Central banks have reacted quickly and massively to the Covid-19 pandemic

The Covid-19 pandemic is causing the world’s worst recession since 1945. This has led to important fiscal measures as well as strong and prompt responses by central banks.

The European Central Bank (ECB) in particular has launched a large-scale stimulus package, including a new Pandemic Emergency Purchase Programme (PEPP), the extension and continuation of existing asset purchase programmes, the easing of conditions for targeted longer-term refinancing operations (TLTRO-III), and an unprecedented easing of collateral standards (Odendahl, Penalver and Szczerbowicz, 2020).

These measures aim to ensure that all sectors can benefit from favourable financing conditions to enable them to absorb the negative shock. The measures are essential given the context, but also because the effects of monetary policy are asymmetric. Indeed, economists consider that attempting to stimulate the economy with loose policy during a downturn is like “pushing on a string”, i.e. less effective than tightening monetary policy to keep the economy in check (Barnichon, Matthes and Sablik, 2017).

The effects of monetary policy are less powerful in a recession

This asymmetry can be due to downward price and wage rigidities, and to precautionary behaviour during a downturn. Moreover, credit rationing as interest rates rise makes monetary policy hikes more efficient than interest rate cuts.

Levieuge and Sahuc (2020) show that monetary policy asymmetry can also stem from downward bank lending rate rigidity: bank lending rates adjust more slowly and less completely to policy rate decreases than to increases. There are several explanations for this. First, banks may decrease their rates only if the benefits of doing so are greater than the inherent adjustment costs. Second, the banking market structure plays a role. Banks in concentrated markets are likely to refrain from lowering lending rates in order to increase or maintain their margins. This market power effect is reinforced by customer switching costs. Finally, according to a “reverse adverse selection”, lenders may be reluctant to cut lending rates because this is likely to attract high-risk credit.

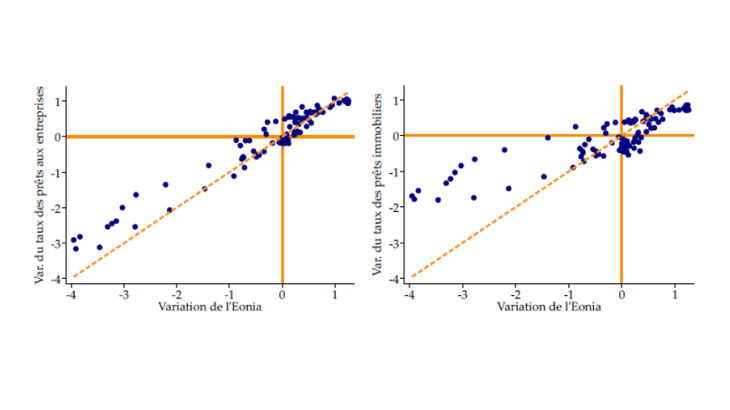

Chart 1 shows the year-on-year changes in Eonia and in bank lending rates to corporates and to households in the euro area over 1999-2012. The scatter points deviate significantly from the 45-degree line, with, in particular, responses of lending rates to negative changes in Eonia of well below one-on-one. Hence, lending rates respond less strongly to accommodative than to tightening monetary policies. This stylised fact is valid regardless of the period, including before the 2008 crisis.

By introducing such downward interest rate rigidities into a macroeconomic model of the euro area, Levieuge and Sahuc (2020) find that the initial response of GDP to a negative monetary policy shock is 25% lower than its response to a positive shock of a similar amplitude. It implies that a central bank would have to decrease its policy rate by 50% to 75% more to yield a medium-run impact on GDP that is symmetric to the impact of a positive shock.

This downward rigidity is stronger in a low interest-rate environment

Furthermore, Levieuge and Sahuc 2020 show that bank lending rates are even more downward rigid when policy rates are stuck at their effective lower bound. This can be due to frictions that are intrinsically related to banks’ business models, such as costly monitoring operations, high fixed operating costs, and premiums charged on loans. Moreover, as deposit rates rarely fall below zero (Heider, Saidi and Schepens, 2018), banks may be reluctant to further decrease their lending rates, for profitability purposes.

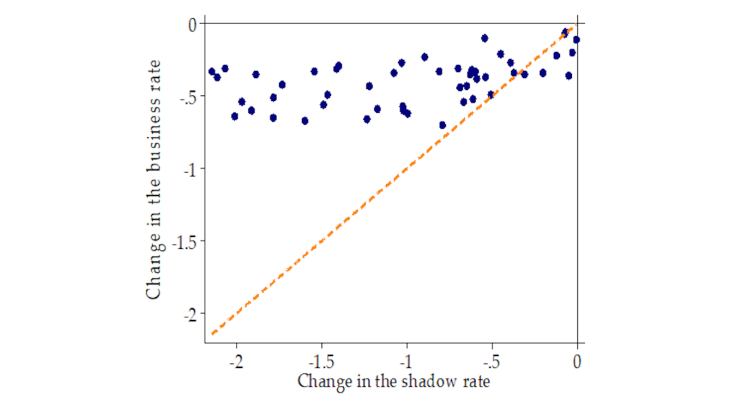

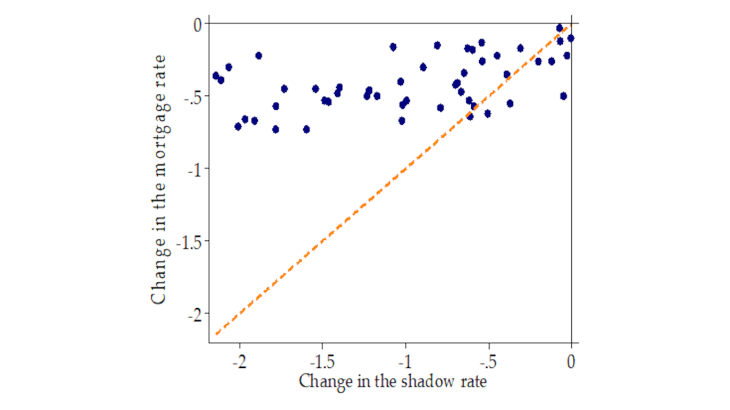

Chart 2 represents the concomitant changes in bank lending rates and the shadow rate since July 2012, when the ECB first brought the deposit facility to zero per cent, before making it negative. The shadow rate is the shortest maturity rate, extracted from a term structure model, that would generate the observed yield curve had the ELB not been binding. By accounting for the influence of market interventions on intermediate and longer maturity rates, it captures both conventional and unconventional policy actions (Wu and Xia, 2016, Mouabbi and Sahuc, 2019). This chart shows that lending rates reacted slightly downward as the shadow rate decreased, but with a constant amplitude, irrespective of the size of the changes in the shadow rate. Levieuge and Sahuc (2020) show that this disruption of the monetary pass-through can be reproduced in a model by considerably increasing the parameters governing the degrees of rigidity and asymmetry of the lending rate changes.