Transmission channels from the APP to credit spreads

Variations in credit spreads are attributable to both credit demand and supply factors. For example, an improvement in the quality of borrowers (demand factor) may stem from a decrease in the default risk during the term of the loan, leading to a fall in spreads. Similarly, on the supply side, an improvement in lender characteristics such as a better capitalised banking system has an impact on the amounts lent (Klein, Peek et Rosengren, 2002) or on bank interest rates (Santos, 2012).

Credit rates react to monetary policy, irrespective of their maturity. Indeed, long-term interest rates reflect the expectations of economic agents regarding future rates. In the monetary easing phase, the more they are convinced that this is a lasting trend and is part of a medium-term strategy, the more this easing will have a downward effect on long-term interest rates (see post Eco Notepad) for the effects of APPs on interest rates and bond yields).

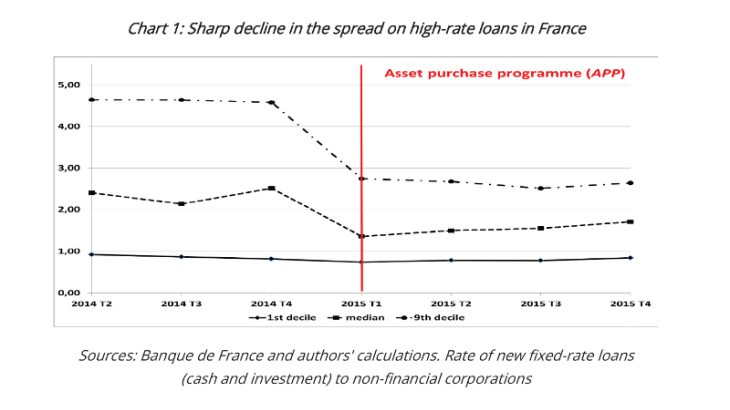

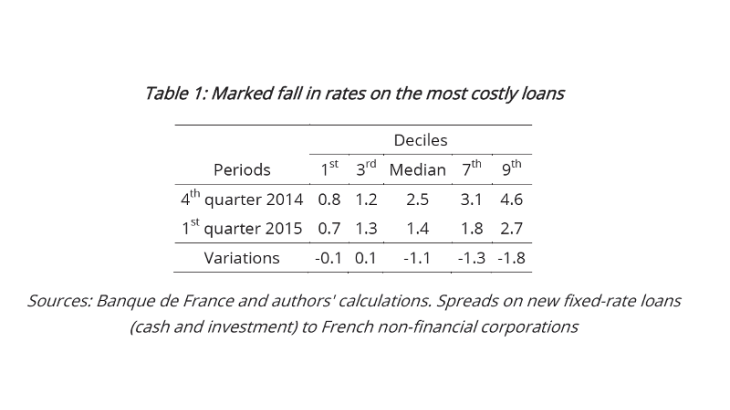

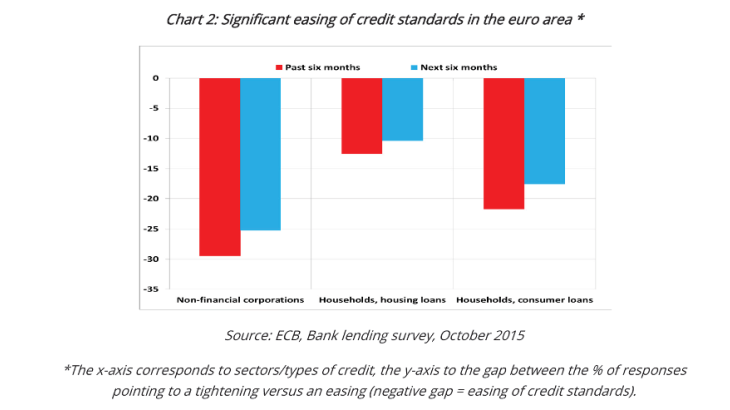

In addition, recent work has shown that monetary policy has an impact on credit spreads. Indeed, an expansionary policy can both stimulate lenders’ risk appetite (resulting in a reduction in the compensation required to meet any losses incurred in the event of a borrower defaulting) and reduce their risk of default. Moreover, credit spread variations may amplify the decline in monetary rates, leading to sharp variations in the cost of credit for businesses (Gertler and Karadi, 2014).

Finally, in the United States, the announcements of quantitative easing significantly reduced credit default swap rates, especially for businesses with the highest default risk (Krishnamurty and Vissing-Jorgensen, 2011). Our results on the effects of the APP announced in January 2015 in the euro area are therefore consistent with those for the United States.