Investment funds, like other financial institutions, must manage the financial risks associated with climate change and contribute to financing of the transition to a low-carbon economy. In order to achieve the European Union's goal of carbon neutrality by 2050, non-financial and financial corporations must take action to reduce their emissions. In this blog post, we focus on equity mutual funds domiciled in France with at least 80% of their portfolios invested in equities of French and foreign firms. In 2022, the assets under management of the funds in our sample totalled EUR 240 billion, i.e. around 63% of the total assets of equity mutual funds domiciled in France. This study analyses the changes in portfolio carbon footprint of these funds over a six-year period, from 2017 to 2022, and identifies the factors behind these changes.

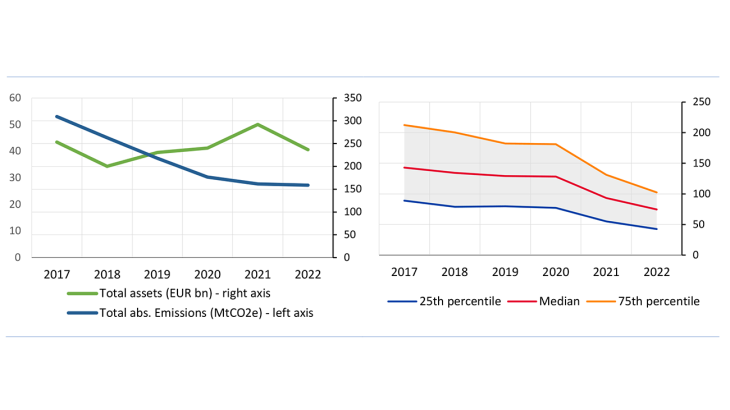

The financed emissions of all the funds together, i.e. the sum of the investee companies' emissions weighted by the investor’s share in the total value of the companies in the portfolio, decreased by nearly 50% between 2017 and 2022. The majority of this reduction occurred between 2017 and 2020, followed by a period of relative stabilization (see Chart 1, left). The decline in financed emissions is not linked to the reduction in the amount of assets under management. Indeed, between 2018 and 2021, assets under management increased while financed emissions decreased.

In terms of the portfolios emissions intensity, i.e. the Weighted Average Carbon Intensity (WACI), that is calculated as the weighted average of each company’s absolute emissions divided by its revenue, the decline primarily occurred after 2020 (see Chart 1, right).

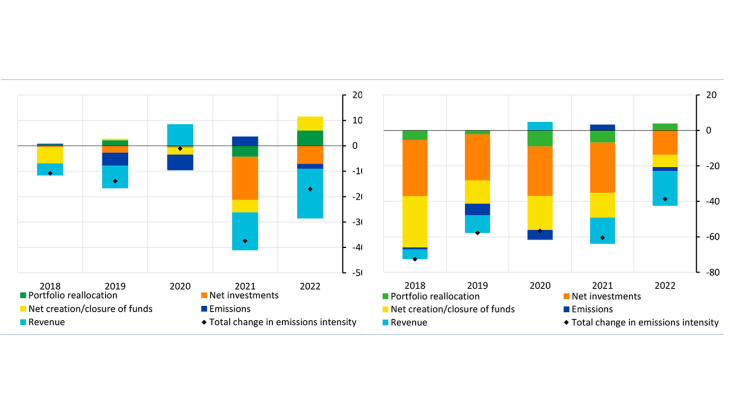

Chart 2: Breakdown of annual variations in emissions intensity by factor, 2017-22 (in tonnes/EUR million)