- Home

- Publications and statistics

- Publications

- Monthly Business Survey – Start of July ...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 26 June and 3 July), activity in June picked up significantly in industry, market services and construction, after a month of May affected by holidays and closures associated with the number and timing of public holidays. In July, business leaders expect activity to continue to grow in industry and, to a lesser extent, in services. There is expected to be little growth in construction. Order books continued to be deemed weak across industry, with the exception of aeronautics, and in construction.

Our uncertainty indicator, based on comments from businesses, has fallen slightly in industry and construction, while rising slightly in services, albeit from a lower level. In industry, the impact of higher US tariffs on business volumes is mentioned particularly in certain segments of the agri-food sector (wine-making), wood-paper-printing, chemicals and capital goods manufacturers.

Within market services, companies specialising in engineering and technical analysis report the greatest impact.

Selling prices were deemed to be slightly higher in industry, while they were deemed unchanged in services and to have fallen in construction. Supply problems remain low overall, except in the aeronautics sector (where they are however tending to ease) and in the automotive sector. Recruitment difficulties remain unchanged, at 19%.

Based on the survey results, together with other indicators, we estimate that GDP should grow at the same pace in the second quarter of 2025 as in the previous quarter, by around 0.1%.

1. In June, activity picked up significantly in all three sectors: industry, market services and construction

In June, industrial activity picked up markedly, exceeding the expectations of the business leaders surveyed last month. After a month of May affected by holidays and closures associated with the number and timing of public holidays, it rebounded in almost all sub-segments, with the exception of the apparel-textiles-footwear and wood paper-printing sectors, which continued to decline. It accelerated in aeronautics, where supply chain problems are easing, as well as in computer-electronics-optical products (driven by the defence sector). It strengthened in agri food, pharmaceuticals and electrical equipment.

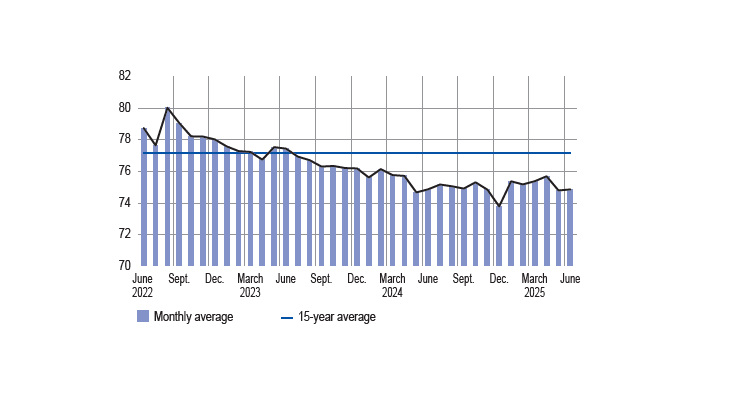

The capacity utilisation rate (CUR) for industry as a whole remained virtually unchanged, at 74.9%, in June (compared with 74.8% in May), well below its long-term average (77.2%). It rose in “other industrial products” (up 2 percentage points), aeronautics, machinery and equipment, and chemicals (up 1 percentage point), but continued to fall in apparel-textilesfootwear (down 2 percentage points).

Inventories of finished goods were virtually unchanged, at levels deemed high. The fall observed in aeronautics, computer-electronic-optical products and machinery and equipment was offset by the increase in the automotive, agri-food and apparel-textile-footwear sectors.

Capacity utilisation rate (%)

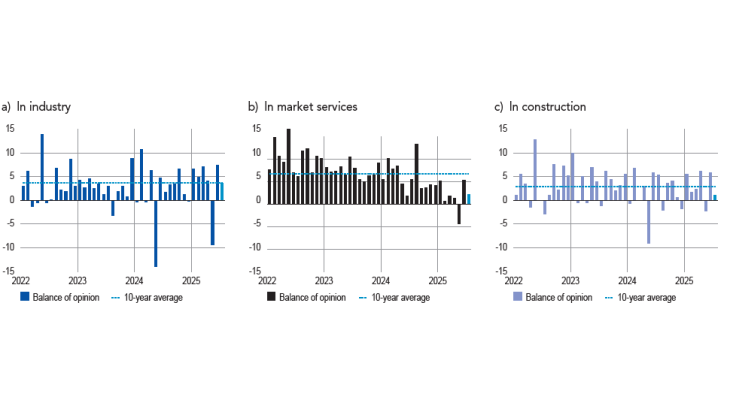

Balance of opinion on the outlook for activity (balance of opinion, adjusted for seasonal and working-day variations; forecast for July)

the past month) stood at 7 percentage points for June in industry. For July (light blue bar), business leaders in industry expect activity to increase by 4 percentage points.

