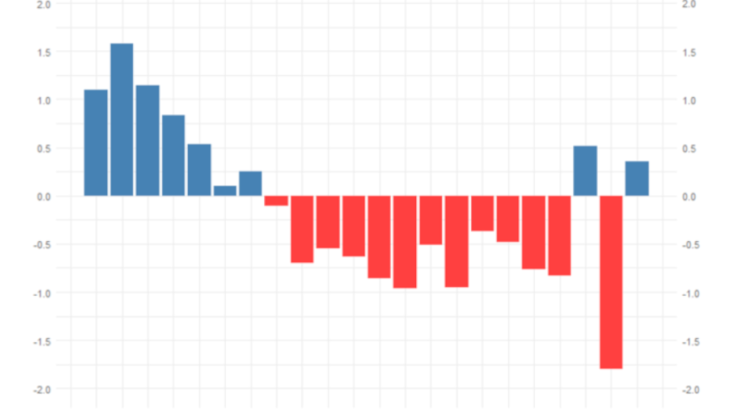

In 2021, the current account balance displayed a surplus of EUR 9 billion, or 0.4% of GDP. It thus returned to its pre-pandemic level (0.5% of GDP in 2019), after a very large deficit in 2020 (see Chart 1). This is France's second current account surplus in 15 years, after that of 2019 (EUR 12 billion). While these results may seem encouraging, a longer-term analysis paints a different picture: current account deficits have been a recurring feature since 2007 and are tending to worsen over time.

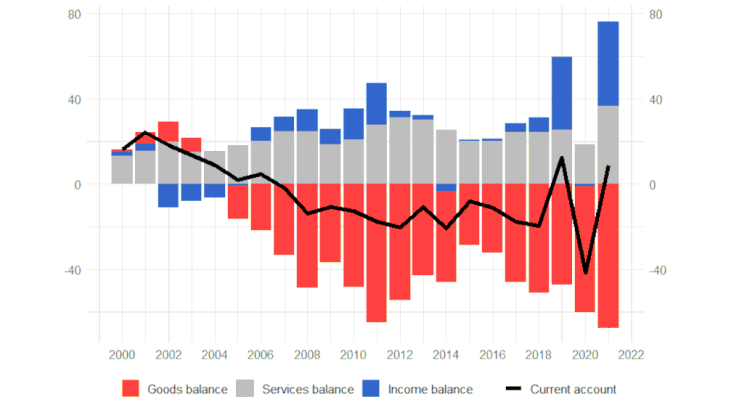

In France, the recurrent current account deficits can be attributed to the goods balance. In 2021, the balance of trade in goods reached its lowest point since 2000 (see Chart 2), standing at EUR -67.4 billion, sharply down on the previous year (EUR -59.1 billion). In addition to the one-off effects from the Covid-19 crisis, there has been a gradual decline in the non-energy goods balance and an energy bill deficit that is expected to continue to affect the economy in 2022, given the sharp rise in gas and oil prices.

Trade in goods: an incomplete picture of French international trade

A country's international trade must be viewed not just from the perspective of trade in goods, but in terms of overall economic trade. In particular, the current account also covers trade in services and income flows. In France, the trade in services and primary income balances (mainly foreign direct investment) are significantly in surplus and, since 2004, have limited the effect of the goods trade deficit on the overall current account balance, or even offset it, like in 2019 or 2021 (see Chart 2). In 2021, the trade in services and income balances showed record surpluses of EUR 36 and 40 billion, respectively. The sum of these two intermediate balances offset the goods trade deficit (EUR -67.4 billion) and resulted in a slight current account surplus in 2021, as was the case in 2019.