The spectacular growth of China's exports following its accession to the WTO, the eponymous “China shock”, has induced substantial adjustments in the manufacturing sectors of developed economies. Most of the literature analyzing those adjustments starts with a measure of this shock (typically the growth rate of Chinese exports) at the sector level. According to this measure, one of the most affected sectors is apparel. Consider two subsets of French firms classified in this sector from our sample in 1999. One set of firms produced women's jackets using woven polyester as an intermediate input. The share of women's jackets imported from China (Chinese import penetration) increased by 30 percentage points (pp) between 2000 and 2007, whereas Chinese import penetration in woven polyester declined during the same period. Another set of firms produced embroidered clothing using women's trousers as intermediate input. Over that same 2000-07 period, Chinese penetration for embroidered clothes declined by 12pp, whereas Chinese penetration for women's trousers increased by 22pp. Both sets of firms were significantly impacted by the sharp rise in Chinese apparel, but in very different ways. The dominant component of the shock for the first set of firms is horizontal: a sharp increase in Chinese exports of products similar to those these firms are producing. On the other hand, the dominant component of the shock for the second set of firms is vertical: a sharp increase in Chinese exports of products used by this set of firms as an intermediate input. While the sales of the firms in the first set decreased markedly between 2000 and 2007, they increased for the firms in the second set over the same period.

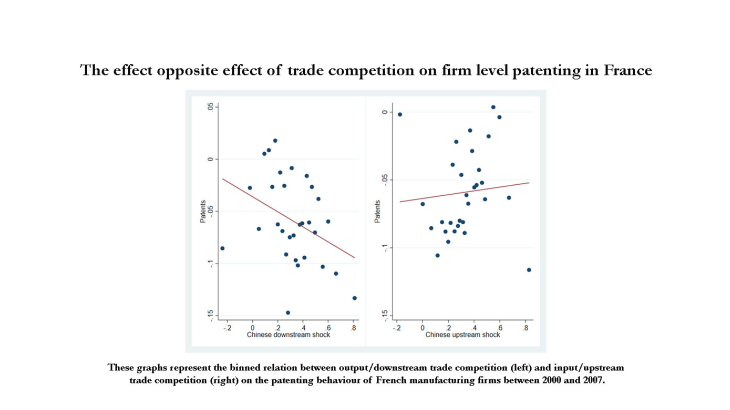

In this paper, we disentangle the output and input supply components of the Chinese import shock at the firm level and analyze its effects on employment, sales, and innovation. We use French accounting records, customs, and patent information on a comprehensive firm-level panel dataset spanning the period 1994-2007 and show that those two components have opposite effects on French firms' outcomes in 2000-07. We find that exposure to output trade competition is detrimental to firms' sales, employment, and innovation. Moreover, this negative effect is concentrated among low-productivity firms. By contrast, we find a positive effect (although often insignificant) for the input component on firms' sales, employment and innovation.

More specifically, on the employment side, we find that including a separate control for the input component increases markedly the negative impact of the output shock. However, part of this impact could stem from an industry aggregate trend which could be driven either by trade competition or other correlated industry-level changes. Directly accounting for these industry-level trends, we show that the (within-industry) output competition from Chinese goods triggers a precisely estimated downsizing of impacted French firms. On the innovation side and contrary to what we find for employment, no significant industry-wide trend emerges in the response of patenting to the China shock. After controlling for the input component of the shock, we find a very strong and significant negative impact of increased output competition on patenting by affected firms.