Standard dynamic stochastic general equilibrium models have recently been augmented to allow for regime-switching behavior of private agents and public authorities. This new class of models - known as Markov-switching rational expectations (MSRE) models - are proven to be powerful in explaining non-linear or time-varying macroeconomic phenomena. However, the underlying theory lacks unity and the literature has not yet reached a consensus on the determinacy conditions of such systems - conditions under which there exists a unique stable equilibrium.

There are various perspectives on how to interpret rational expectations models through the number of stable solutions. First, one can consider determinacy as a selection criterion among multiple models, interpreting the absence of stable solution or its multiplicity as a sign of misspecification. Second and quite contrary to the first interpretation, one can consider the number of stable equilibria as informative about true economic problems: for instance, the multiplicity of stable equilibria is sometimes interpreted as a consequence of bad monetary policy (see for instance Lubik and Schorfheide (2004) and the discussion about the Taylor principle). Regardless of the interpretation, identifying the number of stable solutions is a prerequisite for understanding a model and its ability to account for economic fluctuations.

Since the earlier contributions of Davig and Leeper (2007) and Farmer et al. (2009b), identifying determinacy has been a subtle and difficult task. Due to the inherent non-linearity of regime-switching models, it is not possible to apply the well-known methodologies for linear models to this class of rational expectations models. So far, two major stability concepts to characterize determinacy have been used: boundedness and mean-square stability. Barthelemy and Marx (2019) and Cho (2021) have recently derived determinacy conditions for these two concepts. Not surprisingly, the determinacy conditions do not coincide with each other. But more surprisingly the methods used to derive the determinacy conditions seem very different raising the question of whether there exists a way to unify the two approaches. Such a lack of methodological consensus might be responsible for not using Markov-switching models in macroeconomics more frequently.

In this paper, we develop a unified framework that works for both stability concepts and allows to better understand the differences between the two stability concepts and their implications. Specifically, we consider a class of MSRE models for which determinacy using boundedness and mean-square stability concepts are well-defined. Our main contribution is to establish a complete classification result for MSRE models under the standard hypotheses assumed for mean-square stability. We derive necessary and sufficient conditions for determinacy, indeterminacy and the case of no stable solution under both stability concepts. Then, we show that the MSRE models have in total six partitions with always more mean-square-stable solutions than bounded ones. We also propose efficient ways to check determinacy in practice for the two stability concepts. Finally, we apply the results to two applications: a monetary model in the vein of Davig and Leeper (2008) and a model of monetary and fiscal interaction in the vein of Cho (2021).

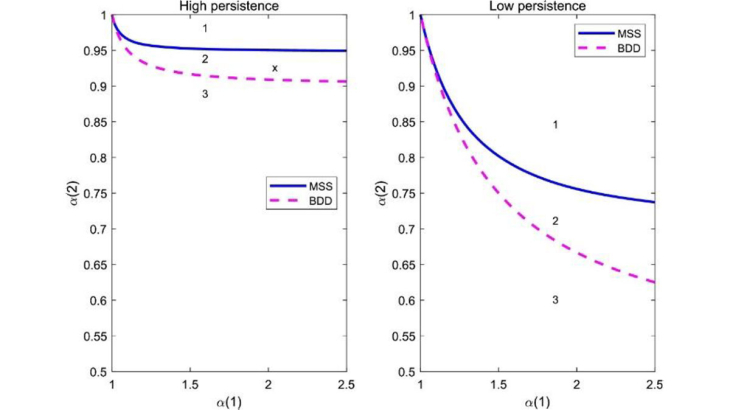

As an illustration, we present below some results for the monetary model à la Davig and Leeper (2008). In this model, monetary policy follows a Taylor-like rule i_t=α(s_t ) π_t where π_t is inflation; i_t stands for the nominal interest rate and the coefficient α measures the reactiveness of monetary policy to inflation. This coefficient can take two values α(1) and α(2) depending on the policy regime denoted by s_t, with transition probabilities p_ij. In addition, inflation is determined through a Fisherian equation linking the nominal interest rate, inflation, and the real interest rate supposed exogenous: 〖i_t=E〗_t π_(t+1)+r_t. Plugging the switching Taylor rule into this equation shows that the higher α, the stronger the response of monetary policy to realized inflation and hence the lower the impact of future expectations on current inflation. This model is simpler than the general case we deal in the paper since there are no backward components in the equation. As a result, we get only three cases (instead of 6), which are represented in Figure 1. For values of (α(1),α(2)) above the blue line, there exists a unique MSS solution which is also bounded. For values of (α(1),α(2)) between the solid blue and dotted magenta lines, there exists a unique bounded equilibrium but several MSS equilibria. Below the magenta dotted line, there are several MSS and bounded equilibria. Three remarks are in order. First, the gap between the two determinacy frontiers crucially depends on the probability of switching from one regime to the other, for very persistent regimes (left figure), this gap is not quantitatively important. Second, the qualitative results do not depend on the exact stability concept that is used: for instance, in this calibrated and simple model, the more monetary policy reacts to inflation in one regime the less monetary policy needs to react in the other regime to rule out equilibrium multiplicity (indeterminacy) and self-fulfilling prophecies. Third, monetary policy should be more active (higher level of α’s, and the more so for more persistent policy) to rule out equilibrium multiplicity under MSS than boundedness. In the fiscal-monetary model presented in the paper, we show that the existence of stable solution requires a more passive fiscal policy for boundedness compared to MSS.

More generally, this study proposes a complete methodological foundation for studying the class of macroeconomic models known as Markov-switching rational expectations models. We find that only six configurations are possible and the two stability concepts lead to the same conclusion in three of them. In any case, there are always more mean-square stable solutions than bounded ones in this class of models. Finally, we believe that our proposed approach is tractable enough and easy to apply for more advanced macroeconomic topics that involve strong non-linearities -e.g., Covid crisis, policy regime shift, financial crisis and so on- impossible to analyse in the context of standard linear models.

Keywords: Markov-Switching, Indeterminacy, Monetary Policy

JEL classification: E31, E43, E52