- Home

- Publications and statistics

- Publications

- Measuring the impact of industrial actio...

Post n°331. What impact did industrial action in the first quarter of 2023 have on France's GDP? We propose a method for quantifying this impact, using the Banque de France's Monthly Business Survey (MBS) and macroeconomic projection models. The downturn was significant in certain sectors and areas, although catch-up effects were seen in the second quarter.

Note: sectors covered by the MBS (manufacturing industry, market services, construction)

Textual analysis of complementary information from the Monthly Business Survey (MBS)

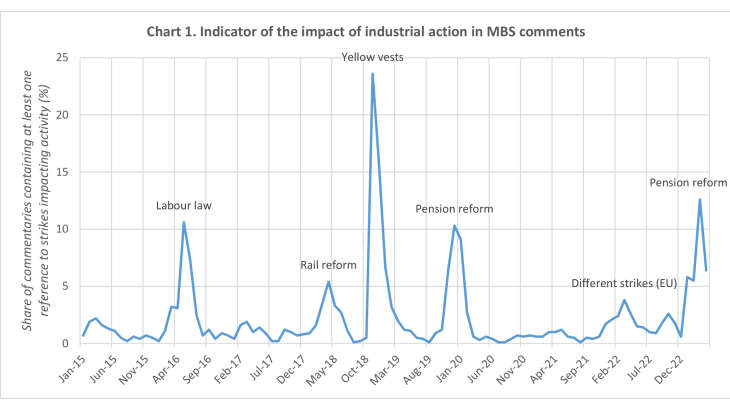

In addition to the questions on the current situation contained in the survey, business leaders can also include comments. Using these textual data, we identified references to strikes, in order to calculate a share of companies claiming to be affected by them. For March 2023, 9% of businesses in industry, 13% of businesses in market services and just over 2% of businesses in the construction sector reported an impact of strikes on their activity. Replicating this method over a longer period gives us the curve in Chart 1, where we matched the different peaks observed with the different industrial action movements that featured prominently in the public debate. This research method has already been used to analyse the impact of the "gilets jaunes" or "yellow vest" movements on economic activity. It concluded at the time that around 20% of businesses had experienced disruption to their activity as a result of such movements over the months in question.

The impact of strikes on balances of opinion on economic activity

Each month, the MBS produces balances of business leaders' opinions on economic activity. We have recalculated these balances by excluding the companies that mentioned strikes, which results in them being assigned the average response of the other companies in their sector. This allows us to construct a counterfactual balance adjusted for the impact of strikes, for the sectors covered by the survey. By comparing this counterfactual balance and the balance of opinion, we note, for certain sectors, including the chemicals industry and road transport in particular, a negative impact of mentioning strikes on the value of the balance. This would mean that the strikes had an economic impact on the activity of the companies covered. This impact is nevertheless moderate (maximum 12 balance points in March 2023 on a scale of 400 points, from -200 for the lowest possible activity to 200 for the highest possible activity). In April, the impact decreased greatly, in line with the easing of this phenomenon in the comments.

Estimated impact of strikes on GDP growth in Q1 and Q2 2023 in real time

For the sectors covered by the MBS, i.e. manufacturing excluding the manufacture of coke and refined petroleum sector, construction, automotive repairs, road freight transport, accommodation and food services, information and communication, business services and household services, we can estimate the impact of industrial action on GDP growth by calculating the impact of strikes on economic activity balances in the March survey. To do so, we produce a growth forecast based on published MBS data, and a growth forecast based on counterfactual data for March, adjusted for the impact of strikes. The difference between the two reflects the impact of strikes on activity. The impact of the industrial action in the first quarter in the sectors covered by the survey is estimated at less than 0.05 percentage point of quarterly GDP.

Moreover, some sectors not or inadequately covered by the survey were badly affected by strikes in the first quarter. These include the manufacture of coke and refined petroleum, energy production and distribution, water, waste management, transport services, particularly passenger transport, and retailing. In real time, when forecasting activity for the second quarter, we used the changes in industrial production index (IPI) and index of services production (ISP) for past strike episodes (as contemporaneous IPI and ISP were not available) to forecast changes in activity in these sectors.

