- Home

- Publications and statistics

- Publications

- The NEU CP market helps finance the Euro...

Post No.367. The Paris-based Negotiable EUropean Commercial Paper (NEU CP) market is the leading short-term debt market in the European Union. It plays a key role in financing the economy. Thanks to its positioning and innovative nature, it is designed to promote the development of a genuine Savings and Investments Union in Europe.

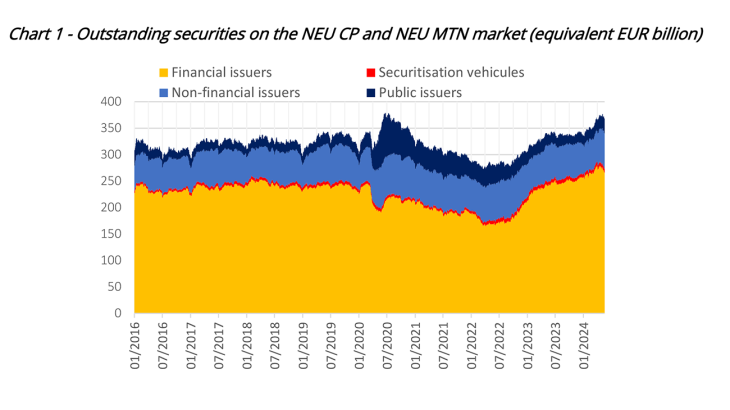

Negotiable EUropean Commercial Paper (NEU CP) consists of negotiable debt securities with maturities of less than one year issued on the French market. The market also includes a segment of securities with maturities of over one year, Negotiable EUropean Medium-Term Notes (NEU MTN). Created in 1985 and extensively reformed in 2016 to increase its international openness, it is the largest short-term debt market in the European Union, with outstandings of around EUR 320 billion at present (EUR 360 billion including the NEU MTN). These outstandings rose by almost 25% between January 2022 and July 2024 (compared with 11% for total outstandings of short-term securities issued by all residents of the European Union). In comparison, according to CMDportal (a private data provider), the outstandings of short-term debt securities on the German and Belgian markets are estimated at around EUR 100 billion (at end-March 2024) and EUR 50 billion (at end-May 2024) respectively.

A key market for the financing of the economy and the transmission of monetary policy

The NEU CP market is a tool for diversifying the resources borrowed by economic agents to finance their activities both in terms of the maturities used (short-term borrowings complementing long-term debt) and financing channels (direct market borrowing alongside intermediated financing). The NEU CP market thus play a key role in the asset-liability management of issuers, which include financial institutions, non-financial companies, public entities and securitisation vehicles (Chart 1). These issuers are located not only in France, but also within and outside the European Union (around 15% of the total).

In the case of French non-financial corporations, outstanding NEU CP and NEU MTN securities total around EUR 60 billion, or just under 10% of the total debt they raise on the markets (see Banque de France). As the most active investors (money market funds) generally seek transactions of large amounts, the market has the capacity to meet issuers' significant liquidity needs. It also offers great flexibility in terms of the maturity of the securities, the type of interest rates offered to investors and the currency of issue, so that issues can be adapted to the needs of the issuer and market conditions.

Because of the role it plays in the short-term financing of banks and businesses, the NEU CP market requires particular vigilance from monetary authorities in terms of both financial stability and the transmission of monetary policy. For example, in March 2020, during the COVID crisis, the Eurosystem intervened in order to address the liquidity shortage on the market and the increase in risk premiums, which had been identified using the detailed data collected daily by the Banque de France as part of its task of monitoring the NEU CP market. The intervention consisted in purchasing short-term securities issued by companies following a decision by the ECB Governing Council to extend the scope of the Corporate Sector Purchase Programme (see de Guindos and Schnabel, 2020). Aside from this type of one-off, targeted measure, the NEU CP market is recognised by the Eurosystem as part of its permanent collateral policy: the securities issued, provided they meet all the eligibility criteria (particularly in terms of credit quality), are thus directly accepted as collateral for refinancing operations.

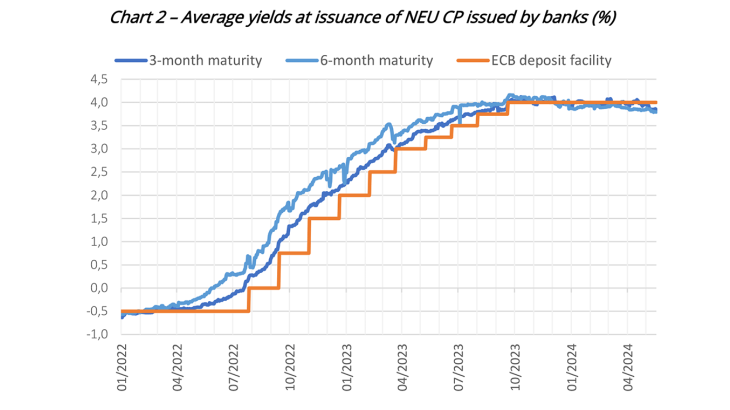

Over the recent period, characterised by the normalisation of the ECB's monetary policy, the NEU CP market, as a segment of the money market, helped to ensure that the rise in key rates (up 450 basis points between July 2022 and September 2023) was passed on to the economy (see Chart 2).

A ‘model’ market, and an asset for the Savings and Investments Union

In a recent report, the Financial Stability Board (FSB) identified a number of ways to improve the functioning and resilience of short-term funding markets. The FSB focused on (i) modernising market practices by increasing digitisation, shortening settlement cycles and rapidly generating transaction identification codes (or ISIN codes) and (ii) enhancing regulatory reporting by market participants and statistical transparency.

Compared with similar markets in Europe and the rest of the world, the NEU CP market appears to be well positioned with regard to the FSB's recommendations. This stems in part from the missions assigned to the Banque de France by the Code monétaire et financier (French Monetary and Financial Code): these consist in monitoring the regulatory compliance of issuers and ensuring market transparency, in particular through statistical publications. With regard to market practices, the Banque de France provides issuers with a tool enabling them to digitise their entire issue prospectus. Market operators also have the option of requesting ISIN codes via a dedicated tool, which enables them to be generated quickly and issues to be made on a "same day" basis. Furthermore, transactions are settled in central bank money via the Eurosystem's T2/T2S system (payment and securities settlement system).

The NEU CP market, which is innovating to incorporate new forms of financing, is an asset at the European level for a Savings and Investments Union. In terms of sustainable finance, a growing number of issuers are integrating short-term instruments into their overall issuance framework, for example to pre-finance sustainable projects or to supplement the funding of large-scale sustainable investments. The NEU CP market has a formalised best practice framework that enables issuers to communicate transparently and in a standardised manner about their issues (standards used, second party opinion, reporting and ex-post verification), thereby facilitating investor analysis. For instance, in May 2024, the Électricité de France (EDF) group adapted its NEU CP issuance prospectus to allow, alongside issuance to finance its general short-term needs, issuance to finance activities aligned with the European Union taxonomy.

The market is also opening up to technological innovations, such as the ‘tokenisation’ of assets (issuing financial assets in the form of a digital token, through the use of distributed ledger technologies), which the Banque de France, as a player in the ecosystem, wishes to support (see Banque de France, 2023). These developments offer opportunities to reduce operational risk and facilitate the monitoring of transactions, the reconciliation of flows by market participants and the transmission of reports (particularly concerning extra-financial performance). One such example is Project Jura, an experiment involving a wholesale central bank digital currency (CBDC) and a NEU CP issued in tokenised form.

Download the full publication

Updated on the 23rd of September 2024