Activity in market services picked up at a faster pace than business leaders expected last month. This upturn stemmed in particular from the transport and warehousing sector, as well as temporary work, which benefited from a catch-up effect following the holidays and closures in May. Activity firmed in legal and accounting services and accommodation, the latter having benefited from fine weather conditions; it remained buoyant in cleaning services. However, it dropped off in the food services sector (the heatwave having reduced customer footfall), and continued to decline in leisure and personal services, vehicle rental and information services.

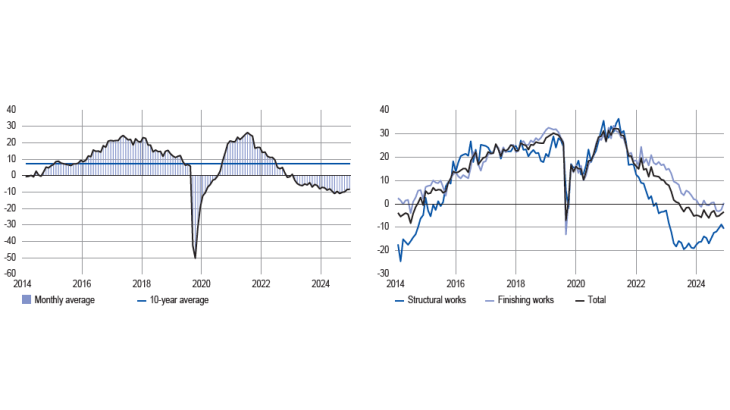

In construction, activity grew more strongly in June than business leaders had expected in May, driven by a rebound in the finishing works sector, while it remained largely unchanged in the structural works sector.

The balance of opinion on cash positions remained slightly negative in industry. It was positive in the pharmaceuticals and apparel-textiles-footwear sectors, but continued to decline quite markedly in rubber and plastic products and electrical equipment, and more moderately in machinery and equipment and the automotive sector.

This balance of opinion remained below its long-term average in all industrial sectors. It was particularly low in electrical equipment, rubber and plastic products, and chemicals. In particular, business leaders highlighted overly high inventory levels and longer payment times from customers.

In market services, the balance of opinion on cash positions rose very slightly, although it varied widely between sub-sectors. The cash position was deemed to be satisfactory in publishing, vehicle rental and temporary work. However, it was deemed to have deteriorated in accommodation and food services, vehicle repairs and some business services, particularly advertising, programming and management consulting.

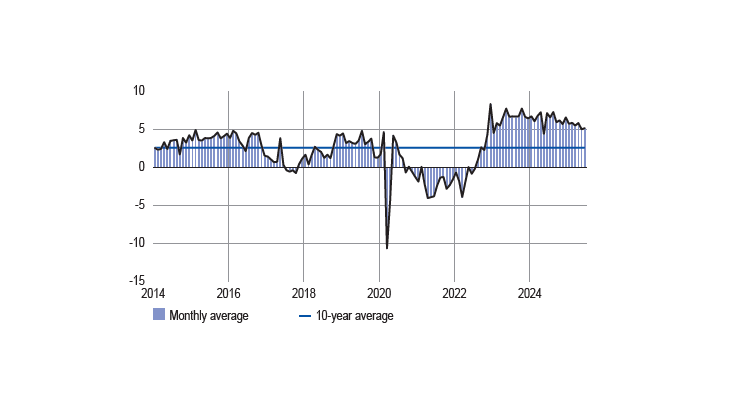

Inventories of finished goods in industry (balance of opinion, adjusted for seasonal and working-day variations)

