The guarantee of access to healthcare for all has been compromised for years in advanced countries by the development of shortages of certain healthcare products, including essential medicines. These problems are due to a number of factors such as growth in global demand, the complexity of the organisation of health systems and distribution channel dysfunctions, but also economic decisions and industrial choices by public and private players. In the healthcare industries, the fragmentation of the stages of goods production worldwide and the globalisation of demand have created geographic interdependencies that, in a context of expanding international trade, are impacting on nations’ public health security. Following the Covid-19 shock, and in anticipation of other pandemics associated with the spread of animal-origin viruses and global warming, many countries’ governments now appear to have taken on board the supply difficulties faced by their health systems. In addition, since Russias invasion of Ukraine, trade globalisation has entered a phase of geopolitical fragmentation with the transatlantic axis considering healthcare products, and biotechnologies in particular, as highly strategic.

Healthcare products are dispersed across different industries in the international trade and production nomenclatures, which makes it hard to measure their overall weight and growth in global trade. The main contribution of this paper is to consider healthcare as an industry grouping in its own right in international trade alongside the other more usual industrial groupings such as mechanical engineering products, electrical equipment, electronics and transport. The list drawn up in this research aims for comprehensiveness and includes all traded products that can be used by the health system. This healthcare industry grouping comprises 368 products from the six-digit Harmonized System Nomenclature, which are classified in five branches covering medicinal products and all their compounds, medical technology equipment and small medical materials.

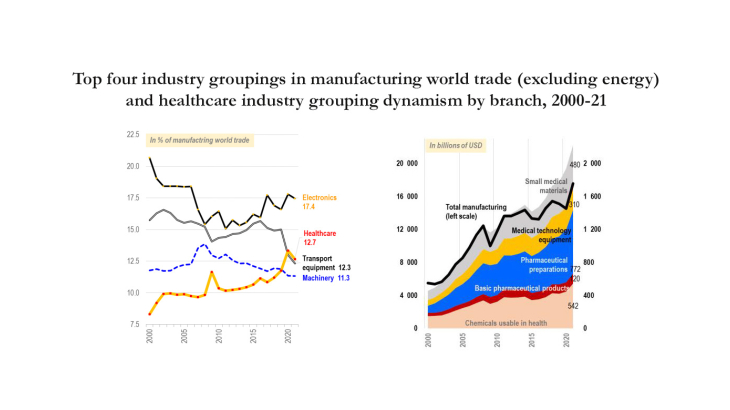

Healthcare products are a key industry grouping in trade, accounting for 13% of world flows in manufactured goods in 2021, in second place behind electronics. Healthcare industries have posted the strongest growth since 2000 out of the ten industry groupings in our breakdown. This buoyancy over the 2000-2021 period owes a great deal to the boom in trade in pharmaceutical preparations, with a growing share of these being biotech treatments. In 2020 and 2021, the Covid-19 pandemic triggered massive needs for healthcare products worldwide. International demand exploded for the branches of chemicals usable in health, pharmaceutical preparations and small medical materials. A focus on “Covid-19” products reveals that, during the crisis, national health systems imported products from across the entire healthcare industry grouping for the prevention and treatment of the virus. Demand for healthcare products is also less procyclical than for others products, contributing to a large share in total world trade in 2020 (as well as in 2009).

The international fragmentation of production processes is very pronounced in this industry grouping. In 2021, over half of trade was in intermediate goods and two-way trade in similar products (i.e. imports and exports of products between two countries in the same category at a detailed level of the trade nomenclature) hit a record level, the highest of all the industry groupings (51% of flows). Another particularity is that it has the lowest proportion of trade in the medium quality/price range.

In 2021, nearly three-quarters of world exports in the healthcare industry grouping came from advanced countries and most of these exports correspond to their intra-zone trade (54% of world flows in 2021). Yet this trade between advanced countries has seen a relative decline since the 2000s (-16 percentage points) due to their exports to the emerging and developing countries, which are posting growth in both their exports to advanced countries and their intra-zone trade, albeit mainly in low range products. Recent thinking on decarbonisation, as well as on fragmentation of production within geopolitical blocs, between countries referred to as “friends”, are at the centre of debates on the geographic reconfiguration of value chains and the security of supply in healthcare.

Keywords: Health Products, International Trade, Advanced Economies, Emerging and Developing Economies

JEL classification: F13, F14, F15, I11, L65