By exploiting instances in which banks cannot adjust deposit rates in response to monetary policy, we show that monetary policy impacts banks’ funding cost, causing them to adjust their supply of credit to the real economy.

Our experiment is based on the existence of regulated-deposit accounts offered to households in France. Unlike regular savings accounts, the rate on regulated deposits is not determined by the banks themselves. It does not depend directly on the monetary-policy rate either but is, instead, set by the government up to twice per year.

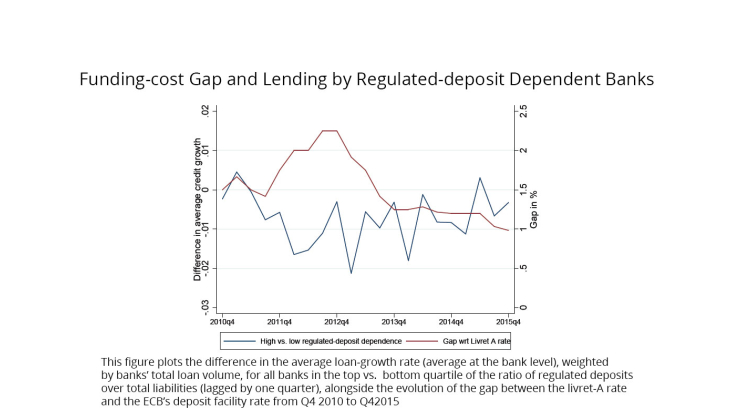

Figure 1 below provides simple graphical evidence for how the stickiness of regulated-deposit rates differentially affects the lending behavior of banks reliant on them as opposed to other sources of financing. The negative relationship between the differential credit growth and the funding-cost gap suggests that higher average cost of funding for regulated-deposit dependent banks induces them to lend less. This result is confirmed in our econometric analysis. We estimate that banks can sustain at least 30 basis points higher funding cost until monetary policy actually has contractionary effects. This results in a sizable aggregate effect for the real economy including a drop in investment, as we show that borrowers can neither substitute credit across lenders nor switch to other sources of funding.

As the cost of funding changes, banks also have incentives for risk taking and rebalancing their loan portfolios, leading not only to a shift in the overall amount of credit supplied, but also to a reallocation across different borrowers and types of loans. They primarily contract lending for their large borrowers, leading to an increase in the exposition of their loan portfolio to smaller, younger, and riskier firms. They also reduce their proportion of loans to household mortgages, which are relatively safe in France.

Besides pointing to an important role of credit supply for the distributional consequences of monetary policy, our results also speak to the potential spillover effects of assets with stable returns for the distribution of liquidity and thus the aggregate stability of the banking system.