- Home

- Publications et statistiques

- Publications

- Strengthening the Global Financial Safet...

Strengthening the Global Financial Safety Net in the face of heightened risks

Post n°126. In a world marked by reduced fiscal and monetary leeway and heightened risks, a strengthened Global Financial Safety Net is desirable, in addition to better macroeconomic policy coordination. This issue, discussed under the French G7 Presidency, calls for a renewed multilateralism (see the blog on “The G7, an engine for multilateralism”).

* The Global Financial Safety Net (GFSN) is a set of mechanisms and instruments aimed at providing insurance to prevent or deal with balance of payments crises by supplying international liquidity. It comprises international foreign exchange reserves, central bank bilateral swap agreements, IMF resources and regional financing arrangements.

In the face of heightened risks, a robust Global Financial Safety Net is needed more than ever

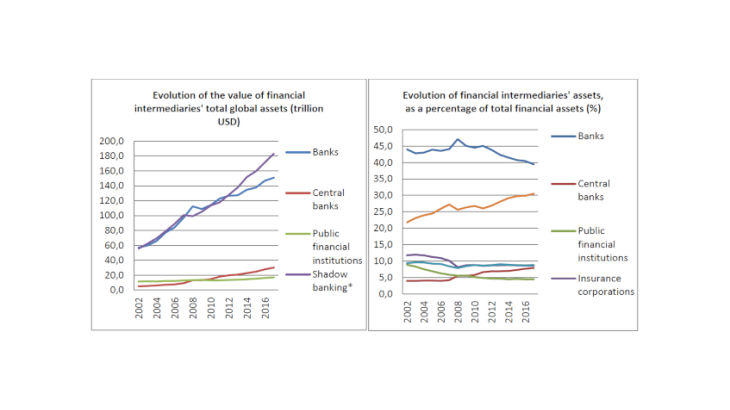

More than 10 years after the 2008 crisis, the economic leeway of a number of countries remains constricted while the risks that weigh on the global economy have grown and changed in nature. This crisis revealed the financial cycle’s amplifying role with respect to the real cycle. In particular, as a result of the counter-cyclical policies put in place, the crisis generated high levels of debt that are difficult to contain (according to IMF figures, total indebtedness of its 189 member countries corresponds to 225% of their aggregated GDP) with contagion effects at the global level. In addition, the exposure of the global financial system to risks related to non-bank financial intermediation ("shadow banking") has grown, with the total value of non-bank sector assets increasing constantly since the crisis from USD 99,230 billion in 2008 to USD 183,100 billion in 2017 according to the Financial Stability Board (see Chart 2).

All of these risks call for a strengthening of the Global Financial Safety Net (GFSN).

