1. The greening of cash activities: a Banque de France priority

Mindful of its environmental footprint, the Banque de France has committed to lowering its greenhouse gas (GHG) emissions, and has set an initial target of a 15% reduction by the end of 2024. Its climate strategy is consistent with the framework defined by international treaties, notably the 2015 Paris Agreement. It sets out an ambitious low-carbon pathway using all available action levers, and with a first milestone at end-2024, followed by further targets for 2030. The Bank’s decarbonisation strategy is also aligned with the European Union’s “Fit for 55” legislative package, which requires GHG emissions to be cut by at least 55% by 2030 compared with 1990.

In 2022, the Banque de France already exceeded its 2024 reduction target relative to 2019: GHG emissions were down 23.6% over a scope comprising energy use, business travel, staff commuting, waste, and fugitive emissions linked to leaks of refrigerant gases from air conditioning systems. In all of these areas, staff engagement is vital to ensure that best practices are applied as broadly as possible. Recent measures to achieve this include incentives to encourage the use of soft transport, and limits on heating and air conditioning use.

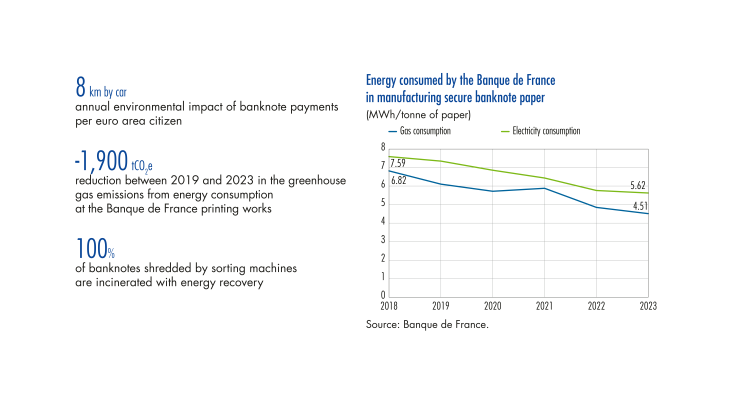

To reach its longer-term targets, however, the Banque de France needs to measure the environmental footprint of all its activities (GHG Emissions Assessment or GHGEA, which is governed by article L. 229-25 of the Environmental Code). Its cash activities, which include the manufacture and sorting of banknotes as well as the circulation of banknotes and coins, are industrial in nature, as opposed to its other activities which are tertiary. As a result, they account for nearly half the Bank’s total GHG emissions, as well as having other adverse effects on the environment: depletion of natural resources, pollution, waste production, etc. These activities are therefore a major focus for the Banque de France, as they are for all cash cycle participants. In 2022 and 2023, it notably took steps to lower its energy and resource consumption, and to reduce the environmental impact of its waste treatment. …

[To read more, please download the article]