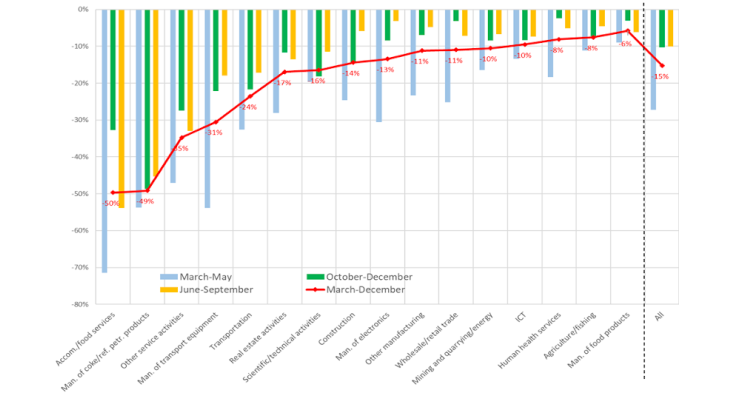

Note: The shock to activity is the difference between observed turnover and the simulated counterfactual level of turnover. The shock is shown as a cumulative loss of activity for the period March-December (red line), and then broken down over three different periods (bar chart): March-May, June-September and October-December.

As well as differing in intensity, the first and second lockdowns also differed in terms of the number of sectors affected (Chart 2).

- The first lockdown (March-April) was a broadspread shock which affected all sectors, although to differing degrees. The worst affected sectors were accommodation and food services, and the manufacture of transport equipment, while the least affected was information and communication technology (ICT).

- For the second lockdown (October-November), where the restrictions were more localised, the findings are very different. Only a few specific sectors were badly affected, for example accommodation and food services, and personal services (included under “other service activities”), whereas most other sectors saw only a limited decline in activity. This was due to the less strict nature of the measures, and to the fact that businesses had managed to adapt to the new operating conditions in the wake of the first lockdown.

The sector-level shock masks marked variations in individual situations

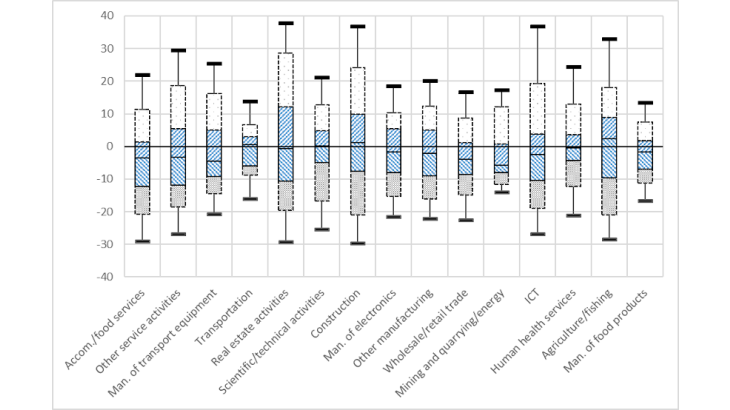

To appreciate how individual trajectories differed in 2020, we need to look at what would happen in a “normal” year. Even without a major shock, trajectories vary widely across sectors and across firms within sectors. But with the 2020 crisis, these divergences were amplified.

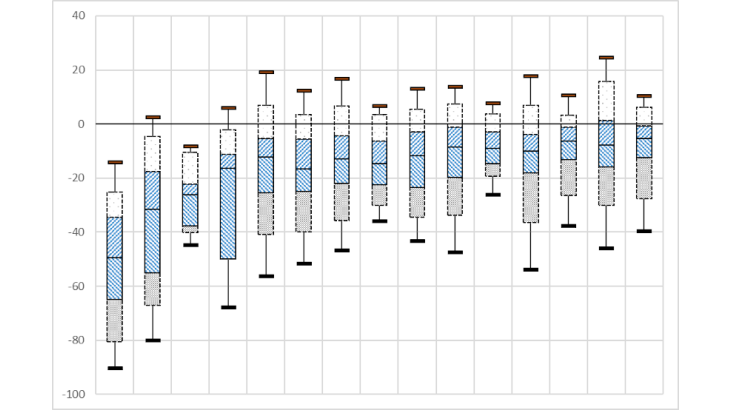

Charts 3a and 3b illustrate these points. The first (3a) shows, by sector of activity, the main quantiles in the distribution of the activity shocks in 2020, which was an exceptional year. The second (3b) shows these same indicators during a “normal” year, in this case 2019. The shocks in 3b are highly dispersed. The median is relatively close to zero, and some firms posted trajectories that were better or worse than might have been expected. Although some sectors appear on the whole to have had better or worse activity levels in 2019 than suggested by the counterfactual, the differences between sectors are not huge.

2020 differs in three respects (Chart 3a). First, the entire distribution is shifted downwards, reflecting the overall drop in activity and a much higher proportion of declines in activity/negative activity shocks. Second, there is a marked difference in trajectories between sectors. Third, the dispersion within each sector is also wider in 2020 than in a normal year.

A slightly stronger sectoral contribution at the height of the crisis

The increased intra-sectoral disparity between activity shocks in 2020 may reflect a higher prevalence of large shocks, or uneven exposures or adaptation to the crisis within sectors. It may also stem from the fact that, in certain sectors, not all firms were subject to the same constraints in 2020: in retail, for example, the authorities’ decision on which shops to close was based on a more refined sectoral breakdown, which took into account the firm’s principal activity.

To capture the nature and extent of the sectoral heterogeneity at a very granular level (across 732 activity codes), the overall variance in individual shocks can be broken down into an inter-sectoral component (reflecting the dispersion between sectors at a granular level) and an intra-sectoral component. At the peak of the crisis (April 2020), the sectoral dimension only explains 20% of the variance in shocks. It plays a much bigger role than during a normal year (less than 5% in any given month in 2019). However, even at this very granular level, it only explains a limited part of the dispersion in activity shocks. The role of the sector is also more marked in those sectors hit by specific administrative measures (e.g. accommodation and food services) than in those sectors only affected by the general measures: for the first type, the share of the variance explained by the sector is six times larger in 2020 than in 2019, whereas for the second type, it is only twice as large.

Understanding the factors that make individual firms within sectors more resilient or vulnerable in the face of the crisis can offer valuable lessons for the future. In particular, the factors that made them more resilient (such as digitalisation, location, reorganisation of working methods) can provide more general lessons on the future direction in which we should steer the economy.

From the point of view of public policies, these findings suggest that, although firms’ sector of activity has played a bigger role than usual, this is not the only criteria that should be taken into account in defining crisis exit policies.