Summary

-

1. Présentation

-

2. Déclarer

-

3. Méthodologie

-

4. Réglementation

-

5. Statistiques

-

6. Analyses

-

6.1 La position extérieure nette créditrice en investissements directs s’est infléchie en 2020

-

6.2 Le secteur industriel tient un rôle moteur dans les investissements directs à l’étranger

-

6.3 Les États-Unis, la Suisse, l’Allemagne et le Royaume-Uni détiennent plus de la moitié des investissements étrangers en France

-

Presentation

Direct investments are international investments by which entities resident in one economy acquire or hold control or significant influence over the management of an enterprise resident in a third economy (direct investment enterprise). By convention, a direct investment relationship is considered to exist when the entity acquires or holds at least 10% of the capital or voting power of the direct investment enterprise. Once a direct investment relationship has been established, all cross-border financial relationships (lending, borrowing, trade credit, equity investments, reinvested earnings) between the direct investor, the companies it controls, the direct investment enterprise and the companies it in turn controls are also considered direct investments and are recorded as such.

Real estate investments are included in direct investments under cross-border asset acquisitions.

All direct investment transactions (carried out abroad by a French resident or in France by a non-resident) in excess of EUR 15 million must be reported to the Banque de France for the purposes of balance of payments preparation within 20 working days. The forms required to report such transactions are available at the direct investment reporting page.

Data on international intra-group company loans and borrowings are collected via specific surveys: the ECO survey for trade outstandings; and the EFI survey for financial outstandings.

Reporting

All direct investment transactions in excess of EUR 15 million must be reported within 20 working days. The form used depends on the nature and purpose of the transaction. The forms required to report direct investments and disinvestments (including real estate) are available on the reporting page and should be sent to invest.direct@banque-france.fr.

Balance of payments surveys (in French)

Methodology

Benchmark methodology for direct investment

The Banque de France applies the official methodology to measure direct investments. The manuals defining the rules and standards for recording international transactions and international investment position stocks are drafted under guidance from the International Monetary Fund (IMF). The Organisation for Economic Co-operation and Development (OECD) has published a benchmark manual on direct investment methodology.

Two different direct investment presentations

Direct investment flows, income and stocks can be recorded and presented according to different principles. The choice of presentation can symmetrically affect the level of flows, income and stocks of French direct investment abroad and foreign direct investment in France, but the overall balance remains unchanged.

The asset/liability principle consists in adding together all claims and obligations (equity or debt – loans and borrowings) within an international group, based on the direction of the investment: a subsidiary's claim on its parent company is thus treated as an investment by the subsidiary in the parent company. Under current international methodology, the asset/liability principle is the benchmark for balance of payments presentation and is therefore applied in the preparation of France’s monthly and quarterly balance of payments reporting.

The extended directional principle consists in presenting transactions and positions according to the economic decision-making unit: claims (equity or loans) between companies belonging to the same international group are not classified according to the direction of the claim, but according to the country of residence of the parent or head office. A subsidiary’s loan to, or equity investment (of less than 10% of the capital) in, its parent company, considered as having been decided by the parent company, are treated as reverse investments and are reclassified as disinvestments by the parent company in the subsidiary. By extension, the directional principle is also applied to dealings between "fellow enterprises”, i.e. enterprises with a “common parent” belonging to the same international group but with no direct equity link between them. For a company resident in France holding a claim on a non-resident fellow enterprise, the claim is treated as a foreign investment if the common parent is also a resident of France. However, the claim is recorded as a foreign disinvestment in France if the common parent is non-resident.

The Banque de France favours "directional principle" data in its analyses of direct investment. These data allow analysts to differentiate more easily between the operations of resident direct investors and non-resident investors, and thereby to better interpret the behaviour of both.

Regulations

Regulatory framework for direct investment data collection

Any foreign direct investment in France (or resident direct investment abroad) in excess of EUR 15 million must be reported for the purposes of balance of payments preparation within 20 working days of its effective execution.

