GVCs enable greater specialization and therefore gains in terms of production costs, but they are complex structures that entail greater risks. As such, supply-chain organization results from the trade-off between cost efficiency and cost uncertainty. When economic conditions change, the terms of this trade-off change; and firms may decide to reorganize their supply-chain. Reorganizing the supply-chain can take multiple forms. It may involve separate business functions (What), different countries (Where), take place within the firm's boundaries or outside the firm's boundaries (How). Whether a firm takes one of these decisions or not (Who) depends on how exposed to changes the firm is and how costly it is to reorganize. This paper studies, along these four margins, how firms adapt their international supply-chain. We leverage a survey of French firms (Chaînes d'activité mondiales, CAM) that fulfils these requirements. For each surveyed firm, we observe whether it has offshored or reshored part of its international value chain between January 2018 and December 2020. We also observe which business functions were thus reorganized, and whether this took place within the firm's boundaries (in-house) or not (at arms' length), controlling for destination-level determinants of location. Importantly, surveyed units are so-called “enterprises”, a concept that reflects a set of legal units sharing a common centre of decision. We make the following working hypothesis: respondents' initially optimal value chain has been subject to unobserved shocks, possibly due to a more uncertain environment. Firms have then made a decision, or not, to reorganize, and this decision is observable, reported in the survey.

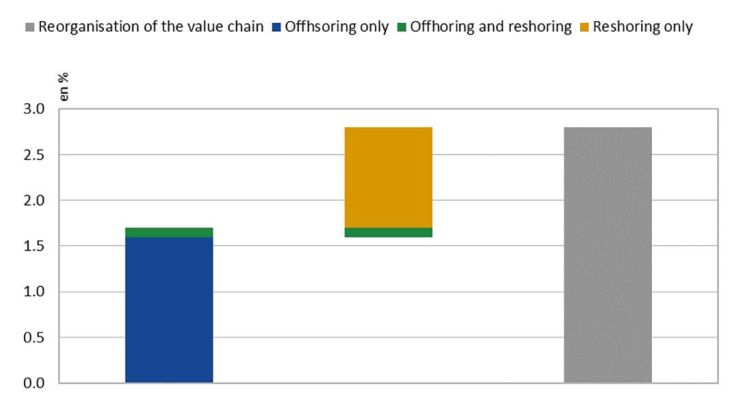

Adjustments are uncommon: less than 3% of firms offshored or reshored during the three years under review, and only a handful of firms did both. These adjustments were made by firms employing a greater proportion of skilled workers, in manufacturing industries rather than services. Multinationals, particularly foreign multinationals, predominate among these firms. Firms report offshoring and reshoring decisions separately for each business function of their value chain and the survey shows that they reorganized only a fraction of their supply-chain: less than one percent of firm-function combinations are reorganized during the period and these are business functions considered to be their core activity. Upon offshoring, we find that the likelihood of offshoring in-house decreases with firm productivity, suggesting that the cost of arm's length relationship is higher than the cost of in-house relationships. Last, the likelihood of reorganizing in-house increases with the fraction of intangible capital in total capital for offshored activities, but not reshored activities. We interpret this result as the sign that intellectual rights are hard to enforce, and harder in foreign countries than in France. We finally find that the likelihood of offshoring in a given destination decreases with distance from France, and that high-skilled and R&D intensive activities are more likely to be offshored in India.

Keywords: Supply-chains, Reshoring, Offshoring

JEL classification: F14, F23, L10, L23