Every year, compulsory annual wage negotiations (négociations annuelles obligatoires - NAOs) are held at two levels: at industry level, where social partners negotiate minimum wage floors below which employees cannot be paid; and at a firm level, as companies with union representation hold bargaining talks on effective wages. Most industries and firms conduct these negotiations between October and March, resulting in wage adjustments in the first quarter of the year. An analysis of agreements signed during this period therefore provides a reliable initial assessment of future wage trends for the year. This blog post presents an initial snapshot of negotiated wage increases for 2025, based on information contained in around 120 industry-level agreements signed for the year (covering approximately 9 million employees, or about half of all employees covered by a private sector collective agreement) and around 1,600 firm-level agreements (covering over 700,000 employees from all market sectors).

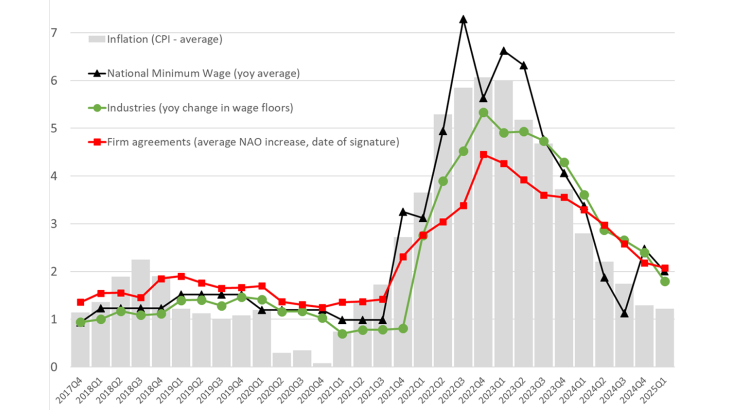

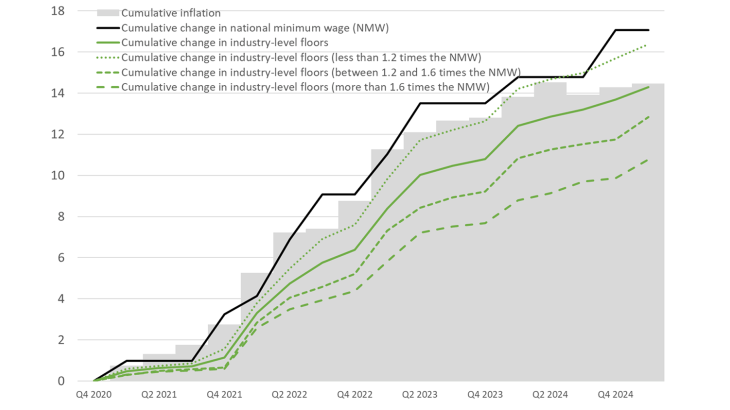

While the pick-up in inflation that first began in late 2021 was passed through fairly quickly to the national minimum wage owing to the latter’s automatic indexing mechanism, it took longer to pass through to other wages owing to the time required for bargaining (Chart 1). At industry and firm level alike, negotiated wages accelerated from 2022 onwards, and increases remained relatively sustained in 2023. In 2024, as inflation receded, negotiated increases moderated while continuing to outpace the rise in prices. However, the decrease in inflation (CPI) to 1.3% on average between October 2024 and February 2025 led to a more pronounced fall in negotiated wage increases for 2025, which averaged around 2%, or sharply higher than expected inflation in 2025 according to Banque de France projections (CPI of 1.5%). Factoring in bonuses and composition effects, we forecast an average annual per person wage increase of 2.4%.

In 2025, increases in industry-level wage floors will continue to ease, while remaining slightly above inflation.

At industry level, the first agreements signed for 2025 provide for smaller nominal increases in the wage floor than in 2024. We provisionally estimate that industry-level floors will rise by 1.8% in the first quarter of 2025, compared with 3.6% a year ago (Chart 1).

This moderation may be partly due to weaker inflation than in past years, with 1.5% expected in 2025. Furthermore, the national minimum wage, which may have had knock-on effects on industry wage floors in recent years, was adjusted upwards by 2% at the end of 2024. Even if this increase exceeds inflation – owing to the national minimum wage’s dual indexation to inflation and to half of the gain in wage purchasing power – the nominal increase in the national minimum wage is still lower than in previous years.

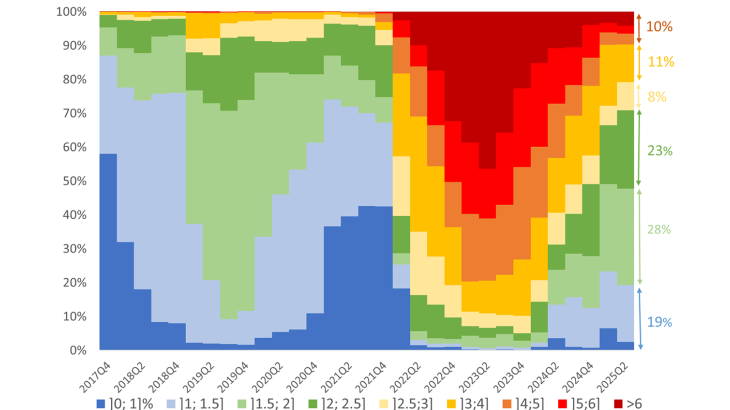

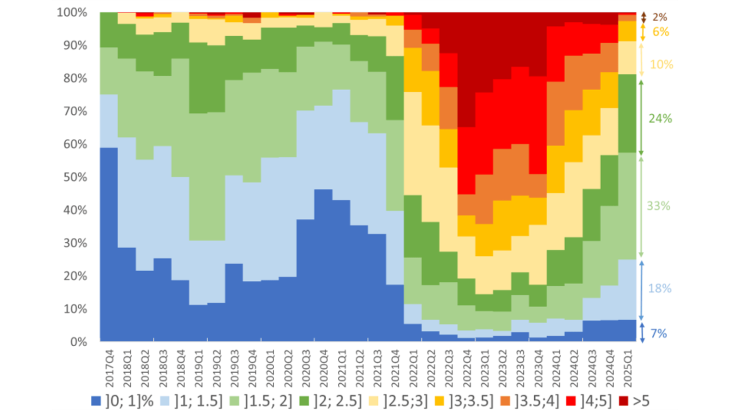

Chart 2: Distribution of industry-level annual negotiated wage increases between 2018 and 2025