- Home

- Publications and statistics

- Publications

- Standard of living & risk of secular sta...

Post n°1. Standard of living has slowed continuously over the past decades in most developed economies, mainly due to a productivity slowdown. Have we entered a period of secular stagnation? In fact, many countries still have a significant catch-up potential, even in Europe, but to achieve this catch-up, the implementation of structural reforms is required.

GDP per capita: a good indicator of the economic standard of living

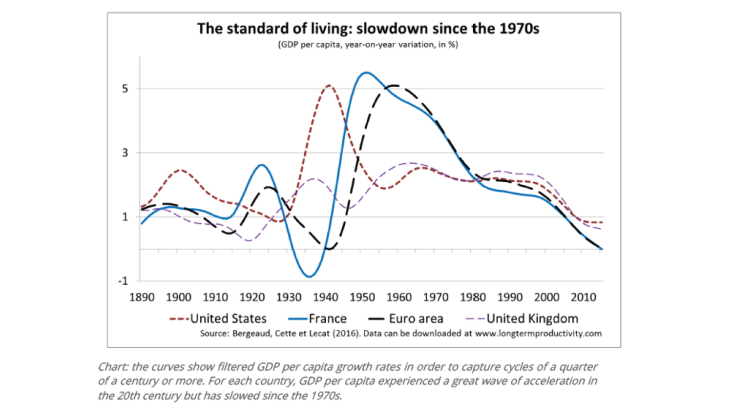

In the most common cases, economic standard of living is measured using GDP per capita. The latter has slowed continuously over the past decades in developed countries. For instance, the annual GDP per capita growth rate was 0.6% in the United States over the 2005-2015 period compared with 2.2% in the 20th century, and 0.3% in France compared with 2.1% for the same periods (see the above Chart taken from "Rue de la Banque", No. 11).

A great wave of growth during the 20th century

In each country or economic area, we observe a long and pronounced wave of GDP per capita growth during the 20th century. Every region was not affected in the same way: from the 1930s to the 1950s, it concerned the United States, then later, after the Second World War until the 1960s, the euro area (recompiled using values for Germany, France, Italy, Spain, the Netherlands, Belgium, Portugal and Finland), and namely France, and to a lesser extent the United Kingdom. The size of the wave also varies significantly depending on the economies: countries with the highest starting level of GDP per capita, namely the United Kingdom, experienced the slowest growth.

This wave corresponds mainly to the spread of innovations developed during the Second Industrial Revolution, which spurred productivity growth and consequently the average economic standard of living. These innovations covered an extremely wide range of activities, including chemicals, pharmaceuticals, energy (oil and electricity), transportation and industrial power generation (the electric motor and combustion engine) as well as telecommunications (telephones, radio and cinema). This wave was also linked to innovations in manufacturing processes (Taylorism) and financing methods (Bergeaud, Cette and Lecat, 2016). Thanks to trade liberalisation, advances in education and better adapted economic institutions, the other advanced countries benefited from a post-war catch-up process.

A slowdown in successive stages since the 1970s

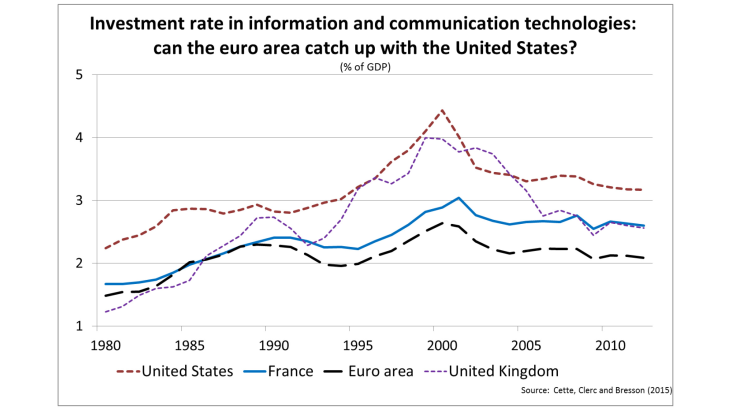

In the advanced countries considered here, GDP per capita has slowed in successive stages since the 1970s, with a brief interruption caused by the information and communication technology (ICT) revolution. The size of this new cycle was more limited, with GDP per capita peaking in the United States at just over 2% at the turn of the 2000s (with GDP increasing more due to demographic effects). It was also shorter, slowing down in the mid-2000s prior to the financial crisis. Although, not all countries reaped the benefits of the ICT revolution and clearly, GDP per capita in Europe did not accelerate.

The consequences of this new order were significant for the countries and populations concerned. For example, the sustainability of social expenditure such as pensions, as well as public spending and more generally the ability to improve well-being were all made possible by the growth in GDP per capita. Could it be possible to benefit once again from the growth rates observed in the 20th century?

Catching up is impossible without ambitious reforms

The new slowdown in growth since the mid-2000s raises fears of a period of "secular stagnation", i.e. a long-term situation of negligible growth. Techno-pessimists (Robert Gordon in particular) argue that the "one big wave" of the 20th century was an isolated incident in the history of humanity caused by an exceptional series of simultaneous innovations in a number of fields. The slowdown in productivity, that can be shown to have started prior to the financial crisis, was largely due to the lower contribution of ICT, which supports this hypothesis.

However, techno-optimists (such as J. Mokyr, E. Brynjolfsson and A. McAfee) defend the view that the potential of ICTs for innovation is exponential and that they will contribute to a new wave of productivity growth. This position is supported by the fact that productivity has not slowed in the most productive companies. In this case, the slowdown in average productivity therefore appears to be due to a growing divergence between those companies and the rest (Andrews, Criscuolo and Gal, 2015). The reasons behind this divergence have been widely analysed and opinions differ. The Banque de France's own research shows that the great waves of productivity in the 20th century are only partly explained by technological innovations.

However, there is major catch-up potential for countries where the diffusion of ICTs was not as extensive as in the United States, which is the case for France and the euro area in general. At the microeconomic level, better allocation of skills and capital between companies as well as improvements in management techniques represent a substantial growth pool.

Achieving this catch-up potential necessitates the implementation of ambitious structural reforms: incentives for change, in particular by encouraging free access to the products market; and possibilities to adapt the manufacturing process, through adequate flexibility in the labour market, vocational training to develop skills that meet requirements and access to suitable financing for the most promising companies.

Selected references:

Andrews, D., C. Criscuolo and P. Gal (2015): "Frontier Firms, Technology Diffusion and Public Policy: Micro Evidence from OECD Countries", OECD Global Productivity Forum background paper.

Bergeaud, A., G. Cette and R. Lecat (2016): "Productivity trends from 1890 to 2012 in advanced countries", the Review of Income and Wealth, Vol. 62, Issue 3, pp. 420-444.

Cette, G., C. Clerc and L. Bresson (2015): "Contribution of ICT Diffusion to Labour Productivity Growth: The United States, Canada, the Eurozone, and the United Kingdom, 1970-2013", International productivity monitor, No. 28, Spring.

The data can be consulted at www.longtermproductivity.com.

Updated on the 25th of July 2024