- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Novem...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 29 October and 6 November), activity in October rose in industry (driven by agri‑food and capital goods), while activity in market services remained sluggish. It picked up again in the structural works sector, owing to txhe rescheduling of building work put on hold during the Olympic Games.

According to business expectations, in November activity should show little change in industry and market services and decline in construction. Order books were still deemed weak in virtually all industrial sectors, with the notable exception of aeronautics, reducing business leaders’ visibility on their activity over the coming months.

Selling prices continued to normalise, especially in market services. Inflation should therefore remain under control.

However, our uncertainty indicator based on comments from the companies surveyed remains relatively high in all sectors, with responses highlighting the domestic political situation, the impact of the fiscal debates, as well as the international environment (upcoming US elections).

Recruitment difficulties declined markedly in the three major sectors: they were reported by 31% of companies across all sectors, down from 35% in September.

Based on the survey results as well as other indicators, we estimate that underlying growth will continue on its slightly positive upward trend in the fourth quarter. This would result in GDP remaining more or less unchanged from the previous quarter, taking into account the adverse repercussions of the Olympics effect, estimated to be ‑0.2 percentage points of GDP.

1. In October, activity increased in

all three major sectors, albeit at a slower pace in market services and in a temporary manner in construction

In October, activity continued to grow in industry, at a slightly higher pace than business leaders had expected the previous month, in most sub‑sectors. It rose markedly in the agri‑food sector. In the manufacturing industry, growth was driven by aeronautics, wearing apparel, textiles and footwear (a demand for winter products boosted by autumn weather), computer products (strong demand from the defence, aeronautical and rail sectors) and chemicals. By contrast, activity declined in wood, paper and printing. In the automotive sector, business leaders reported difficulties in electric vehicle production, which is being affected by Chinese competition and a fall in demand for these models.

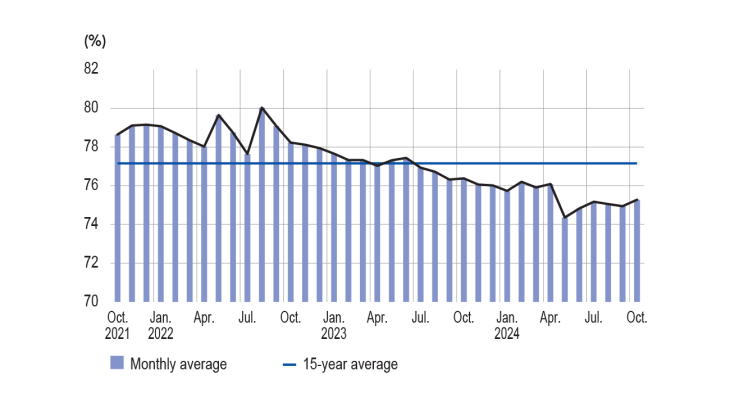

CAPACITY UTILISATION RATE

The capacity utilisation rate for industry as a whole rose slightly to 75.3% (from 74.9%). The indicator improved notably in wearing apparel, textiles and footwear (up 1 percentage point) and agri‑food (up 2 percentage points), and declined slightly in the automotive sector (down 1 percentage point).

