In 2015, the Governor of the Bank of England, Mark Carney, highlighted the potential impact of climate change on asset prices and financial stability. Since then, the financial community has increasingly focused on understanding and addressing the potential systemic risks posed by climate change. These risks are typically categorized as physical risks, arising from climate-related hazards, and transition risks, stemming from the transition to a low-carbon economy. Climate risks can directly affect financial institutions through the devaluation of portfolios, increased insurance claims, or reduced borrower creditworthiness, termed as first-round effects. Moreover, simultaneous climate shocks or transmission through interconnected financial networks can lead to contagion effects, known as second-round effects.

In this paper, we introduce an innovative market-based framework derived from the empirical asset pricing literature for assessing the influence of climate risks on systemic risk in the financial sector. The rationale for adopting a market-based approach is the premise that climate risks should prompt the repricing of securities held by financial institutions. The framework aims to identify vulnerable institutions and explore mitigation strategies for both institutions and policymakers. While existing studies focus mainly on first-round effects, this framework is the first to propose a test procedure for detecting and quantifying second-round effects of climate risks on financial institutions.

The framework consists of several steps. First, a new measure of systemic risk is developed that distinguishes between individual tail risks and tail dependencies. This distinction is crucial for studying and differentiating the first- and second-round effects of climate risks on the financial sector. Second, tail transition and physical risk factors are constructed to capture changes in the expected impact of extreme climate shocks on nonfinancial firms, to which financial institutions are exposed. Third, we introduce a two-pass test procedure to assess whether climate risks exacerbate tail risk dependence among financial institutions. This approach extends the work of Adrian and Brunnermeier (2016) and is akin to a “climate” exposure CoVaR indicator, incorporating extreme climate risks as potential stress factors for financial institutions. Fourth, we examine the financial and extrafinancial characteristics that are correlated with financial institutions’ exposure to climate risks.

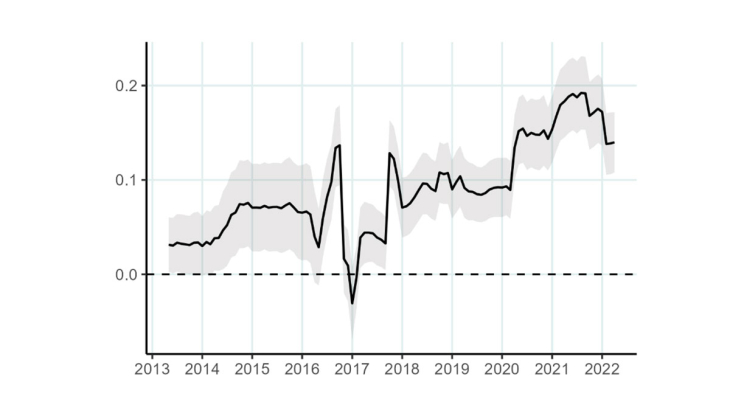

We apply this framework to a sample of 371 large European financial stocks, spanning from 2005 to 2022 at a monthly frequency. We focus on Europe rather than the United States for several reasons. First, European investors may have stronger environmental concerns than their American counterparts do. Second, an escalation in systemic risk could yield more severe economic consequences in Europe, as the failure of European institutions is typically large relative to domestic GDP. The results show that transition risk has a significant impact on tail risk in the European financial sector. The findings also indicate a continuous increase in exposure to transition risk since 2015, particularly among banks and insurance companies (see Figure 1). However, no evidence of contagion effects is found for physical climate risk. Overall, financial institutions that have cleaner portfolios, are committed to environmental risk management, and with a long-term orientation show lower exposure to climate risks. Some of the recent ESG regulations also seem to reduce risk levels.

Overall, the proposed framework provides valuable insights for policymakers and financial institutions in managing systemic climate risks. First, our approach allows for dynamic monitoring of systemic climate risks from an investor perspective. Market perceptions play an important role, as the threat climate risks pose to financial stability largely depends on the repricing of assets by investors. Second, since climate shocks appear to affect both individual risk and tail dependence in the financial sector, we argue that the characteristics we find associated with climate risk exposure are relevant for the development of both microprudential and macroprudential climate risk regulations. Finally, the framework we develop in this paper is flexible and can be applied to different contexts, including other countries, sectors, asset types, or periods.

Keywords: Climate Risks, Contagion, ESG, Financial Stability, Systemic Risk

Codes JEL: G10, G20, G32, Q54