As climate change accelerates, central banks worldwide are confronted with two emerging challenges to their price stability mandates. The first issue is climateflation, which refers to the inflationary effects resulting from climate-related events (extreme weather, natural disasters, resource scarcity) and their adverse effects on the economy's productivity. The second challenge is greenflation, which pertains to inflationary pressures stemming from the transition to a low-carbon economy, characterized by higher carbon taxes and abatement spending. While the first phenomenon can be characterized as an adverse supply shock, the second is a mixture of a positive cost-push shock and a positive demand shock. Central banks face a delicate balancing act in addressing both climateflation and greenflation and maintaining price stability, while supporting the real economy.

We investigate these two phenomena and their implications for central bank policy-making. To this end, we develop and estimate a tractable nonlinear New Keynesian Climate (NKC) model for the world economy featuring climate change damage and mitigation policies. The New Keynesian framework captures the interplay between aggregate demand and supply, highlighting the role of inflation, output, and monetary policy in shaping the overall economic landscape. By augmenting the traditional 3-equation model with elements that capture climate externalities and abatement costs, we aim to enrich our understanding of how climate change affects the economy. The tractability of this framework facilitates the analytical decomposition of the inflationary effects, including those attributed to climateflation and greenflation.

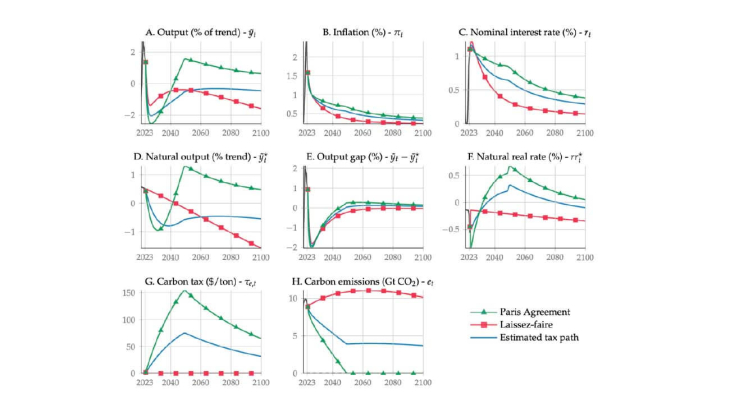

Our empirical analysis, based on the Bayesian estimation of a fully nonlinear model, provides a data-grounded quantitative analysis of the transition to a net-zero carbon economy (cf. the figure above). To this end, we examine three scenarios regarding the carbon tax trajectory (Panel G): (i) a "laissez-faire" economy, which is characterized by an increasing stock of carbon, that warms the planet and makes resources scarcer (red line), (ii) the "Paris-Agreement", which requires world governments to implement mitigation policies to reach net-zero carbon emissions by 2050 (green line), and (iii) an intermediary scenario corresponding to the carbon tax path consistent with the forecasts of the estimated model (blue line). The Paris Agreement scenario takes the form of a linear increase in the carbon tax, such that full abatement is reached in 2050. The rise in carbon tax forces firms to internalize the effects of their carbon emissions on aggregate productivity.

We show that under the estimated monetary policy rule mitigation policies that implement the Paris Agreement with rising carbon taxes and increased abatement spending lead to more persistent inflation relative to a laissez-faire environment policy (Panel B). This conclusion remains robust across various alternative specifications of the model, including wage rigidities and investment adjustment costs, and structural parameter values. However, the short-term costs of the green transition, characterized by heightened dispersion in inflation and output, must be balanced against the long-term benefits of lower damages from climate change to productivity and higher output and consumption (Panel A). Furthermore, postponing the transition intensifies the economic costs of climate damages, with output dispersion increasing by approximately 30% post-2050.

We also emphasize the necessity of integrating the evolving natural rate of interest into monetary policy rules to mitigate the inflationary effects of carbon taxes. Static rules expressed as deviations from the steady state lead to an additional 1.5% annual inflation during the transition, whereas climate-adaptive Taylor rules that integrate the natural interest rate mitigate the inflationary effects of carbon taxes. Finally, our findings indicate that the social cost of carbon, which captures the cost in dollars of the economic damage that would result from emitting one additional ton of carbon dioxide into the atmosphere, is largely unaffected by price stickiness. Although these rigidities marginally reduce consumption, they do not significantly alter the transition trajectory. This evidence reinforces the argument for implementing ambitious climate policies comparable to those currently under consideration in flexible price contexts.

Keywords: Climate Change, Inflation, Monetary Policy, E-DSGE Model, Bayesian Estimation, Stochastic Growth

JEL classification: E32, E52, Q50, Q54