The so-called equilibrium or natural rate of interest, widely known as rt∗, is a key variable in finance and macroeconomic theory. For investors, the steady-state level of the real short rate serves as an anchor for projections of the future discount rates used in valuing assets. For policymakers and researchers, the equilibrium or natural rate of interest is a policy lodestar that provides a neutral benchmark to calibrate the stance of monetary policy: monetary policy is expansionary if the short-term real interest rate lies below the natural rate and contractionary if it lies above. A good estimate of the equilibrium real rate is also necessary to operationalize popular monetary policy rules such as the Taylor rule. For fiscal policy, the equilibrium real rate of interest is instrumental to assessing the sustainability of public finances in the long run. More broadly, in the decades prior to the COVID-19 pandemic, the possibility of a lower new normal for interest rates was at the centre of key policy debates about bond market conundrums, global saving gluts, and secular stagnation. More recently, the post-pandemic spike in interest rates globally has given rise to intense policy debates about whether interest rates will hold steady at the new higher levels or revert back towards their pre-pandemic lows. In short, the natural rate of interest is a variable of immense importance. Unfortunately, despite its importance, the natural rate of interest is not directly observable. Instead, it has to be inferred from economic data. We propose to estimate the natural rate of interest in the presence of market risk and real term premia by using an arbitrage-free dynamic term structure model of real yields augmented with a bond-specific risk factor.

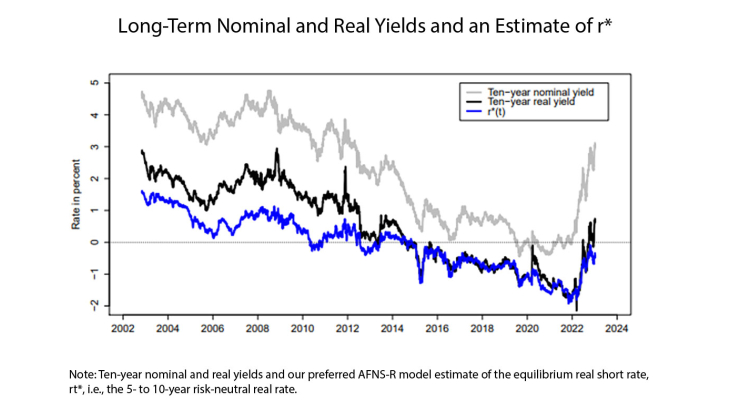

Our preferred estimate of the natural rate of interest, rt∗, is shown in Figure 1 along with ten-year nominal and real yields. Both nominal and real long-term yields in the euro area trended down together during the 2002-2021 period, and this concurrence suggests little net change in inflation expectations or the inflation risk premium during that 20-year period. The estimated equilibrium real rate fell from above 1.5 percent to below -1.5 percent by the end of 2021, before retracing some of that decline during 2022. Accordingly, our results show that more than 75 percent of the 4-percentage-point decline in longer-term yields by the end of 2021 represents a reduction in the natural rate of interest. Our model estimates also indicate that about 75 percent of the interest rate increases the past year reflect increases in the natural rate of interest. As a separate contribution, we use our model to devise finance-based measures of the stance of monetary policy by deducting our rt∗ estimate from observed measures of one-year real yields in the euro area. The results indicate that it took significant time for monetary policy in the euro area to reach an accommodative stance during both the Global Financial Crisis (GFC) and the COVID-19 pandemic.

Keywords: Affine Arbitrage-free Term Structure Model, Financial Market Frictions, Convenience Premium, Monetary Policy, Rstar

JEL classification: C32, E43, E52, G12