Lower employment prospects weigh on consumption

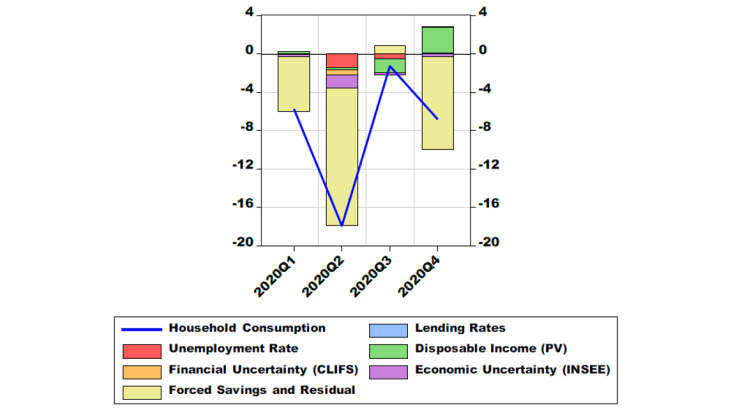

In a second exercise, we examine the role of households’ expectations in simulations with FR-BDF. In the model, household consumption is affected, inter alia, via the link between the unemployment rate and expected disposable income, independently of any direct effect that changes in unemployment may have on current disposable income. Thus, the effect of the expectation channel can be isolated from any potential direct income channels through which unemployment might also affect consumption in the short run.

We examine the impact of a permanent increase in the unemployment rate of 2 ppt compared with the rate in a baseline scenario up to end-2023. By only allowing for consumption changes related to the link between unemployment and expected future income in the alternative scenario, we ensure that the comparison of the two scenarios reflects only the expectation channel.

With a permanently higher unemployment rate, households’ expectations of future disposable income are lower. In turn, their incentive to accumulate savings is larger. This effect translates into cumulative “surplus” savings of about EUR 3 billion a year, i.e. an increase of around 0.2 ppt in the saving ratio. While this difference seems quantitatively moderate, it should be noted that it reflects only the isolated precautionary savings channel effect described above.

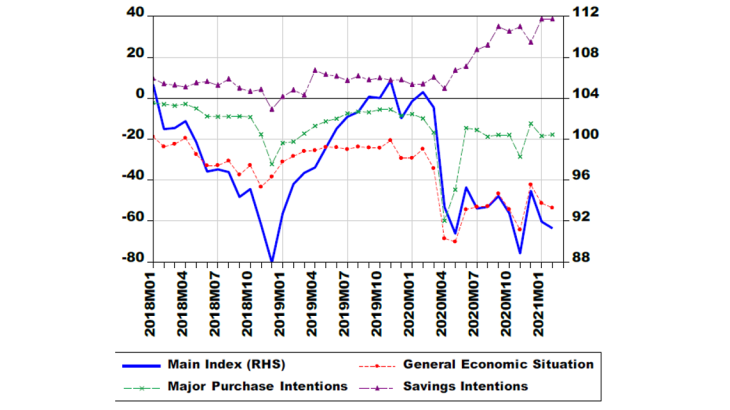

The evolution of uncertainty may have positive or negative impact on household consumption

Overall, this blog indicates that precautionary motives can negatively affect household consumption in the current context. Even though forced savings likely explain the majority of the excess savings accumulated during the Covid-19 pandemic, precautionary motives seem to have played a significant role during the first lockdown. Should employment-related uncertainty increase again, precautionary motives could again contribute to excess savings accumulation. On the contrary, if pandemic related uncertainties were to decline markedly, this could have a positive effect on household consumption.