During recessions, such as the Covid-19 crisis with the lockdown measures, many firms are faced with a heightened risk of default. Macroprudential regulators have identified corporate insolvencies as a major threat to financial stability. With inadequate bank capitalization, a wave of corporate defaults may increase bank portfolio risk, leading to a rise in the bank default probability.

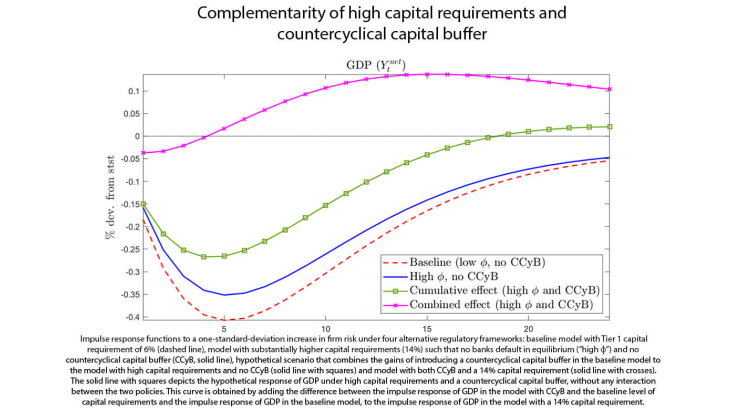

In this paper, we complement the existing literature on the interplay between firm and bank defaults focusing on the stabilization properties of macroprudential policies. In particular, compared to the existing literature, we show that a high capital requirement and a countercyclical capital requirement are complementary policies.

Using time series regression techniques, we show that an increase in firm risk leads to a significant fall in output and inflation in the US over the sample January 2005 to June 2020. Moreover, bank risk rises significantly, which indicates that firm risk carries over to the banking sector in the form of a higher implicit bank default probability. With these empirical results at hand, we consider the transmission of risk shocks in a model that combines New Keynesian price setting frictions with financial market imperfections. Macroprudential policy aims at limiting the amount of resources lost due to bank failures. The macroprudential policy instrument in our model is a target bank capital ratio, which requires banks to fund part of their assets using relatively more expensive equity capital. Banks that deviate from this target incur a cost. A further macroprudential instrument is a countercyclical capital buffer to implement Basel III regulation.

We show how high minimum capital requirements can help to safeguard financial stability when the economy experiences a wave of firm insolvencies. Capital regulation prevents the bank default rate from increasing; however, the downside is a reduction in credit provision, which in turn exacerbates the recession. With a well-capitalized banking sector, implementing a countercyclical capital buffer as an additional macroprudential policy limits the drop in credit provision. The joint implementation of the two policies is effective at stabilizing both the macroeconomy and the financial sector in response to firm risk shocks (see Figure).

Keywords: Bank Default, Capital Buffer, Firm Risk, Macroprudential Policy

JEL: E44, E52, E58, E61, G28