Wealth effect on consumption during the sovereign debt crisis: Households heterogeneity in the Euro area

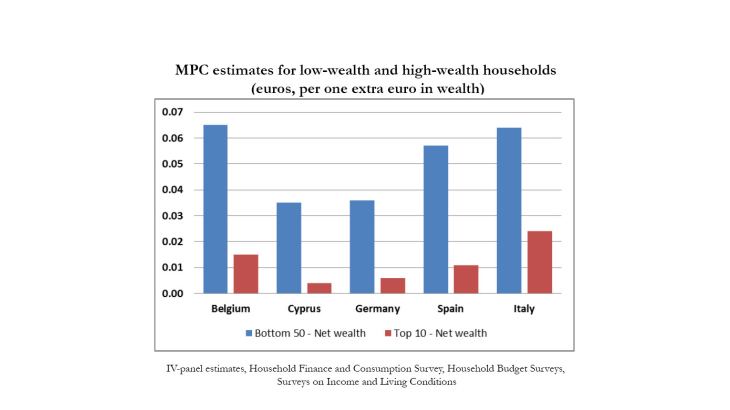

Working Paper Series no. 751. This paper studies the heterogeneity of the marginal propensity to consume out of wealth (MPC) both across and within countries. We estimate the MPC based on a cross-country harmonized household level dataset which combines surveys on wealth, income and consumption. We use panel regressions and an instrumental variable approach. First, our panel-based MPC estimates are very similar to those obtained on aggregate data and show substantial heterogeneity across countries. The wealth effect is coming both from housing and financial assets, while the main asset channel varies between countries. Second, the MPC is higher for low-wealth households, whatever the country. Third, we find some asymmetries across countries regarding the reaction to losses versus gains. Fourth, higher MPC is obtained for the two main consumption expenditure categories. Fifth, we find evidences that housing prices shock decreases consumption inequality while financial wealth shocks have a limited effect on consumption inequality.