The “services” component of the Harmonised Index of Consumer Prices (HICP) represents 44% of the total index. It includes all services for consumers, covering a variety of services including transport, communications, housing, healthcare, restaurants, etc.

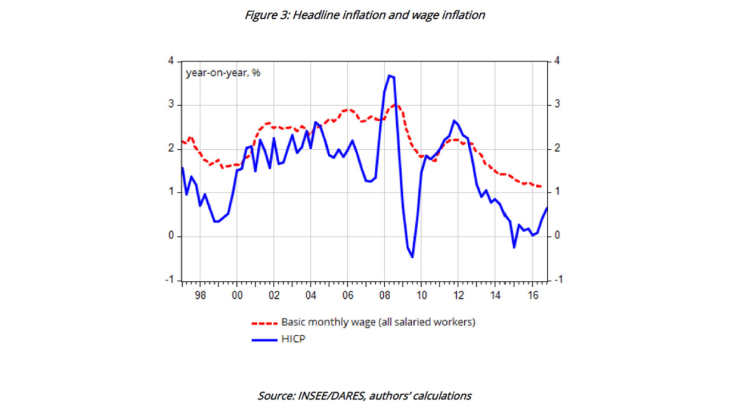

As an annual average, services price inflation was 1.0% in 2016, after 1.2% in 2015. In February 2017, it stood at just 1.1% year on year. This growth rate is well below the average of around 2% recorded between 1999 and 2015.

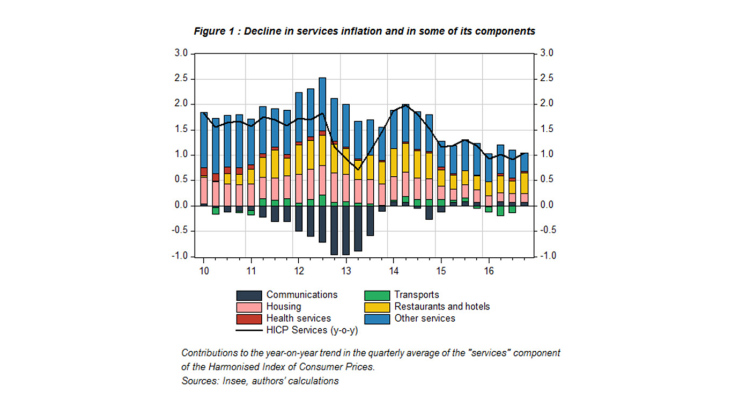

The slowdown concerns most of the components of services prices

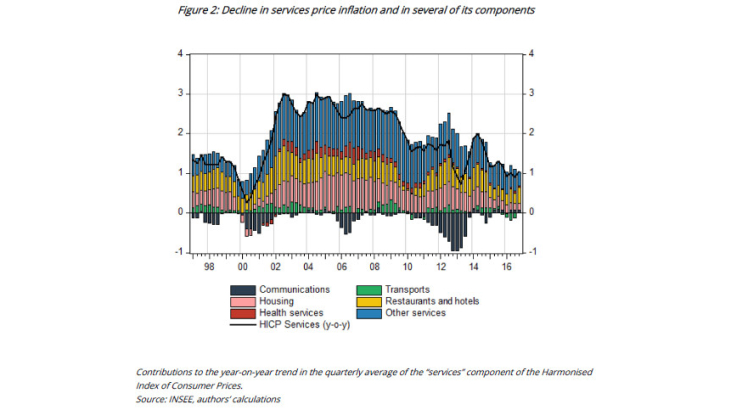

Two periods of very low services price inflation have been recorded in the past twenty years: (i) in 2000, services inflation dropped to 0.6% (after 1.2% in 1999); (ii) in 2013, it dropped to 1.0%, mainly due to lower communications prices linked to the arrival in the market of new mobile telephone operators in 2012.

The present situation differs from that of 2013 as there has been a generalised slowdown in prices in several sub-components of the “services” HICP and it is not solely the result of lower communications prices. Figure 2 shows the contributions to the HICP of the six services sub-components. A comparison of the trends in 2012 with those of 2016, to avoid using 2014, which was marked by a rise in VAT rates, and 2013, which featured the fall in communications prices, shows a strong slowdown in prices in three of the six categories: “housing”; “transport” and “other services”, which includes repairs, cleaning services, hairdressers, etc. Between Q1 2012 and Q4 2016, services inflation slowed by 0.7 percentage point (pp). The decline in inflation in these three categories contributed -1.1 pp to this decrease.