- Home

- Publications et statistiques

- Publications

- Payment times still long in French overs...

Payment times still long in French overseas territories despite the health crisis

Post n°284. Late payments are a structural weakness of companies in the French overseas territories. By accelerating the recovery of trade receivables, the health crisis has led to a significant reduction in the cash flow needs associated with payment times. However, companies facing the longest payment times did not benefit from this improvement.

Late payments are a structural weakness of companies in the French overseas territories

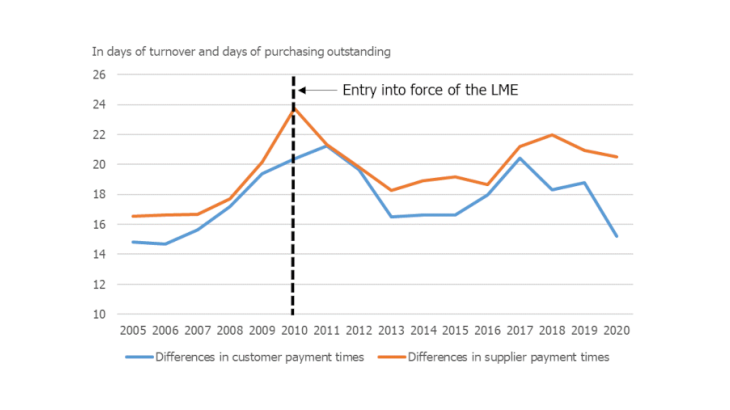

Payment times in the French overseas departments and collectivities (DCOM) of the euro area (comprising the departments of French Guiana, Guadeloupe, Martinique and Mayotte, La Réunion, and the collectivities of Saint Barthélemy, Saint Martin and Saint Pierre et Miquelon) are about 20 days longer than those in mainland France (Chart 1). Customer payment times at the end of 2020 stood at 58 days of turnover (compared to 43 days in mainland France) and supplier payment times at 70 days of purchases outstanding (compared to 49 days).

By setting a ceiling of 60 days on supplier payment terms, the Law on the Modernisation of the Economy (LME), which came into force in 2010, led to a reduction in the difference between the French overseas territories and mainland France until 2013. The positive impact of the LME was enhanced by the introduction of the corporate mediation scheme and the deployment of the network of VSE correspondents in the different IEDOM branches. The Directorate-General for Competition, Consumer Affairs and Fraud Control (DGCCRF) also regularly monitors compliance with the LME. Since 2013, however, this difference has increased. Indeed, supplier payment terms have never been below the legal limit of 60 days in any of the overseas territories

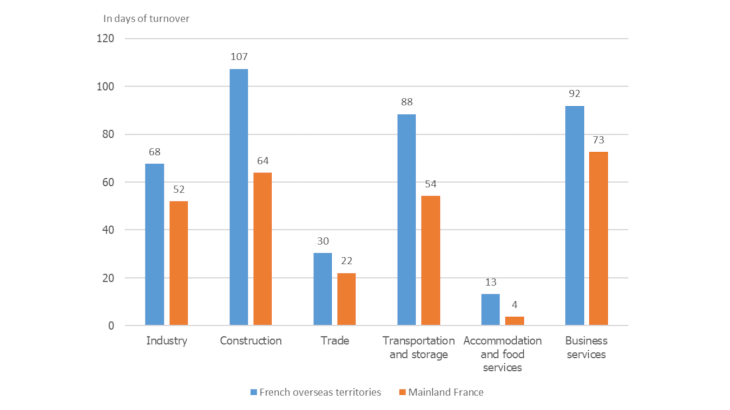

Overseas companies are more specialised in the trade sector than their counterparts in mainland France, which allows them to enjoy shorter customer payment times than companies in the French overseas departments and collectivities that operate in the non-trade sector. If the sectoral specialisation of French overseas territories were identical to that of mainland France, the differences in payment terms would be even greater than those observed (around one day more in Reunion and up to three days more in the French Antilles).

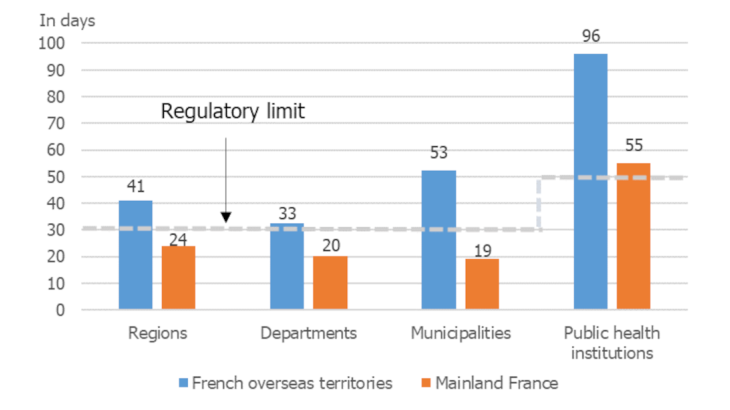

The main structural factors that explain the longer payment times are insularity, distance from mainland France, where many customers and suppliers are located, and the quality of maritime and air transport. We also note that payment times in the local public sector and in the hospital sector are well above the regulatory limit of 30 days for the former and 50 days for the latter. This worrying situation is due to the deterioration in their cash flow.