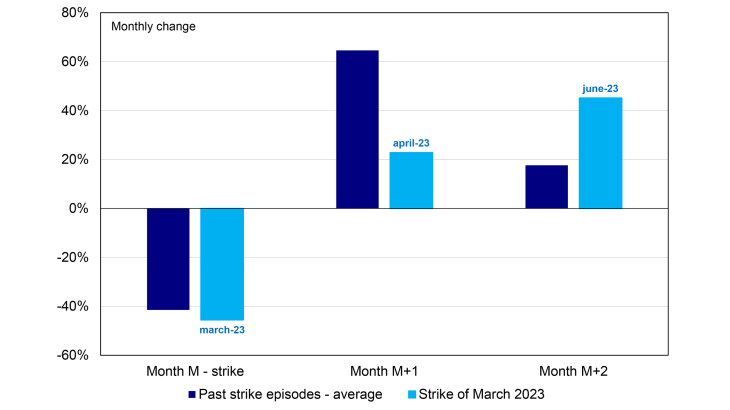

For the manufacture of coke and refined petroleum and energy sectors, water and waste sectors, we selected three strike episodes that occurred in October 2022 (strikes in refineries and fuel depots to obtain wage increases), in spring 2016 (strike against the reform of the Labour Law) and in October 2010 (strike against the pension reform). For the transport services sector, we used the SNCF industrial action against pension reform in December 2019, and the action against rail reform in spring 2018. This simple method is obviously not without its limitations, since it assumes linearity of responses, and neglects seasonal effects and any other concomitant shocks. It does, however, give an approximate monthly estimate of the impact of strikes on activity, which is particularly useful in forecasting exercises (especially when production indices are not yet available). The estimated impact of the 2023 strike was in fact close to that observed in past episodes, and its inclusion improved the quality of the GDP forecast for the first and second quarters. For example, the chart below shows, for the manufacture of coke and refined petroleum sector, a fall of comparable magnitude in the IPI during the month of the strike, followed by a catch-up during the following two months (as the strike in spring 2023 continued until the beginning of April, the catch-up was slightly delayed compared with past strike episodes).

Source: INSEE, calculations: Banque de France

To measure the impact of the March 2023 strikes retrospectively, we use the production indices

In order to estimate the negative impact of the industrial action on the sectors not covered, and their subsequent rebound, we use the IPI, the ISP and the retail sales index, published by INSEE with a lag of one and two months respectively.

In the manufacture of coke and refined petroleum sector, which accounts for 0.1% of France's total value added, the IPI fell by 46% in March 2023. This has an impact of a few hundredths of a percentage point (pp) on the quarterly change in GDP (covering all sectors) in the first quarter. The increases in the IPI of 23% in April and 45% in May then had an impact of a similar magnitude on GDP growth in the second quarter.

We then replicate this calculation for the energy, water and waste management sector, where the impact is also estimated at a few hundredths of a percentage point of GDP.

For the land transport services (excluding road freight transport) and retail sectors, the impact of strikes on GDP growth appears to be negligible.

Thus, in total, according to our estimates, the industrial action in March and April 2023 is estimated to have reduced GDP growth by around -0.1 pp in the first quarter, but to have been followed by a catch-up effect of around 0.1 pp in the second quarter, with the rebound in April and May offsetting the fall in activity observed in March. As a reminder, according to INSEE, compared with the previous quarter, GDP rose by 0.1% in the first quarter and by 0.6% in the second quarter.

This estimate of the impact of industrial action is consistent with those made by INSEE for other strikes. In its March 2019 Economic Outlook, INSEE estimated, for example, that the industrial action in the second quarter of 2018 had depressed activity by -0.1 percentage point of GDP.

Download the PDF version of the publication

Updated on the 25th of July 2024