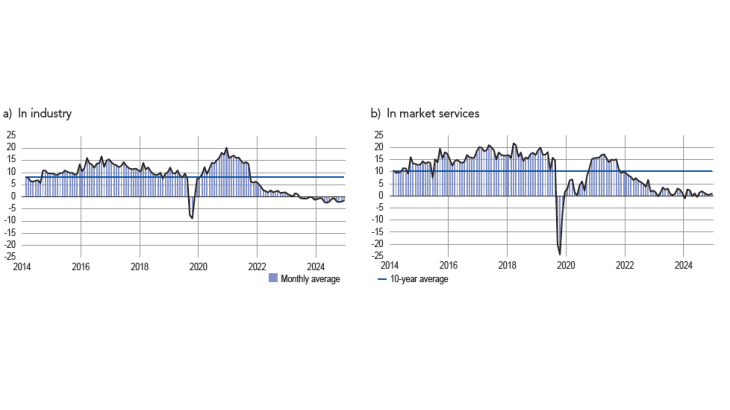

Cash position (balance of opinion, adjusted for seasonal and working-day variations)

2. In July, business leaders expect activity to continue to grow in industry, to increase more moderately in services and to remain largely unchanged in construction.

In July, business leaders and industry expect activity to continue to grow, at a slower pace than in June, but close to its long-term average. It is expected to be up in the vast majority of sub-sectors and to strengthen in the chemical and agri-food sectors. It is expected to remain unchanged in machinery and equipment, and metal and metal products.

In market services, activity is expected to remain on an upward path overall in July, but with wide variation between sub-sectors. Activity is expected to grow significantly in leisure and personal services, publishing and most business services, particularly cleaning, IT services, engineering, and legal and accounting services. On the other hand, it is expected to decline in vehicle rental and to remain relatively unchanged in temporary work.

Lastly, in construction, activity is expected to decline in the structural works sector and to grow at a more moderate pace in the finishing works sector.

At the end of June, industrial order books remained weak (well below their long-term average) in all sectors except aeronautics, where they were at very high levels. They were particularly weak in rubber and plastic products, apparel-textiles-footwear, chemicals and the automotive industry. Business leaders reported a general climate of wait-and-see among customers, particularly in the case of luxury goods companies.

In construction, the balance of opinion on order books was unchanged in the finishing works sector and stopped improving in the structural works sector, despite a slight upturn in demand for detached houses. Business leaders cited the cancellation of public orders and the sluggishness of the collective housing market, especially in the private sector.

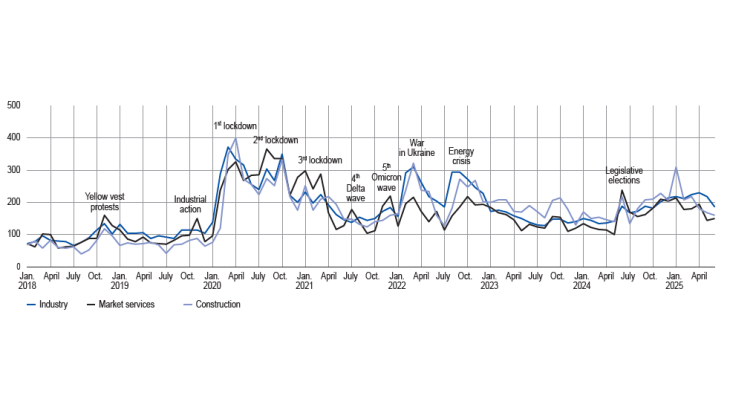

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by the surveyed companies, continued to decline in industry and construction, while rising slightly in services, albeit from a lower level. In industry, the impact of higher US tariffs on business volumes was particularly highlighted in certain segments of the agri-food sector (winemaking), wood-paper-printing, chemicals and capital goods manufacturers. Among market services, engineering and technical analysis companies reported the biggest impact (see box below).