Article L. 141-6 of the French Monetary and Financial Code (Code monétaire et financier) authorises the Banque de France to obtain any documents and information required for the preparation of France’s balance of payments and international investment position.

Article R. 152-3 of the French Monetary and Financial Code specifies that the reporting obligation covers:

- Foreign direct investment in France as defined in paragraph 4 of Article R. 151-1 and their liquidation;

- Acquisitions or disposals of non-resident companies by French residents;

- Acquisitions or disposals of real estate assets abroad by French residents and real estate assets in France by non-residents.

Decision No. 2007-01 of the Monetary Committee of the Banque de France General Council on the collection of statistics for the compilation of the balance of payments and international investment position of France, the euro area and the European Community sets out its application (Articles 5 and 7).

Decision No. 2021-01 of the Governor of the Banque de France on the declaration of statistical information by financial intermediaries for the preparation of the balance of payments and international investment position covers the scope of declarations expected from financial intermediaries.

The French Monetary and Financial Code and Decisions (in French)

- The French Monetary and Financial Code – Article L. 141-6

- The French Monetary and Financial Code – Article R. 152-3

- Decision No. 2021-01 of the Governor of the Banque de France of 21 April 2021 on the collection and control of statistical information required from credit institutions and other financial intermediaries

Statistics

Statistical data on France’s direct investment

Direct investment statistics form part of the financial account of France’s balance of payments and international investment position. Income actually paid is reported in the current account of the balance of payments. Reinvested earnings, which are the subject of a flow in the opposite direction, are also reported in the financial account.

The table of France’s quarterly direct investment flows contains data prepared according to both the extended directional principle and the asset/liability principle. The sub-headings can be used to analyse the change from one set of statistics to another.

Annual direct investment stock, flow and income data are published in The French balance of payments and international investment position Annual Report. They are broken down by country and by sector. Flow data by type are updated quarterly. Total direct investment is estimated on a monthly basis and published in Stat Info – Balance of Payments.

A wide range of direct investment data is available on the Webstat statistics portal.

European and international comparisons

The application of internationally accepted standards allows comparisons to be made between different countries.

Eurostat (the statistical office of the European Union) provides data on the direct investment flows and stocks of most European Union countries.

The Organisation for Economic Co-operation and Development (OECD) compiles international direct investment data reported by all its member states.

The International Monetary Fund (IMF) consolidates the results of an annual survey of its members' direct investment stocks, broken down by partner economy, in its Coordinated Direct Investment Survey (CDIS).

The United Nations Conference on Trade and Development (UNCTAD) regularly publishes statistics on foreign direct investment worldwide, particularly in its World Investment report.

Quarterly flows

Benchmark methodology for direct investment

The Banque de France applies the official methodology to measure direct investments. The manuals defining the rules and standards for recording international transactions and international investment position stocks are drafted under guidance from the International Monetary Fund (IMF). The Organisation for Economic Co-operation and Development (OECD) has published a benchmark manual on direct investment methodology.

Two different presentations of direct investment

Direct investment flows, income and stocks can be recorded and presented according to different principles. The choice of presentation can symmetrically affect the level of flows, income and stocks of French direct investment abroad and foreign direct investment in France, although the overall balance remains unchanged.

The asset/liability principle consists in adding together all claims and obligations (equity or debt – loans and borrowings) within an international group, based on the direction of the investment: a subsidiary's claim on its parent company is thus treated as an investment by the subsidiary in the parent company. Under current international methodology, the asset/liability principle is the benchmark for balance of payments presentation and is therefore applied in the preparation of France’s monthly and quarterly balance of payments reporting.

