In a recent study, Pappadà and Zylberberg (2017a) measure the ability of a government to collect tax revenues using the ratio between the VAT revenues collected by the government and the notional VAT revenues computed on observed consumption. With perfect tax enforcement, there would be full tax compliance and this ratio would be exactly equal to 1 over the business cycle and would not respond to tax reforms.

Tax compliance is sensitive to output fluctuations and tax reforms

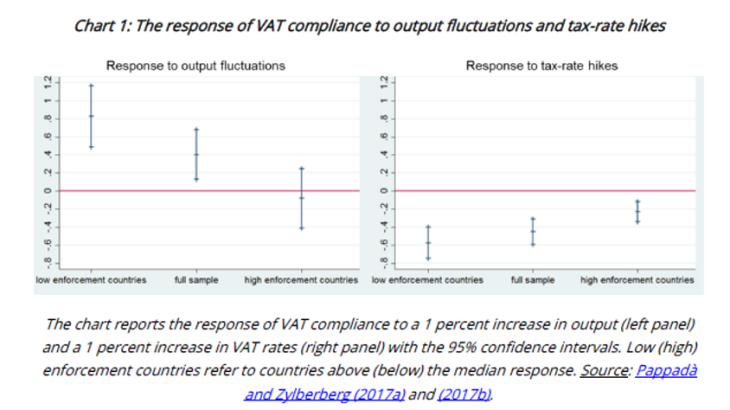

As shown in chart 1, this study documents two novel stylized facts:

- VAT compliance increases in expansions and decreases in downturns

- The response of VAT compliance to tax-rate hikes is sizeable and negative

The sensitivity of tax compliance to economic fluctuations and tax reforms varies across countries. While some countries display stable tax compliance, those with a lower capacity to collect taxes are exposed to large fluctuations in tax revenues. These countries sometimes try to compensate for weak enforcement by raising the average tax rate. But this is no guarantee that tax receipts will increase.

Noticeable examples are the several rounds of austerity plans implemented in Greece over the past few years. Pappadà and Zylberberg (2017a) show that VAT compliance dropped by about 7% in Greece after the 20% increase of VAT rates in 2010. The drop in tax compliance accounted for the gap between the actual VAT revenues and the expected VAT revenues. The fluctuations in tax compliance are not specific to the Greek case. The results on a panel of 35 countries show that a 1 percent increase in VAT rates is associated with a fall in tax compliance up to 0.5 percent in countries where the response of tax compliance to tax hikes is large.

Highly sensitive tax compliance increases default risk

Pappadà and Zylberberg (2017b) explore the consequences of the fluctuations in tax compliance on the risk of default on sovereign debt. In this paper, fiscal consolidations affect the capacity to levy taxes in the future - through the negative response of tax compliance - thereby increasing the risk of default. When highly indebted, countries with a weak capacity to raise tax revenues are hanging off a cliff: governments are unable to stray from debt ceilings because tax hikes generate long-run distortions on output, thereby increasing the incentive to default and the cost of servicing debt. As a result, periods of high tax rates, low output, low fiscal surplus and high default risk may be long-lasting.

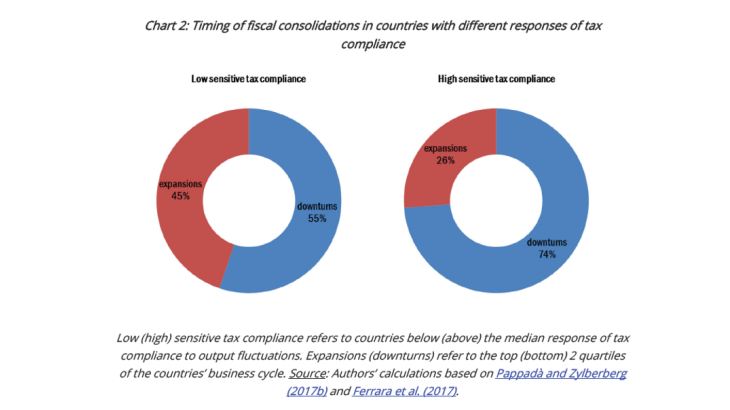

The interaction of the imperfect capacity to collect tax revenues and limited commitment to repay sovereign debt may explain the adoption of pro-cyclical fiscal consolidations, typically based on expenditure cuts in downturns as shown in Ferrara et al. (2017). When looking at fiscal consolidation episodes in OECD countries, we indeed observe that countries with more sensitive tax compliance are also those implementing fiscal consolidation measures more often in downturns than in expansions, as shown in chart 2. Despite the large distortionary effects of raising taxes in economic downturns stemming from imperfect tax compliance, these countries have no other means than adopting austerity measures in downturns in order to raise revenues and avoid the default.