Post No.369. Of those firms that took out a state-guaranteed loan (SGL) during the public health crisis, 10% chose to repay it in full a year after disbursement, while 73% opted to repay it over the maximum term. This blog post explores the different repayment methods chosen by firms (deferred, at term, instalments) according to their size and financial health. Small firms generally opted to spread out their repayments over time, except for those with abundant liquidity before the crisis, while intermediate-sized firms were more likely to repay immediately or with a one-year deferral. At the end of June 2024, 62% of the total amount loaned had been repaid.

In 2020, the French government imposed a lockdown in response to the public health crisis, leading to a collapse in firms’ revenues and cash levels. As outstanding debts still needed to be repaid, firms had to look elsewhere for liquidity: they could either draw down existing credit lines (Vinas, 2020), or take out one of the state-guaranteed loans (Covid SGLs) introduced by the government to meet their liquidity needs. A large number of firms opted to contract an SGL, but, in hindsight, did they all really need them? Did SGLs provide an opportunity for financially constrained firms to obtain funding at a low cost? Was repaying an SGL rapidly a way of sending a signal to the markets that the firm was in sound financial health?

Nominal turnover figures have been adjusted for the consumer price index.

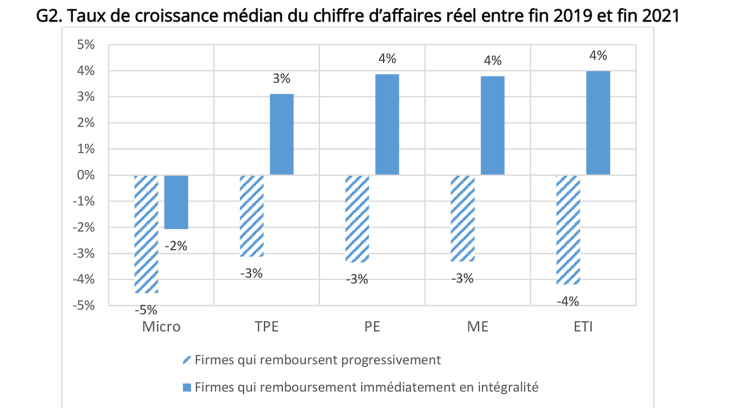

An analysis of corporate turnover for 2019 to 2021 shows that firms that repaid their SGLs in full at the end of the first year reported stronger growth than those who kept their loans for longer (see Chart 2). Aside from trends in turnover, did any other factors influence repayment choices?

In this blog post, we analyse SGL repayment choices by comparing the features of firms that repaid immediately and in full a year after disbursement with those of firms that opted to repay gradually.

SGLs: a flexible support mechanism with different repayment options

“Covid SGLs” came with very favourable terms. As well as being cheaper than other forms of financing, the first repayment was only due on the first anniversary of the loan. In addition, at the end of the first year, firms could opt to: (i) pay back the loan in full immediately; (ii) start repaying in instalments over one to five years; or (iii) defer the first repayment by another year and then spread out the instalments over one to four years.

A total of EUR 143 billion of loans were granted. Our analysis excludes large corporations and holdings, as well as firms in the agriculture, education and financial sectors. Our sample contains 579,778 beneficiaries of Covid SGLs, representing outstanding lending of EUR 105 billion (73% of the total).

Small firms that chose to repay their SGL immediately and in full had higher cash levels going into the Covid crisis

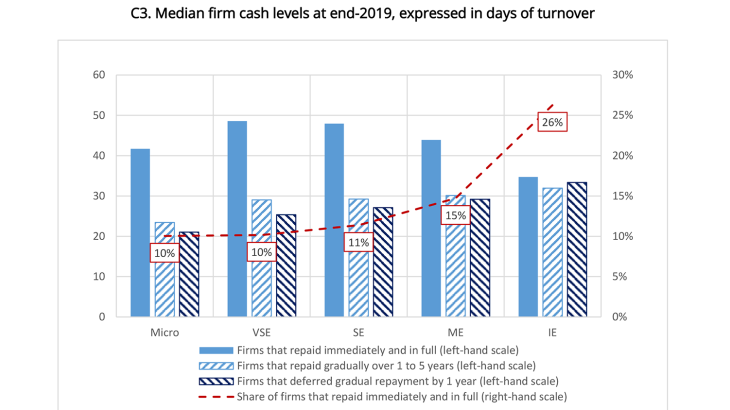

The decision to repay the loan immediately and in full one year after disbursement depended on a large number of criteria. We find size to be a determining factor: only 10% of microenterprises and very small enterprises (VSEs) chose to repay their SGL in full in 2021, compared with 15% of medium-sized enterprises (MEs) and 26% of intermediate-sized enterprises (IEs), as shown in Chart 3.

The firm’s cash position on the eve of the March 2020 lockdown was also likely to have influenced the decision. We observe (see Chart 3) that the median cash level at end-2019 (in days of turnover) was higher for firms that chose to repay their loan immediately and in full than for those who chose to repay it gradually, with or without an extra one-year deferral.