The extended directional principle consists in presenting transactions and positions according to the economic decision-making unit: claims (equity or loans) between companies belonging to the same international group are not classified according to the direction of the claim, but according to the country of residence of the parent or head office. A subsidiary’s loan to, or equity investment (of less than 10% of the capital) in, its parent company, considered as having been decided by the parent company, are treated as reverse investments and are reclassified as disinvestments by the parent company in the subsidiary. By extension, the directional principle is also applied to dealings between "fellow enterprises”, i.e. enterprises with a “common parent” belonging to the same international group but with no direct equity link between them. For a company resident in France holding a claim on a non-resident fellow enterprise, the claim is treated as a foreign investment if the common parent is also a resident of France. However, the claim is recorded as a foreign disinvestment in France if the common parent is non-resident.

The Banque de France favours "directional principle" data in its analyses of direct investment. These data allow analysts to differentiate more easily between the operations of resident direct investors and non-resident investors, and thereby to better interpret the behaviour of both.

Direct investment: annual series

Direct investment statistics, taken from the 2024 Balance of payments Annual Report, can be consulted on a yearly basis:

- direct investment flows by country and by sector (2000 to 2024);

- direct investment stocks by country and by sector (2000 to 2024);

- direct investment income by country (2005 to 2024).

Analyses

Statistics on direct investment (carried out abroad by a French resident or in France by a non-resident) are a measure of France’s integration in the global economy.

The net asset position of international direct investments contracted in 2020

Over the long term, France invests more abroad than it receives in foreign direct investment. The stock of French foreign direct investment (FDI) abroad was EUR 1,261 billion at the end of 2020 while FDI in France amounted to EUR 785 billion. Although France’s international FDI position is structurally positive, it weakened in 2020, falling from EUR 512 billion in 2019 to EUR 476 billion, solely due to a major negative valuation effect largely related to the appreciation in the euro.

Direct investment transactions generated net capital outflows of EUR 36 billion in 2020 after EUR 5 billion in 2019.

On the one hand, French FDI flows abroad rose from EUR 30.2 billion in 2019 to EUR 40.3 billion in 2020. These flows can be broken down into two categories: capital transactions and loans-deposits. This breakdown shows that French multinationals provided EUR 12.7 billion in net lending outflows to their foreign subsidiaries in 2020, compared with net borrowing inflows of EUR 8.7 billion in 2019. Conversely, flows of equity capital shrank from EUR 38.6 billion to EUR 27.5 billion owing to the downturn in reinvested earnings, i.e. the part of companies’ annual pre-tax profit that is allocated to reserves rather than being distributed.1 The public health crisis had a major impact on turnover and profits, and consequently on reinvested earnings and investment income. The direct investment income surplus contracted from EUR 54.5 billion in 2019 to EUR 31.0 billion in 2020.

On the other hand, net foreign investment in France amounted to only EUR 4.3 billion in 2020, the lowest level recorded since 2014.

Net lending-borrowing flows between foreign groups and their French subsidiaries resulted in a capital outflow of EUR 12.2 billion in 2020. Furthermore, in 2020 the number of capital transactions declined and none of them were significant. The total number of foreign investment or disinvestment transactions in France thus shrank by 63% in 2020. Ultimately, net equity capital investment flows from foreign groups amounted to only EUR 16.4 billion in 2020 compared with EUR 32.1 billion in 2019. This reflects the wait-and-see attitude adopted by companies during the crisis. Therefore, the decline in direct investment in France in 2020 appears to have been essentially cyclical, and should not be interpreted as an indication of a structural deterioration in France's attractiveness (generally speaking, year-on-year variations in direct investment inflows from abroad are not a reliable measure of a country's attractiveness – they can fluctuate massively with a few major merger-acquisitions, which can be planned several quarters before they are actually carried out, while lending and borrowing activities between multinationals and their foreign subsidiaries often have no direct link to a country's attractiveness).