Indicator of uncertainty in the comments section of the monthly business survey (MBS) (unadjusted data)

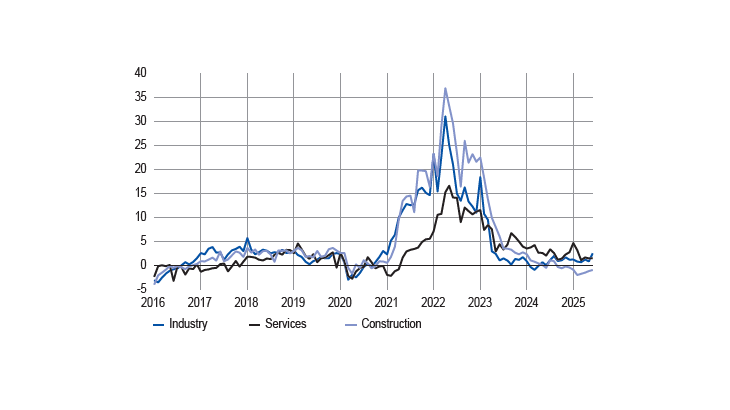

3. Selling prices were broadly unchanged in services, rose slightly in industry, but continued to fall in construction

In June, supply difficulties remained broadly stable compared with the previous month (8% of companies reported them, down 1 percentage point on May). They remained relatively high in the automotive and aeronautics sectors (they were reported by 25% and 19% of companies in these industries, respectively), but eased in aeronautics compared with the previous months. Supply difficulties in construction remained rare (4%).

In industry, business leaders reported that raw materials prices rose slightly, mainly in the agri-food, other industrial products and apparel-textiles-footwear sub-sectors. The balance of opinion on finished goods prices 1 was also up slightly, as in May, driven by aeronautics, agri-food and, to a lesser extent, wood-paper-printing. Prices in other industrial sub-sectors were fairly stable.

Change in selling prices by major sector (balance of opinion, adjusted for seasonal and working-day variations)

More specifically, 7% of business leaders in industry reported that they had raised their selling prices in June, close to pre-Covid June figures and below the same month between 2021 and 2023. Price increases were most widespread in aeronautics (15%), agri-food (14%) and wood-paper-printing (13%). Conversely, 3% of business leaders in industry reported that they had lowered their selling prices, also close to the pre-Covid June figures. Price decreases for finished goods concerned computer-electronic-optical products (8%), wood-paper-printing (6%), chemicals, and metal and metal products (5%).

In construction, the balance of opinion on price movements remained negative in June, in both the structural and finishing works sectors. 2% of business leaders reported increasing their quote prices, which was a lower proportion than that observed in June of previous years. Conversely, 15% of business leaders (8% in June 2024) said they had reduced their quote prices, a much higher proportion than in June of previous years.

In services, the balance of opinion remained very slightly positive, at the same level as in May. The share of companies reporting price increases was 6%, in line with pre-Covid June figures and below those for 2021-23. Price increases mainly concerned accommodation and food services and publishing. At the same time, the share of companies reporting price decreases was 4%, on a par with figures reported in June of previous years.

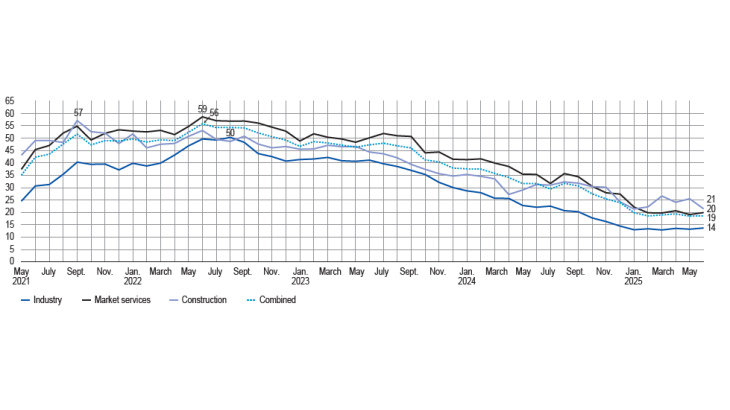

In June, 19% of business leaders reported recruitment difficulties, the same proportion as in May. These were still highest in construction and lowest in industry, although this gap narrowed in June. Those in services, meanwhile, were close to the overall average. In industry, staffing levels (including use of temporary staff) were again deemed to be very slightly down.

