1 Since 2014, European authorities have had exceptional powers to manage bank failures

How to deal with bank failures

Public authorities impose a large number of rules on banks. They must obtain a license to operate and receive funds from the public, i.e. deposits. Under the supervision of the banking supervisor, they must manage their day-to-day activities in compliance with certain prudential rules: for example, they must hold sufficient capital to cover the risks they take. This specific regulation of banks is necessary to protect depositors, the financial system and the real economy (households and businesses), since a bank failure can set off a chain reaction.

In the event of failure, businesses file for bankruptcy and lose their capital. However, during the 2008 financial crisis, some banks were deemed “too big to fail”, because their failure would have threatened the entire financial system and economic activity. The authorities therefore rushed to rescue failing institutions. When they did not (as in the case of the US bank Lehman Brothers), the failure was catastrophic for the global economy.

Since the Great Depression of the 1930s, banking crisis management policy has been dominated by two problems. On the one hand, banks can be threatened with failure due to depositors’ mistrust, if this leads to massive withdrawals of deposits. On the other hand, it is difficult to interrupt banking activity, as it is a service of general interest. Commercial banks create money, grant loans and manage means of payment. In so doing, they contribute to financial stability and the smooth running of the economy, which are common goods.

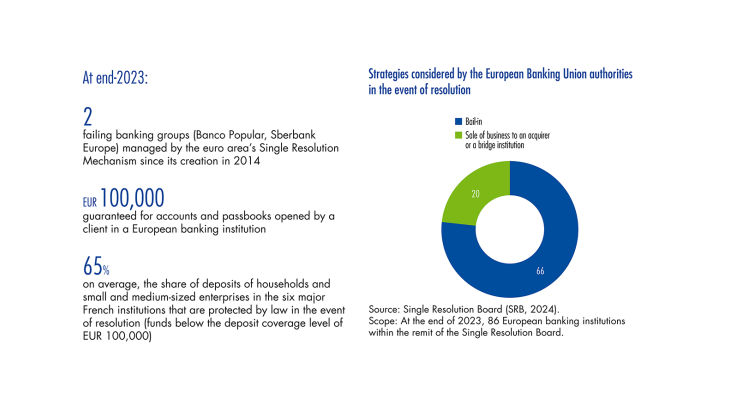

Faced with these two problems, the authorities have come up with two solutions. To instill confidence and protect depositors, they cover deposits under a certain ceiling (EUR 100,000 in the European Union – EU, USD 250,000 in the United States) thanks to an insurance financed by contributions from the banking sector. In the spring of 2023, the US authorities even took the exceptional step of fully guaranteeing the deposits of failing regional banks Silicon Valley Bank and Signature bank. To punish bank management errors while preserving financial stability and the continuity of banking services, a number of G20 countries introduced so-called resolution regimes after the 2008 financial crisis. These regimes give certain administrative authorities extraordinary powers and instruments to manage failing banks in the public interest. …