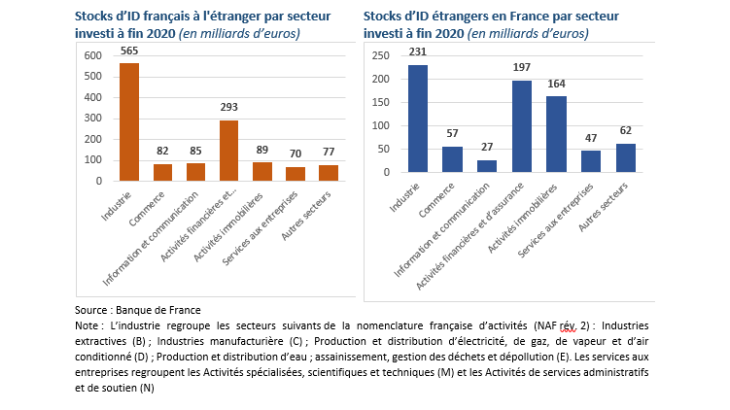

The industrial sector is a driving force behind foreign direct investment

Stocks of French FDI abroad are largely concentrated in the industrial and financial sectors (EUR 565 billion and EUR 293 billion, respectively, in 2020). The same can also be said of stocks of foreign investment in France, which mainly break down between the industrial sector (EUR 231 billion), banking and insurance activities (EUR 197 billion) and real-estate investments (EUR 163 billion).

In 2020, there was more robust growth in French direct investment abroad in the manufacturing sector, public utilities (electricity, water, sewerage, etc.) and transportation services. On the other hand, flows declined in the finance-banking-insurance sectors, and disinvestments were reported in accommodation and food services and business support services (particularly scientific research).

The United States, Switzerland, Germany and the United Kingdom account for more than half of foreign investment in France

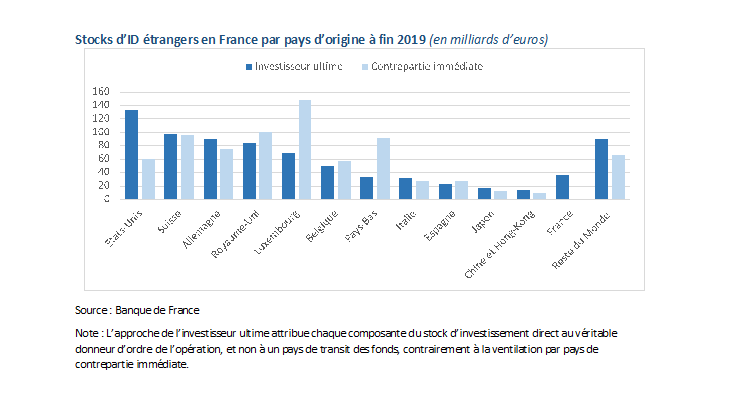

With regards to a breakdown of investments by country, at the moment only the immediate counterparty country can be identified using the 2020 data. At the end of 2020, Luxembourg (EUR 144 billion), Switzerland (EUR 104 billion) and the United Kingdom (EUR 101 billion) accounted for the most significant direct investment stocks in France.

Stocks of FDI in France by country of origin at end-2019 (EUR billion)

In order to supplement the traditional by-country immediate counterparty measure, the Banque de France identifies the “ultimate investor” country. As the information required was not yet available for 2020, it has been calculated up to 2019.

In France’s case, the ultimate investor approach notably shows that Luxembourg and the Netherlands are transit countries for many direct investment operations: although they place first and fourth respectively according to the immediate investor approach, they rank fifth and eighth, respectively, in terms of ultimate investors. By applying the ultimate investor approach, the United States emerges as the leading investor country in France, with more than EUR 132 billion at the end of 2019, or almost 17% of total stocks (see Chart 7). Investments originating from Switzerland, the United Kingdom and Germany each exceed EUR 80 billion (a little more than 35% of total foreign investment in France). Therefore, based on the ultimate investor approach, more than half of FDI in France is held by residents of four countries.

1 Reinvested earnings are the undistributed (non-dividend) share of after-tax operating income from subsidiaries and equity interests attributable to the direct investor. The direct investment flows linked to equity capital correspond to the sum of flows into share capital and reinvested earnings. See Methodology for the balance of payments and international investment position (Box No. 4, page 28).

Contact us

Updated on the 8th of August 2025