its productive fabric, persistent inflation, and ultimately highly unstable inflation. But macroeconomic stability is more precious than central banks’ profits and losses. Bear in mind that each percentage point of GDP is worth EUR 26 billion to France, and that each inflation point not offset by an equivalent rise in wages reduces the purchasing power of household gross disposable income by EUR 16 billion (see INSEE, National Accounts 2022). In 2022 and 2023, the Eurosystem, like many central banks around the world, did not hesitate to raise its key rates rapidly, knowing full well that this would adversely affect the accounts of all euro area central banks. At a time when private currencies are becoming increasingly appealing, we must recall that only an independent central bank is capable of serving the public interest rather than the financial interests of its shareholders.

A transfer to the private sector?

Did the fight against inflation unduly benefit commercial banks? This is what Paul de Grauwe and Yuemei Ji have suggested in various opinion pieces. According to these authors, the rapid rise in returns on bank reserves has led to a transfer of resources from central banks to commercial banks, i.e. away from the state's consolidated account with the central bank. In practice, during the period of quantitative easing, banks sold euro area central banks long-term sovereign bonds belonging to themselves or, more often, to banks outside the euro area and to non-bank customers. In return, they accumulated reserves at the central bank (and their customers accumulated deposits in their accounts). As from July 2022, commercial banks started to benefit from the fact that the rate of return on reserves rose at a faster pace than the return on other assets.

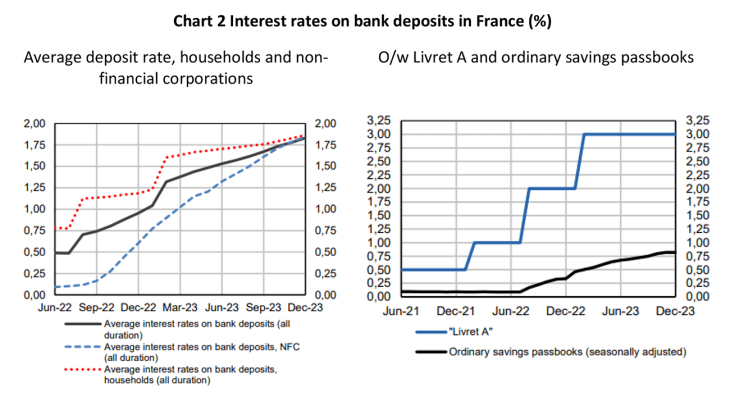

However, we should avoid looking only at a snapshot of 2023, but rather view the film as a whole since 2015. The return on banks' excess reserves remained negative between 2015 and 2022. Thereafter, the increase in the return on bank reserves, on the assets side of commercial banks' balance sheets, was accompanied by an increase in the return on household and business deposits, on the liabilities side. The increase in the cost of liabilities was particularly rapid in France because of the rules applying to interest on Livret A savings accounts. Before stabilising at 3% in the summer of 2023, this interest rate then led to an increase in rates on term deposits, and depositors transferred a substantial proportion of their sight deposits to these interest-bearing products (Chart 2).

Interest rates on deposits 2023Dec

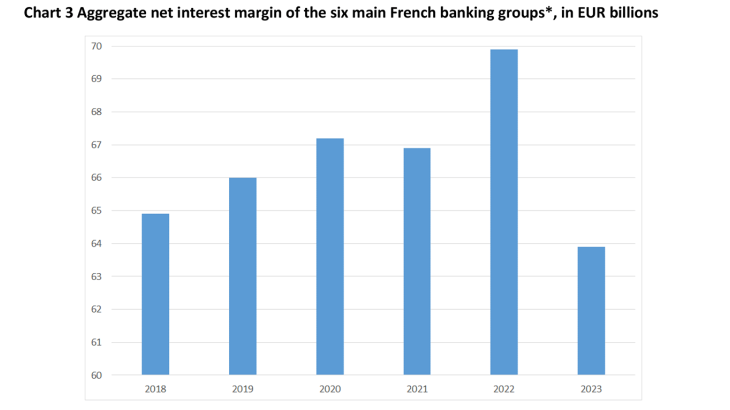

Meanwhile, French banks benefited little from the rise in interest rates on their loans to the economy, due to the very high proportion of fixed-rate loans in France (almost 100% for home loans and 78% for business loans): initially, the rise in interest rates had little impact on the average return on the stock of loans. As a result, their net interest margins (the difference between interest received on assets and interest paid on liabilities) fell in 2023 from an already low level when compared with the other advanced countries (see HCSF, Annual Report 2023 and Chart 3). The impact on annual earnings varied according to the share of regulated savings and housing loans on the balance sheets of the banking groups.

Lastly, we must not lose sight of the fact that what matters for monetary policy is commercial banks' capacity to transmit monetary policy impulses without adding financial instability to macroeconomic instability. The soundness of the banking system, which has been reinforced since the global financial crisis by a very substantial increase in capitalisation and liquidity ratios, facilitates the transmission of monetary policy. As far as central banks are concerned, the cycles of rising and falling accounting results are good news: they reflect active monetary policies and prove that central banks are indeed independent from governments. Instead of worrying about this, we should welcome it.

Updated on the 24th of June 2024