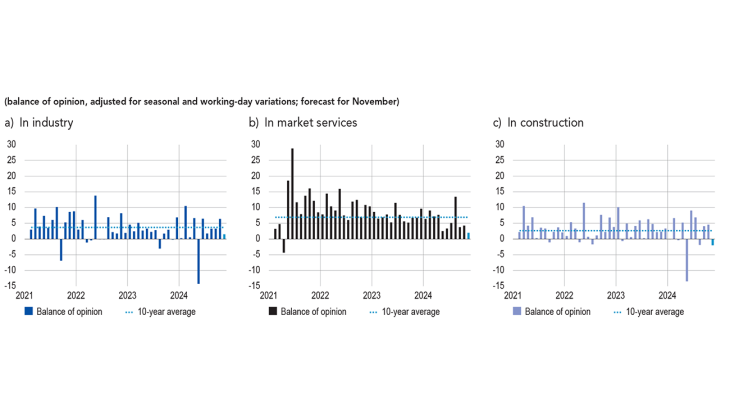

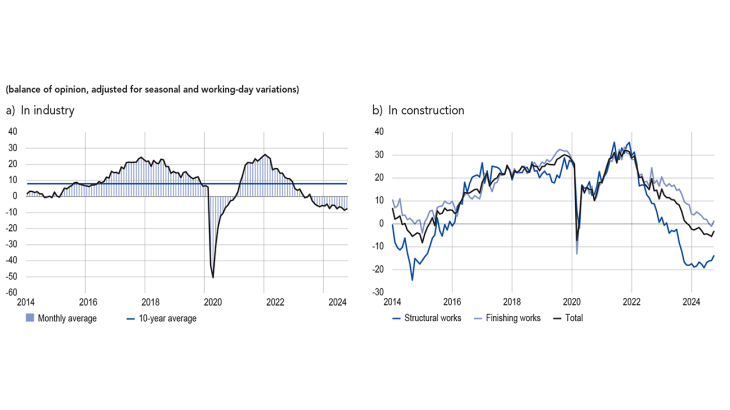

BALANCE OF OPINION ON THE OUTLOOK FOR ACTIVITY

over the past month) stood at 6 percentage points in October in industry. For November (light blue bar), business leaders in industry expect activity to increase by 2 percentage points.

Inventories of finished goods were almost unchanged compared with September. They increased in pharmaceuticals

and metal and metal products manufacturing, but fell in chemicals and computer, electronic and optical products owing to stronger demand. They remained at levels deemed high and above their long‑term average in all sectors, particularly in aeronautics (an indirect consequence of supply chain difficulties) and electrical equipment.

INVENTORIES OF FINISHED GOODS IN INDUSTRY

Activity was sluggish in market services in October, growing at the same rate as in September and in line with what business leaders had expected the previous month. Temporary work declined for the second month in a row, driven by wait‑and‑see approaches adopted in view of the uncertain environment.

Activity in programming and consultancy also declined in October.

Activity grew in other sub‑sectors, particularly rentals, leisure activities and personal services (robust activity in amusement parks during the All Saints’ Day long weekend), engineering and IT services.

In construction, activity rose in structural works owing to building work that had been postponed owing to the Olympic Games.

It was little changed in the finishing works sector, with business leaders mentioning a certain wait‑and‑see attitude among clients regarding changes to the “MaPrimeRénov’” scheme in 2025.

The balance of opinion on the cash position deteriorated in industry, driven down in particular by aeronautics (tight cash positions owing to inventory financing) and to a lesser extent by wearing apparel, textiles and footwear, chemicals, and machinery and equipment. By contrast, it improved slightly in the automotive sector. Business leaders cited longer payment times as a factor penalising their cash position.

In market services, the balance of opinion on the cash position fell again, with longer payment times also mentioned. The cash position was deemed weak in food services, management consultancy, vehicle repairs and cleaning services. In the latter sector, the business leaders surveyed cited the postponement of the abolition of the cotisation sur la valeur ajoutée des entreprises (CVAE – corporate value added contribution) and the rise in the national minimum wage on 1 November 2024 as factors weighing on their cash position.

CASH POSITION

2. In November, business leaders expect to see little change in activity in industry and market services, and a slight contraction in construction

According to business leaders in industry, activity in November should change little at the global level, and unevenly within sub‑sectors. The upward trend seen in October is expected to continue in agri‑food, computer, electronic and optical products, chemicals and aeronautics. Conversely, activity is set to decline in wearing apparel, textiles and footwear, rubber and plastic products and metal and metal products.

Activity is also set to remain virtually stable in market services, with mixed trends across sectors. Motor vehicle rental and business services as a whole are expected to grow, as is the transport and warehousing sector. Temporary employment activity is expected to decline further.

Finally, in construction, activity should contract somewhat after the slight rebound in October, driven down by the structural works sector.