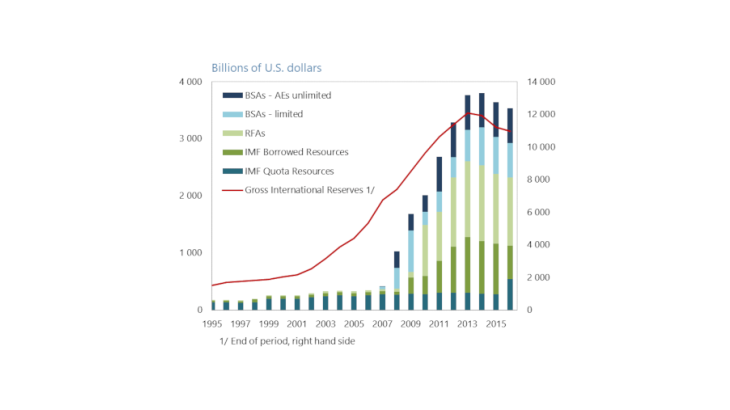

The GFSN is a set of mechanisms and instruments aimed at providing insurance to prevent or deal with balance of payments crises by supplying international liquidity. The IMF was given this role in the Bretton Woods agreements and its actions are still pivotal. The GFSN has since been expanded with the addition of further layers (see Chart 1), illustrated by the creation of new regional financing arrangements (RFAs), such as the Eurasian Fund for Stability and Development, or the enhancement of existing arrangements such as the Arab Monetary Fund, the Chiang Mai Initiative Multilateralization (CMIM), the Latin American Reserve Fund (FLAR) or the BRICS Contingent Reserve Arrangement.1 The financial crisis also led to an accumulation of foreign exchange reserves globally (increasing to USD 11,992 billion – excluding gold reserves – in December 2018 from USD 7,604 billion in December 2008) and particularly in emerging countries (with USD 4,266 billion in 2018 – excluding gold reserves – compared with USD 2,832 billion in 2008), largely for precautionary reasons. Lastly, the crisis encouraged the adoption of flexible solutions such as central bank bilateral swap arrangements. Indeed, even though the IMF’s resources have grown since the crisis, particularly by mobilising borrowed resources (Bilateral Borrowing Agreements and New Arrangements to Borrow), they now only account for a reduced fraction of GFSN resources.

An ideal size for the GFSN?

The overall size of the GFSN should be assessed in light of future liquidity needs in the event of a global crisis, which are very difficult to estimate with precision. The GFSN has quadrupled since the 1990s to almost USD 4,000 billion but despite that, the IMF considers that there are a number of plausible, and significant, crisis scenarios in which the GFSN would be insufficient. Maintaining substantial foreign exchange reserves and thus demonstrating a strong desire for self-insurance also shows that the insurance mechanisms are inadequate. However, the methods used to estimate the suitable size for the GFSN are flawed as they rely on historical data, based on the latest crises. Consequently, new approaches are needed. In order to anticipate future needs, one possibility would be to include new risks, such as climate change or cyber-risk, in the stress tests and scenarios used to assess the desirable size of the GFSN.

Closing the gaps in the GFSN?

A robust GFSN requires effective coordination between the various layers to ensure that it can be immediately and fully used in the event of a crisis. While RFA resources have expanded, this is mainly due to the creation of the European Stability Mechanism (ESM), which covers the specific needs of a monetary union and can only be partially likened to RFAs. But the resources of the other RFAs remain wanting and are very unevenly distributed. Many countries in Sub-Saharan Africa, Latin America and Central and South Asia are not covered. Central bank bilateral liquidity swaps can be mobilised quickly and unconditionally but they are granted on a discretionary basis and remain highly concentrated in (i) a western pole (the United States, the United Kingdom, Canada, Switzerland, Japan and the ECB) and (ii) a Chinese pole (with smaller volumes and also a different purpose – support for bilateral trade).

If the GFSN is to be strengthened, its backbone – the IMF – must be consolidated. Renewing IMF borrowed resources due to expire would maintain its current overall envelope. This development would be doubly welcome: firstly because increasing the permanent quota resources of the IMF is subject to protracted political negotiations; and secondly because borrowed resources are a more appropriate means of financing than precautionary instruments.

Since 2008, the IMF has developed numerous precautionary instruments, which, unlike traditional loans with specific conditionality, are granted on the basis of eligibility conditions. They are similar to swap lines between central banks in that they offer fast and flexible access to liquidity but they have ex-ante defined qualification criteria (thereby limiting the discretionary aspect, of swaps). The debate on the development, flexibility and financing of these instruments should be revisited. Lastly, to what extent GFSN instruments are appropriate for the risks related to global public goods (climate risk) is an issue that should be explored.

Managing the moral hazard specific to the GFSN

Like any insurance instrument, the GFSN is subject to moral hazard. It is the ultimate safeguard in times of crisis, which can encourage excessive risk-taking or inappropriate economic policy choices. Confronted with the escalation in contagion effects (which increase collateral risks in the event of a crisis), a first possibility would be to create a tailored system that would allow collateral victims to benefit from reduced conditionality, while also avoiding moral hazard by correcting deviant behaviour through reinforced conditionality, to avoid repeated misconduct. Another possibility would be to develop the precautionary instruments by making the (ex-ante) eligibility criteria more flexible, particularly reflecting the collateral risks involved. Lastly, addressing moral hazard may require immediate and non-discretionary sanctions.

***

The multi-dimensional nature of the GFSN leaves open the question of the international lender of last resort, which, strictly speaking, should be an issuer of an international currency. However, because it represents an almost universal membership, the IMF is the only body that has the legitimacy to take on the role. The practices of lender of last resort have changed with the financial crisis, and it is now time to reconsider the definition of that role and the scope of its actions.

1 IMF, Adequacy of the Global Financial Safety Net – Considerations for Fund Toolkit Reform, 2017.

Updated on the 25th of July 2024