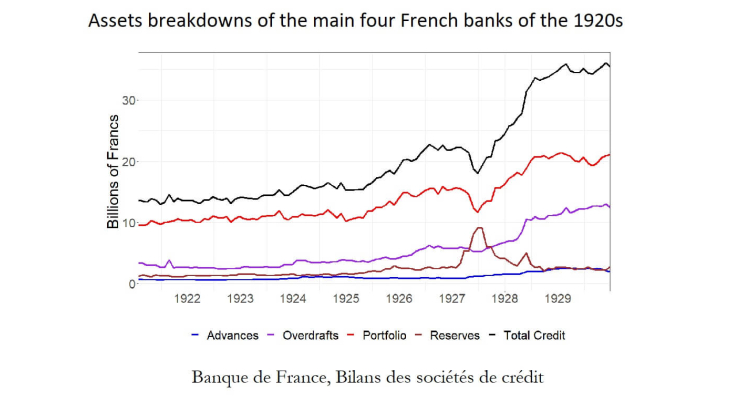

Following World War I (1914-1918), France's public debt grew to unprecedented levels in the context of deep political instability. This culminated in a financial and government crisis in the spring of 1926. A new government, led by veteran centre-right politician Raymond Poincaré, took office in July 1926 with a clear intention to stabilize public debt. This resulted in a drastic change in the maturity of government bonds, with short-term bills nearly vanishing. I show that this policy severely destabilized French money markets and the leading banks of the time, which relied heavily on such bonds. Indeed, short-term public debt repayment triggered a cash inflow for banks, pushing interest rates down. During the first half of 1927, without alternative short-term instruments to manage their liquidity, banks deposited incoming funds at the French Treasury, a practice allowed since WWI. Looking for higher yields, the largest Parisian banks successfully pushed the government to end the ban on capital exports that had been in place since 1918. This legal change contributed to the sizeable expansion of leading banks' balance sheets. This episode also had a compositional effect by reallocating capital from public domestic assets to private foreign assets. Overall, this sequence brought French capital to the forefront of international finance in the run-up to the Great Crash of 1929 and the banking panics of the early 1930s.

This paper bridges a gap between classical studies on France in the 1920s, focusing on debt and monetary management, and a more recent strand of literature focusing on the sudden decrease in banking activity in 1930-1931. The Poincaré government has been studied mainly as the outcome of the political instability that followed the war or for its role in international monetary relations. By focusing on debt restructuring, I explore how much this policy destabilized the main banks of the time. Indeed, withdrawing short-term bills reduced the supply of liquid and safe assets in money markets when demand for such assets increased because of the monetary stabilization.

Moreover, the episode provides a case study of the link between financial stability and publicly produced liquid and safe assets and their degree of substitutability with private assets. Taking a historical standpoint enables one to assess the external validity of existing theories. By studying a dramatic attempt by the State to retreat from financial markets, this paper departs from the marginal changes in the supply of short-term public debt that underpin most theoretical contributions. Following the Poincaré Stabilization, as the State was the leading producer of safe and liquid assets for French banks, the repayment of short-term public debt greatly disorganized their activity in money markets. As a reaction, some projects were discussed to foster the supply of domestic private liquid and safe assets. The French central bank considered developing a deeper interbank market, notably by introducing open market policies. Nevertheless, its hesitation was detrimental, and foreign money markets remained a more attractive option.

These findings have broader implications for debt management and financial stability. They underline the importance of public financial instruments for private actors, especially in economies experiencing a "saving glut" and structural instability. The underdevelopment of the money market in France during the Interwar period was instrumental in the expansion of foreign credit, highlighting how the effect of debt management on financial stability depends on the structure of financial markets and, thus, the need to account for such a structure in policymaking.

Keywords: Public Debt, Liquidity, International Finance, Interwar

JEL: N14, N24, E44, G21