The fiscal rules enshrined in the Stability and Growth Pact (SGP) are no longer suitable: they are lacking in effectiveness and poorly adapted to the current economic climate and need to be largely overhauled. There is broad consensus among economists concerning the need for reform (Bénassy-Quéré, 2022; Blanchard et al., 2022; Cahen and Larosière, 2022; Martin et al., 2021).

1. A much needed reform of EU fiscal rules

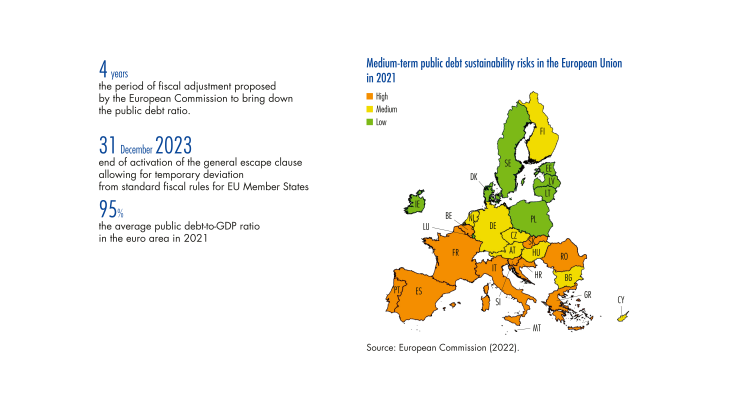

Fiscal discipline is absolutely essential in a monetary union like the European Union (EU) because of the negative externalities that a debt crisis would have on other Member States. Because fiscal policies are defined at national level, coordination is needed to forge the most effective macroeconomic policy mix (i.e. national fiscal policy and single monetary policy) and reduce the risks of a systemic crisis by safeguarding public debt sustainability among Member States. The prohibition on any type of monetary financing in the EU means that any risk of payment default by a weakened country must be prevented by means of prudent fiscal policy. A suitably adapted governance framework for the euro area as a whole therefore makes it possible to preserve the single currency, while supporting medium term growth.

Moreover – and this is probably the key element from a central bank perspective – sound public finances help avoid the risks of fiscal dominance, whereby monetary policy decisions would be constrained by the need to ensure government solvency (Barthélémy et al., 2021). The central bank would then have to arbitrate between public debt sustainability and monetary stability, which is not part of its mandate. For example, when the central bank has to raise interest rates to stabilise inflation, this leads to a de facto increase in the public debt, which

can have a destabilising impact when public debt is very high. This gives rise to two risks and both would result in an undesirable outcome: either the public debt becomes unsustainable or the central bank abandons its inflation target. EU fiscal rules are designed to prevent just such a situation.

However, the current rules have only partly fulfilled their role in providing a national fiscal policy framework. Their shortcomings have been clearly identified, namely complexity, lack of transparency, use of unobservable variables, procyclicality, limited effectiveness, low national ownership, insufficient investment support and poor coordination between Member States (Schmidt and Sigwalt, 2022).

[to read more, please download the article]