The Phillips curve – a useful tool for central banks

The Phillips curve establishes a relationship between inflation and the economic environment. It was first introduced 60 years ago, but is the focus of repeated debate, notably regarding whether or not it is still relevant (see Rue de la Banque No. 56; for a review of the literature, see Le Bihan, 2009).

Inflation projections, including those compiled by the Eurosystem, are based on more complex models than the Phillips curve. However, the latter is still widely used by economists as it makes it possible to check whether a macroeconomic scenario is coherent using a reduced-form model based on a few key variables. Nonetheless, there is still some uncertainty over the “best specification” of the Phillips curve to use (ECB, (2019)), and notably over the choice of explanatory variables (see Béreau, Faubert and Schmidt (2018)). These uncertainties justify using a range of specifications rather than just one. This approach, known as “thick modelling”, is the one we follow in this post.

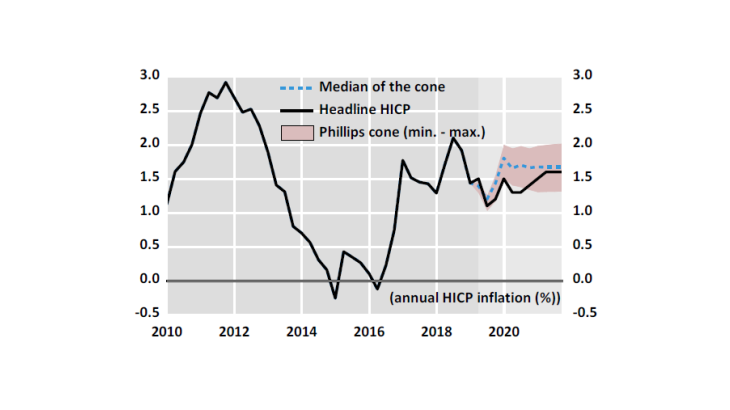

The Phillips cone shows the relationship between prices and the economic environment

The “Phillips cone” can be defined as a range of possible values obtained using different specifications of the curve, and a central forecast corresponding to the median of the different models. For each date, the cone is determined by the gap between the highest and lowest simulations resulting from the chosen specifications.

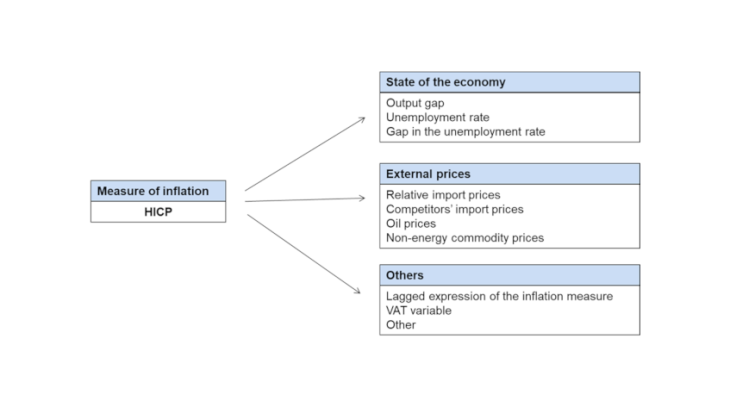

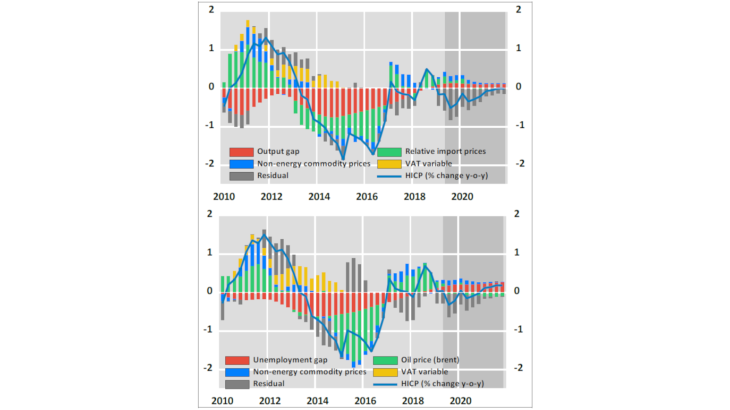

The Phillips cone shown here is obtained using a set of three standard specifications. First we use a variable that measures the state of the economic environment (output gap, unemployment rate or the gap between the unemployment rate and the structural unemployment rate), lagged by a quarter. In a second step, we add a variable for external prices as an indicator of the strength of global demand or of external shocks (relative import prices, competitors’ import prices which correspond to the export prices of the euro area’s main trading partners, oil prices or the change in the price of other commodities). Last, the estimation is enhanced with a lagged expression of HICP inflation (harmonised index of consumer prices) to reflect the stickiness of price formation and of agents’ inflation expectations. In some equations, we also add a variable corresponding to variations in VAT to take into account changes in tax policy (see Figure 1).