1 The introduction of a specific framework for globally systemically important banks (G-SIBs)

One objective: mitigating moral hazard

The concepts of “too big to fail” and “too connected to fail” relate to financial institutions that, because of their size or interconnectedness in the financial ecosystem, are considered to be of systemic importance because their failure could have disastrous consequences for the wider financial and economic system. Implicit guarantees of government and central bank support in the event of these institutions encountering difficulties could encourage them to take greater risks. This mechanism constitutes moral hazard, with adverse consequences for financial stability, such as increased risk-taking by these institutions, reduced market discipline and distortion of competition.

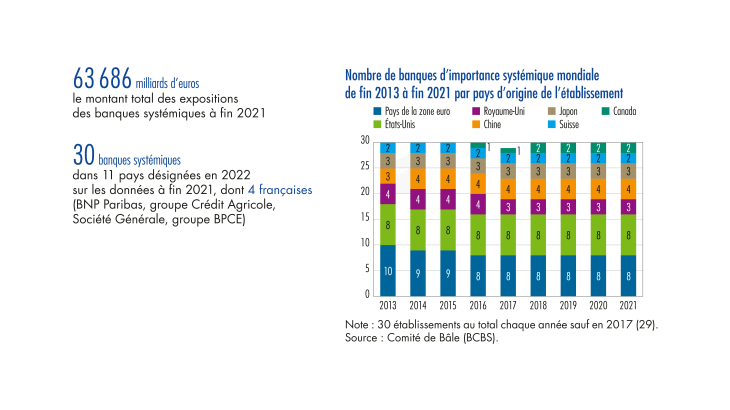

The failure of a global systemically important bank (G-SIB) is not just a problem for the national authority, given the potential repercussions beyond national borders. This is why the issue of systemic institutions was placed on the agenda of international financial supervisors by the G20 at the Pittsburgh summit in September 2009, following the financial crisis in the wake of the collapse of Lehman Brothers. These authorities drew up specific standards to reflect the cost of a potential failure of a systemic institution. The new Basel III prudential rules incorporate a macroprudential dimension by tackling the sources of systemic risk, with two main objectives: (1) reducing the probability of failure of a G-SIB by assigning it a capital surcharge based on its systemic footprint and (2) reducing the impact of a G-SIB failure by improving the resolution and recovery frameworks. Under the Basel framework for identifying global systemically important banks (G-SIB framework), institutions designated as systemic are subject to enhanced supervisory measures, including a capital surcharge, which came into force in 2016 for the banking sector. These measures have been fully effective since 2019.

A G-SIB score based on a multi-indicator approach

G-SIBs are identified at the global level using a quantitative methodology, based on a relative individual score from a main sample of 76 institutions (see Part 2). This is an annual exercise, covering data through 31 December of the previous year. The score represents the simple average of five sub-scores (each with a 20% weighting): size of balance sheet and off-balance sheet exposures, interconnectedness with the financial system (measured by outstanding securities issues, loans and borrowings from financial institutions), substitutability of the services or financial infrastructure provided …