Payment times increased by more than 10 days in 2020 for public health institutions, reaching 96 days (up by only 3 days in mainland France), as the emergency situation and the exceptional spending to combat the pandemic exacerbated their structural cash flow problems.

The health crisis has prompted an easing of the cash flow needs associated with payment times

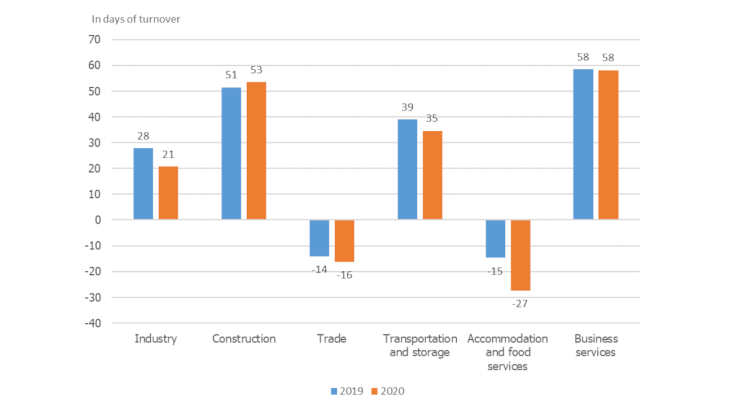

In order to compensate for the reduced cash flow resulting from the slowdown in their activity caused by the health crisis, companies sought to recover their receivables from their customers more quickly by pursuing an active receivables collection policy. According to the business leaders surveyed by the IEDOM for its business survey, faster receivables collection was the main measure implemented as of the third quarter of 2020 to address cash flow difficulties. This resulted in a sharp drop of 4 days (the largest observed in 15 years) in customer payment terms. At the same time, supplier payment terms fell by only one day to 70 days payable outstanding.

The cash flow constraints resulting from payment delays can be assessed using the trade credit balance. It reflects the financing gap generated by payment terms when the company extends more credit to its customers than it receives from its suppliers.

The much sharper deterioration in customer payment times compared to supplier payment times resulted in a significant reduction in the trade credit balance to 13 days of turnover (down 3 days compared to 2019). Although it remains 2 days higher than in mainland France, the difference is the smallest observed over the last 15 years.

More than EUR 500 million of cash flow freed up thanks to the absence of late payments

Payment terms are very heterogeneous across sectors since they reflect the operating cycle, which differs greatly across industries. The best situation for a company is to have a customer base of pay-at-purchase households and to pay its suppliers on credit. This is mainly the case in the accommodation and food services sector and in retail trade, where the trade credit balance is negative. Conversely, companies working exclusively for professional customers or belonging to the public sector finance their business partners through trade credit according to the terms they grant them.

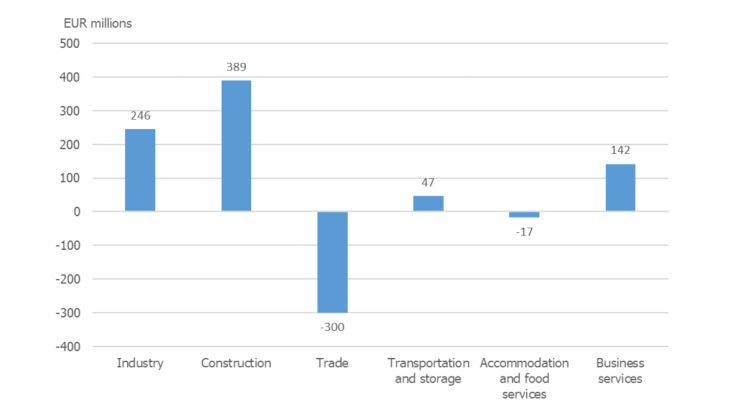

The differences in sectors' exposure to payment times can be measured by estimating the net cash flow that would be available to individual companies if there were no late payments (by calculating the difference between the observed amounts of trade receivables and payables and the amounts that would be recorded on companies' balance sheets if there were no late payments). Construction companies alone would benefit from an estimated additional cash flow of EUR 389 million (or 43 days of turnover). These additional funds would be from financial companies, the state, local and regional government, households and non-residents, as well as from overseas companies in the trade sector, which would provide up to EUR 300 million.

Not all companies benefited to the same extent from the improvement in the trade credit balances observed in 2020. The burden decreased by 13% for companies with payment times of less than one month, while the cash flow requirement increased by 2% for those with later payments.

Companies with the least difficulty in getting paid on time saw the greatest overall improvement in cash flow. Conversely, the situation of companies facing very long payment times did not improve at all. Most of these firms are in the construction and business services sectors and cater to a customer base of local authorities that are unable to speed up their payments due to their impaired financial situation.

Efforts to tackle long payment times must therefore be continued, in particular by speeding up the dematerialisation of invoice processing and the more widespread use of commitment accounting, so that all businesses can benefit from it.

Updated on the 25th of July 2024