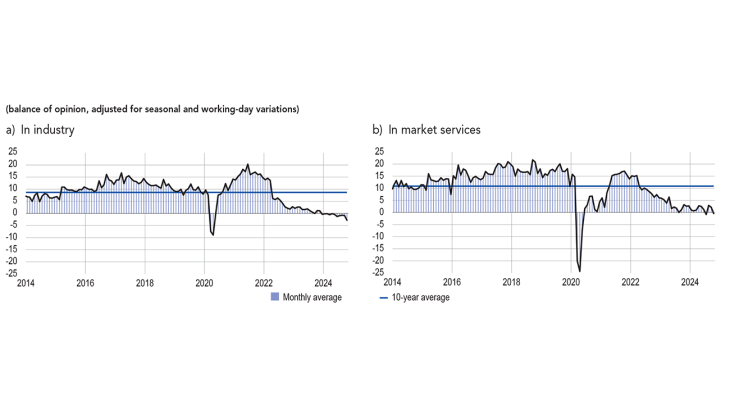

Industrial order books continued to look weak in October in most sectors, especially rubber and plastic products, machinery and equipment (drop in orders from clients in the automotive sector), wood, paper and printing, wearing apparel, textiles and footwear, and the automotive sector.

Order books were deemed to be well below their long‑term average in all sectors except aeronautics.

In construction, the level of order books is deemed to have picked up slightly in October in the building of single‑family homes, albeit from a low level.

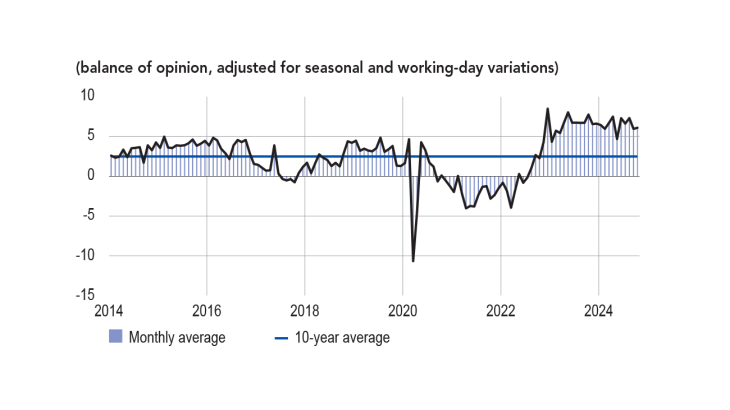

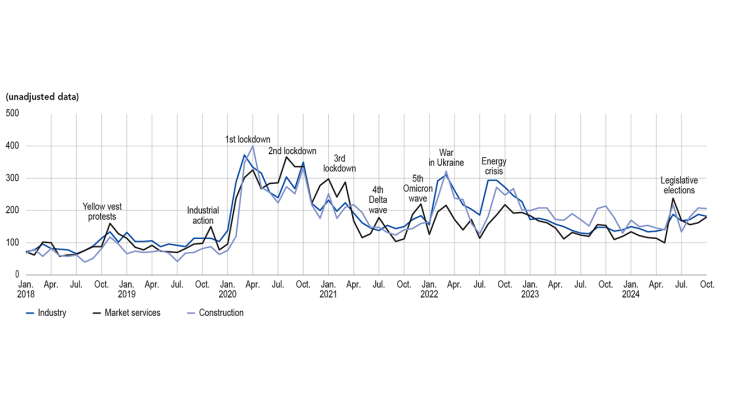

Our monthly uncertainty indicator, which is constructed from a textual analysis of the comments made by surveyed companies, was still relatively high, with an increase in services over the month. Business leaders cited uncertainty about national economic and fiscal policy and the instability of the geopolitical situation (particularly before the US elections), which tend to cause investments to be put on hold.

LEVEL OF ORDER BOOKS

INDICATOR OF UNCERTAINTY IN THE COMMENTS SECTION OF THE MONTHLY BUSINESS SURVEY (MBS)

