- Home

- Publications et statistiques

- Publications

- The real effects of bank runs: France in...

Post n°271. During the Great Depression, bank runs in France were characterised by a flight from banks to savings institutions, which were perceived as safer. Here, we identify and quantify the effects of these bank runs and analyse the conditions that led them to deepen the economic crisis.

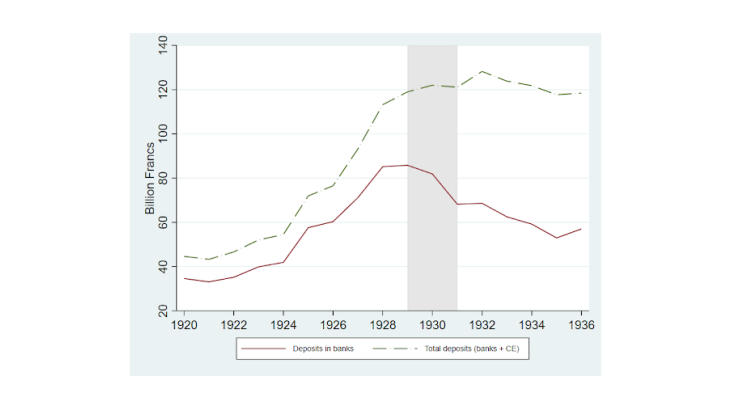

Note: The grey shaded area indicates the drop in bank deposits at the aggregate level between 31 December 1929 and 31 December 1931.

Although there is extensive economic literature on bank runs, two blind spots remain. First, economists are often incapable of identifying the causal effects of bank runs and are thus unable to quantify the impacts. This is because it is difficult to distinguish between bank runs caused by self-fulfilling changes in depositors' expectations and panics triggered by deteriorating economic fundamentals. Second, the literature rarely considers what happened to the deposits that were withdrawn from the banks. The standard assumption is that during a period of extreme risk aversion individuals prefer to hoard cash rather than trust other banks. Consequently, traditional models do not consider the other liquid assets available to depositors, even though these assets themselves can be a source of bank runs.

In this blog, we look at these two issues together. We investigate the causal impact of bank runs by taking as a means of identification a key feature of the Great Depression in France in 1930-31 that created exogenous geographical variations in bank deposit withdrawals: the density of savings institutions (Caisses d’épargne ordinaires – CEOs) at the local level.

Flight-to-safety and the credit crunch

The financial crisis in France in the 1930s was characterised by a flight-to-safety (see Chart 1). Starting in November 1930, French depositors – both households and firms – suddenly withdrew their funds from commercial banks across the country (Baubeau, Monnet, Riva and Ungaro 2021, Monnet, Riva and Ungaro 2021). At the time, French banks were still unregulated: the first banking laws were passed in 1941. Depositors transferred the funds they withdrew from banks to CEOs. Unlike banks, CEOs were regulated and had the advantage of being guaranteed by the government, but they were not authorised to provide loans or payment services: they could only hold government securities. Consequently, at the local level, savings institutions did not offer an alternative to bank credit.

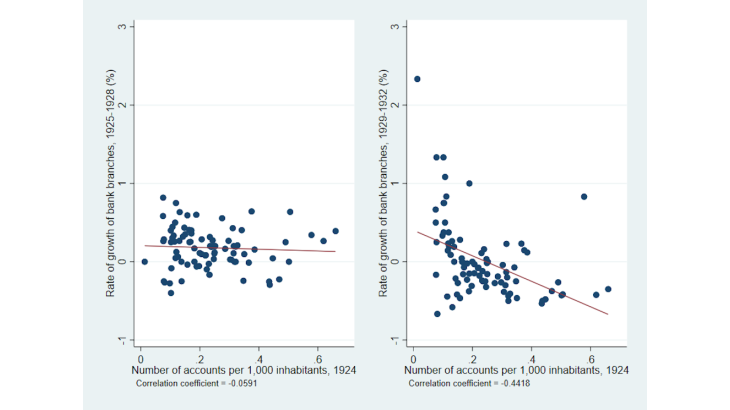

The right-hand panel in Chart 2 shows the correlation between the local distribution of CEOs prior to the crisis, measured by the number of accounts per inhabitant in 1924, and the growth rate of banking activity between 1929 and 1932. We use the number of bank branches (the only bank statistic available at departmental level for this period) to approximate banking activity.

Note: Number of pre-crisis CEO accounts per 1,000 inhabitants (1924) and the growth rate of bank branches, at departmental level. Left-hand panel: prior to the crisis (end-1925 to end-1928). Right-hand panel: during the crisis (end-1929 to end-1932).

The chart shows a strong negative correlation during the crisis years between the pre-crisis density of CEOs and the growth rate of banking activity. Econometric analyses and the historical literature establish that the departments with a higher density of CEOs are those that experienced the most significant decline in banking activity (Monnet, Riva and Ungaro 2021). For example, the most affected areas include departments in the east and south-east of the country and major industrial zones where savings institutions were widespread. By contrast, departments that had fewer CEO accounts per inhabitant saw a smaller decline and even an increase in bank branch numbers.

This negative correlation was not the continuation of a prior trend. The left-hand panel in Chart 2 shows no correlation between the pre-crisis (1924) CEO density and the growth rate of bank branches between 1925 and 1928. Prior to the crisis, CEOs and banks complemented each other rather than acting as a substitute (Bonin, 1999). Banks provided their customers with means of payments and services such as portfolio management and investment advice – often free of charge – while CEOs simply offered “pure”, albeit well remunerated, deposit accounts.

However, when the panic broke out, withdrawals from banks were observed countrywide and deposits in CEOs and in banks became negatively correlated. Consequently, bank lending to the economy contracted. Local GDP fell sharply in real terms as CEOs transferred deposits to the Treasury in the form of cash by buying government securities (Monnet, Riva and Ungaro 2021). As for the Treasury, it did not use these funds to carry out investment programmes but instead used them to reduce public debt, as the “gold-standard mentality” of the time dictated.

The real effects and conclusions for financial stability

Our study proceeds to use pre-crisis CEO density as an exogenous instrument to measure the growth rate of bank branches during the crisis. Our identification strategy relies on the fact that we know where the funds withdrawn from banks were ultimately deposited. Using this method, we find that a decline in banking activity has a major effect on GDP. A 1% decrease in the number of bank branches caused a drop in GDP of about 1% per year between 1929 and 1932. To give an idea of the scale, an annual 1% decrease in bank branches was linked to a 2% decline in bank credit (calculated using national-level data). Roughly speaking, the causal effect of the bank run we thus identified may explain one-third of the drop in real GDP in 1930-31.

Although today’s banking systems are very different from the interwar French system, this study allows us to draw several conclusions for the current period. Bank runs may still take place despite deposit insurance and they are a feature of many emerging market economies that have not yet implemented credible deposit protection measures. We also show how the dualism between highly regulated deposit-taking institutions and unregulated institutions represents a source of financial instability.

This historical case study therefore allows us to illustrate what could happen to the financial sector if households and firms suddenly transferred their deposits to regulated banks from unsafe non-banking financial institutions (NBFI) that are not subject to deposit insurance. The study also applies to the possibility of a run on bank deposits in the event of the introduction of a central bank digital currency (CBDC) (see, in particular, Bindseil and Panetta 2020). During the crisis, the safe savings accounts analysed in our study attracted funds deposited in banks, as could a CBDC in the future, as central banks are supposed to never default. This example from our past cautions us to design a CBDC in such a way that guards against this risk, notably by imposing a ceiling on individual holdings.

Updated on the 25th of July 2024