Share of businesses reporting recruitment difficulties (%, unadjusted data)

4. Our estimates suggest that GDP will edge up in the second quarter, by around 0.1%

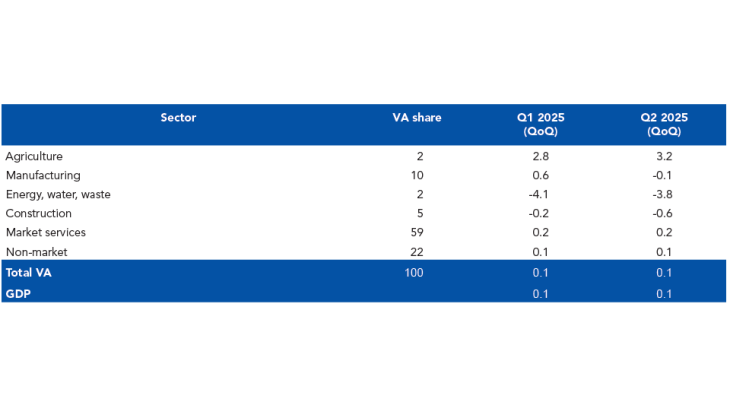

The detailed results of the quarterly accounts published by INSEE at the end of May confirmed that GDP growth was 0.1% in the first quarter of 2025, with a rebound in the manufacturing sector and a more moderate increase in market and non-market services. Activity declined in the energy and construction sectors.

Based on the results of the Banque de France monthly business survey (MBS), rounded out by other available data (INSEE production indices and surveys and high-frequency data), we forecast that GDP will grow slightly in the second quarter, by around 0.1%. GDP growth is expected to be mainly supported by the moderate increase in value added in market and non-market services. Value added is expected to fall slightly in manufacturing, with the decline in the industrial production index in May only partly offset in quarterly average terms by the rebound in June suggested by our survey. Activity is expected to decrease further in the construction and energy sectors, as a result, in the latter case, of the unusually high temperatures in April.

Quarterly changes in GDP and value added in France (%)

Note: QoQ = quarterly change.

Box

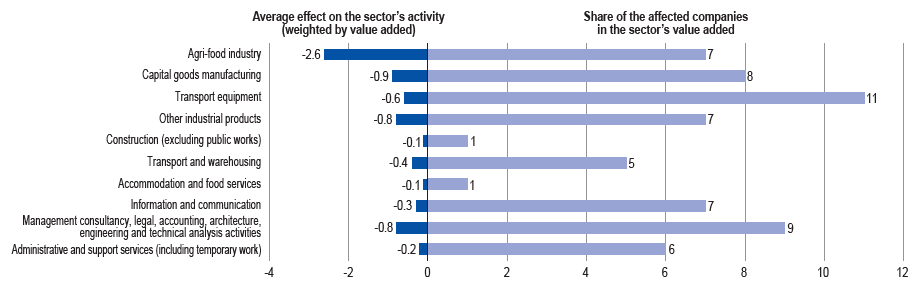

Since April, the monthly business survey has included questions designed to assess the direct and indirect effects of US tariffs (including possible retaliatory measures, uncertainty, changes in competition, particularly from China, repercussions on supply chains, etc.) on the activity of French companies compared with the same month in a typical year. Where relevant, business leaders are asked to detail the nature of the impact observed.

In June 2025, 6% of the companies surveyed (in terms of share of value added) reported a negative impact on their business volumes, of which 8% were in manufacturing, 6% in market services and 1% in construction.

Average effect and share of companies impacted by survey sector (%)

The impact within the agri-food industry, which is the industrial sector hardest hit, is concentrated in the winemaking industry. Among other industrial products, the wood-paper-printing industries are also affected, particularly through their cooperage and packaging activities linked to the wine industry, as well as the chemical industry. Capital goods manufacturers also reported an impact, linked to a drop in North American orders and increased uncertainty. Among market services, engineering and technical analysis companies reported the biggest impact.

Download the full publication

Updated on the 21st of July 2025