Moreover, we find not only that cash positions were a determining factor for small firms, but also that SMEs that paid their loans back immediately and in full had significantly higher cash levels, in days of turnover, than IEs.

The smaller the firm, the longer the repayment term

One year after SGLs were disbursed – i.e. in the spring of 2021 for the majority – firms that decided not to repay immediately and in full had to choose the duration of their repayments (one to five years). However, they could also choose to defer repayment by another year: in this case, instalments could be spread over one to four years to stay within the six-year loan limit.

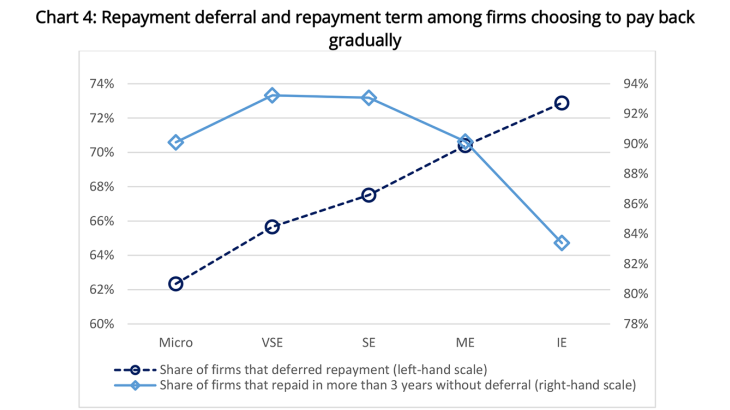

Firms that had not repaid in full after one year frequently chose this additional deferral option. However, it was most popular among the larger firms in our sample: 72% of IEs chose to defer their SGL, compared with 62% of microenterprises. This relationship between payment deferral and firm size rises linearly as size increases (see Chart 4).

The lower preference for deferral among smaller firms may reflect a desire to smooth their repayments over time. Among firms that did not fully pay off their SGL in 2021 and chose not to defer repayment to 2022, we also find that smaller firms were more likely to opt for a longer repayment term: more than 90% chose a period of three years or more, compared with “just” 83% of IEs (see Chart 4). A similar trend can be observed for firms that did choose to defer their loan, but with less marked divergences between firm sizes.

Lastly, firms could choose to reimburse their loan in one lump sum at term. In our sample, this option was most popular among the larger firms: 32% of IEs repaid at term, compared with 20% of MEs, 16% of SEs, 13% of VSEs and 11% of microenterprises. Here again, the trend can be seen as reflecting a desire among smaller firms to smooth their repayments over time; it may also be linked to the greater complexity of managing this type of loan.

At the present time, the repayment of SGLs raises no particular concerns: at the end of June 2024, 62% of the amounts disbursed had been paid back, in all firm size categories. At the same date, EUR 4.3 billion of guarantees had been called in, representing 3% of the total amount loaned.

More limited recourse to “resilience SGLs”

In 2022, the French economy began to feel the effects of rising energy costs. The Covid SGL scheme ended in 2022 and was replaced, from April 2022 to December 2023, by resilience SGLs. The lending criteria on these loans were stricter than for Covid SGLs, and the interest rates higher. Only 3,334 firms took out a resilience SGL, amounting to total lending of EUR 2 billion. Among the beneficiaries, 62% had already taken out a Covid SGL, and only 145 of these had repaid it in full in 2021.

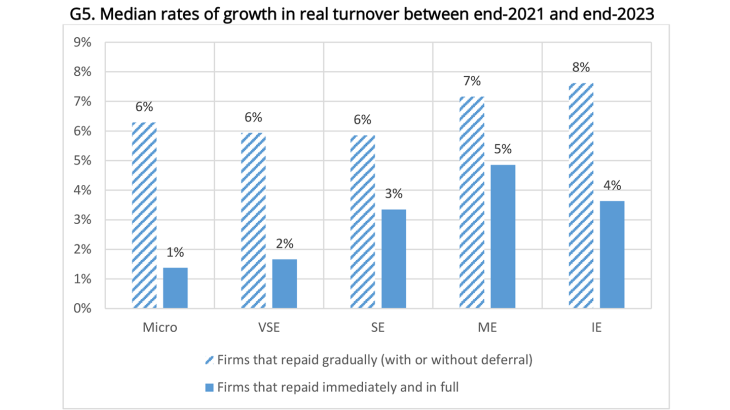

Is it possible that Covid SGLs provided a partial liquidity cushion during the energy crisis? If we look at median rates of real turnover growth between 2021 and 2023, firms that decided to repay their Covid SGL gradually reported stronger turnover growth in 2021-23 than those that repaid their loan in 2021 (see Chart 5), contrasting with the trend observed in 2019-21.

Nominal turnover figures have been adjusted for the consumer price index.

This rise in growth rates probably reflects a partial catch-up effect. However, it also raises questions as to the role played by Covid SGLs during the energy crisis: did keeping a Covid SGL give firms greater financial flexibility in 2022? A more in-depth analysis, beyond the scope of this post, is needed to examine this question.

Download the full publication

Updated on the 21st of October 2024