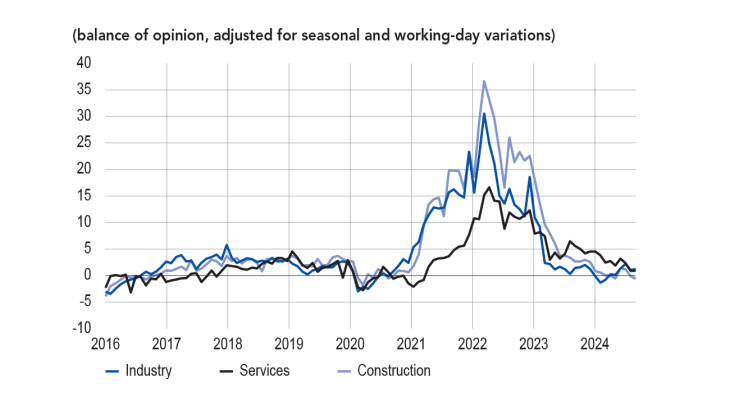

3. Selling prices have now returned to normal, including in market services

In October, supply difficulties were stable compared with the previous month (with 10% of companies reporting them). However, they were still relatively high in aeronautics (37%, an increase compared with the start of the year, when the share was close to 25%) and in the automotive sector (16%). Supply difficulties in the construction sector remained rare (2%, after 3% in September).

In industry, business leaders deemed raw material prices to be stable. They are expected to grow in the agri‑food and electrical equipment sectors but are set to fall in most other sub‑sectors. The balance of opinion on finished goods prices in October remained slightly positive.

More specifically, 6% of business leaders in industry reported that they had raised their selling prices in October, a proportion close to the levels seen in October during the pre‑Covid period, and well below those for the same month in 2021‑22.

Price rises were mainly seen in chemicals (20%) and agri‑food (11%). Conversely, 6% of business leaders in industry said they had cut their selling prices, in line with the months of October during the pre‑Covid period. Falls in finished goods prices mainly concerned wearing apparel, textiles and footwear, wood, paper and printing, and machinery and equipment manufacturing (9%).

In construction, 4% of business leaders reported raising their quote prices, whereas 12% reported lowering them, which is a higher proportion than in previous months of October.

According to business leaders, the elevated share of price reductions was driven by demand (small number of housing starts) and increased competition.

In services, price dynamics have now completely normalised. The share of companies reporting an increase in prices was 6% – the same as in the months of October pre‑Covid – while the share of companies reporting a fall in prices was 7%, above the levels observed in October in previous years. Price cuts were mainly seen in transportation and accommodation.

Business leaders’ expectations for November indicate that 5% of them plan to raise their prices in industry, 5% in market services and 2% in construction.

CHANGE IN PRICES OF FINISHED GOODS BY MAJOR SECTOR

Business leaders were also asked about their recruitment difficulties, which decreased again in October: 31% of businesses surveyed reported difficulties, down from 35% in September. The fall was seen in industry, market services and construction. Within industry, we can see the shares converging across sub‑sectors: the sub‑sectors that were most exposed to the recruitment difficulties at the start of 2024 are those reporting the strongest declines during the year (aeronautics, pharmaceuticals, rubber and plastic products, metal and metal products).

SHARE OF BUSINESSES REPORTING RECRUITMENT DIFFICULTIES

1 The balance of opinion is the difference between the proportion of business leaders reporting increases or decreases, weighted by the intensity of the variation (with three possible grades in the monthly business survey: low, normal and high). A business leader indicating a “high” increase in prices will, all other things being equal, influence the balance of opinion more than a business leader indicating a “low” increase.

4. Our estimates suggest that GDP will be

relatively stable in the fourth quarter,

with underlying growth being offset

by the Olympic Games counter-effect, which is estimated to be ‑0.2 percentage points of GDP

The quarterly account first estimates published by INSEE at the end of October put GDP growth at 0.4% for the third quarter of 2024. This increase is in line with the forecast in our last update on business conditions. Activity slowed in agriculture, was virtually stable in the manufacturing industry and construction, and grew in the energy sector and in market and non‑market services. The temporary impact on third‑quarter growth of the Olympic and Paralympic Games is estimated at around a quarter of a percentage point, mainly driven by household services (ticket sales) and information and communication (broadcast rights for the events).

Based on the results of the Banque de France monthly business survey (MBS), as well as other available data (INSEE service and industry production indices and surveys and high‑frequency data), and taking into account the repercussions of the Olympic and Paralympic Games, we estimate that activity will remain more or less stable in the fourth quarter.

Download the full publication

Updated on the 18th of November 2024